Who is responsible for the eurozone crisis? The simple answer: Germany

The wrong economic model of the crisis led Germany to insist on tighter fiscal rules which created a second eurozone recession. German influence on the European Central Bank also led it to delay QE for six years, and raise rates during 2011. Finally we saw how the actions taken much earlier by German employers and employees helped to protect Germany from the consequences of all this.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.There is no doubt that the eurozone has performed lamentably in terms of recovering from the Great Recession. GDP per capita remains well below pre-recession peaks. Eurozone unemployment is close to 11 per cent, compared with 7.5 per cent in 2008.

This is what allows George Osborne to talk up UK growth as exceptional, even though in reality it has at best just been at rates that match historical averages.

The standard story behind the eurozone’s poor performance is that it is an inevitable result of the debt funding crisis that hit the eurozone periphery in 2010. This is simply wrong.

Recently 16 widely respected economists wrote an article reiterating what most have known for some time: the 2010 crisis was essentially the result of excess lending to the private sectors of countries such as Ireland, Portugal and Spain, lending that often originated with the banks in Germany or France. Countries like Belgium or Italy entered the crisis with debt-to-GDP ratios over 100 per cent, yet did not require Troika bailouts, whereas Ireland and Spain, which had ratios below 40 per cent, did. The major factor leading to a rise in Irish government debt was that it bailed out its own banks that had lent excessively.

Only in the case of Greece do we have a classic case of government profligacy. Yet the German government in particular chose to see the entire 2010 crisis as the result of government profligacy, and as a result it changed the eurozone’s fiscal rules so that from 2010 all the eurozone countries were forced to embark on austerity.

Back-of-the-envelope calculations suggest that cuts in government consumption and investment between 2010 and 2013 reduced eurozone GDP by around 4 per cent in 2013. More sophisticated estimates including those based on model simulations suggest an impact at least as large.

In normal circumstances that would have hit Germany as hard as the rest of the eurozone. However as Peter Bofinger, the “minority Keynesian” member of Germany’s Council of Economic Experts, recently argued action taken much earlier by German employers and employees ensured that Germany was (and still is) in a far better position than its neighbours following the crisis.

Stability within a monetary union is only possible if inflation in each member country is roughly the same. As is well known, this was not the case for the eurozone periphery before the recession. The excessive private-sector lending that I have already mentioned led their inflation rates to outstrip the eurozone average, so that when the crisis hit they had become highly uncompetitive.

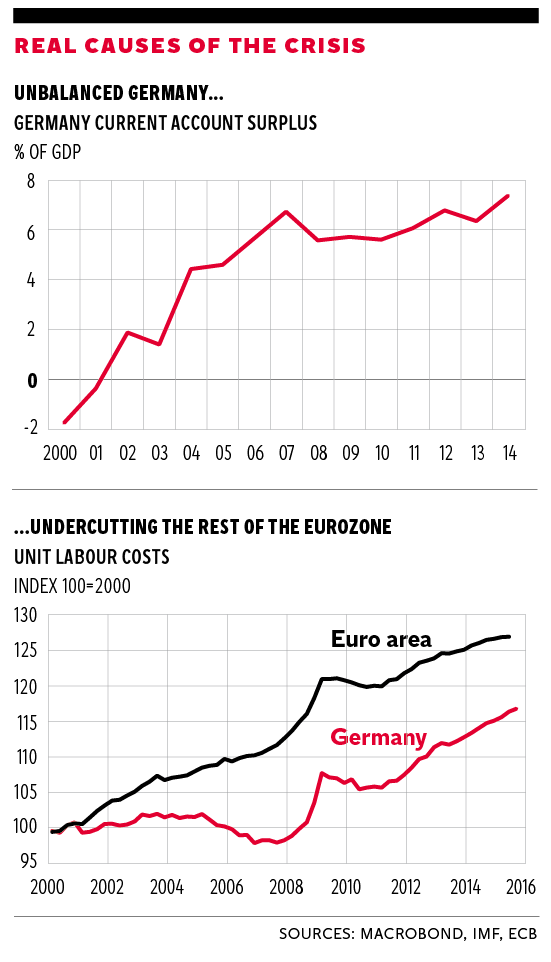

What is less known is that Germany did exactly the reverse. Employers and employees co-operated to ensure that nominal wage increases were remarkably low, and as a result the competitiveness of German traded goods steadily increased before the crisis, not just in relation to periphery countries, but also against all its other eurozone neighbours. The result was strong export growth, which substituted for the reduced domestic demand caused by fiscal contraction.

Today Germany’s current account surplus is a massive 7.5 per cent of GDP. While unemployment has increased substantially since the recession in nearly every other eurozone country, in Germany it has fallen. German officials would like you to believe that this relative success indicates the soundness of German economic policies, but what they do not tell you is that undercutting their eurozone neighbours was critical to this success.

We can go further. The European Central Bank only started a large-scale quantitative easing programme this year, some six years later than similar programmes in the US and UK. A major reason for this delay was resistance by German economists, central bankers and politicians to this programme. The Bundesbank’s obsession with inflation, together with the strong influence that German central bankers have on some of their colleagues at the ECB, allowed interest rates to rise twice in 2011, which added to the second eurozone recession.

We can go further still. The scale and scope of the eurozone debt funding crisis was greatly increased by the influence on the ECB of German central bankers, politicians and economists. It is now well understood that the reason why economies in the eurozone, and only those economies, suffered a debt funding crisis in 2010 is that these countries did not have their own central banks. Central banks in countries like the UK play a key role in reducing the risk associated with government debt by acting as a “sovereign lender of last resort”, which means being prepared to buy its own government’s debt if the market fails to. The ECB initially refused to play this role, leading to self-fulfilling market panics over Irish, Portuguese and Spanish government debt. The ECB changed its mind in 2012, and the debt funding crisis quickly came to an end. Despite this, German politicians have tried to declare this move illegal in the courts.

Thus Germany helped to aggravate the 2010 crisis by pressurising the ECB not to act as a lender of last resort. We have also seen how adopting the wrong model of the crisis led Germany to insist on tighter fiscal rules which created a second eurozone recession. German influence on the ECB also led it to delay QE for six years, and raise rates during 2011. Finally we saw how the actions taken much earlier by German employers and employees helped to protect Germany from the consequences of all this. The eurozone crisis was not made in Greece, Ireland or Spain; it was made in Germany.

A great conspiracy? Not really. More the consequence of a set of misguided ideas about macroeconomics and how central banks should work. However, Germany has made a false narrative for itself which is sufficiently embedded, popular and self-serving that it will never change from within, despite the courageous efforts of a few enlightened German economists to tell the real story. The key to a better future for the eurozone is that the other countries suffering the consequences of all this begin to see Germany’s pivotal role in their own discomfort.

Simon Wren-Lewis is professor of economic policy, Blavatnik School of Government, Oxford University

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments