The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

Think the market is always ‘right’ when it comes to top pay? Think again

The average pay of FTSE 100 bosses has risen far faster than the average value of their companies in the past two decades, despite the insistence from boards that executives are only ever rewarded for performance. That pattern fits bargaining theory much more closely than marginal productivity theory.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.When confronted with an outburst of public anger over massive corporate pay for a privileged few, a common response of the libertarian right is to invoke the economics of the free market.

Such spectacular rewards, we’re informed, are delivered by individuals selling their labour in a free market. And because such pay levels were set through this natural process, no one has the moral right to question them. Further, to interfere with such natural processes would be economically inefficient, making us all worse off in the end.

We got a flavour of this last week from the Adam Smith Institute (ASI). The libertarian think-tank objected to a report from the High Pay Centre which had calculated that the average FTSE 100 boss would earn more than the average annual pay of a UK worker in just two days in the office (with the clear implication that this was excessive).

Yet this was lazy “pub economics” according to Sam Bowman of the ASI. “Executives can be worth a lot to firms… CEOs make really important decisions that can make or break the firm,” he wrote in a blog post entitled “Seven reasons not to care about high pay”.

Mr Bowman said the High Pay Centre had no grounds to criticise such rewards unless it could say how much these executives really ought to be paid. The High Pay Centre, in other words, does not know better than the free market.

There is a venerable economic theory behind this kind of reasoning. At the end of the 19th century, the American economist John Bates Clark hypothesised that in a perfectly competitive economy, demand for labour is determined by its “marginal productivity” and wage rates are determined by the “marginal product” of labour.

To translate, if a firm can make a profit by adding another worker to its payroll, it will do so. And the amount a firm will be willing to pay for that labour in wages will be determined by the additional profit the individual worker adds to the company’s bottom line. So if a worker adds a lot of profit, he or she can command a lot of compensation. But if they add only a little profit, he or she will get only a little. This means people with low personal productivity get small amounts. But people with high personal productivity (chief executives for instance) receive big bucks.

It is certainly an attractively coherent theory. But there are some problems with it as a description of the way in which the world actually works. For a start, how does a company know what the marginal product of an individual worker is, or will be? This isn’t something that is directly measurable. The vast majority of us work in teams; how is it possible for management to determine our individual contribution to the financial success of that team, or of that team to the company? How can a business know how much of the profit added was due to the individual’s particular skills? The conditions necessary for the Clark theory that everyone gets what they “deserve” don’t exist.

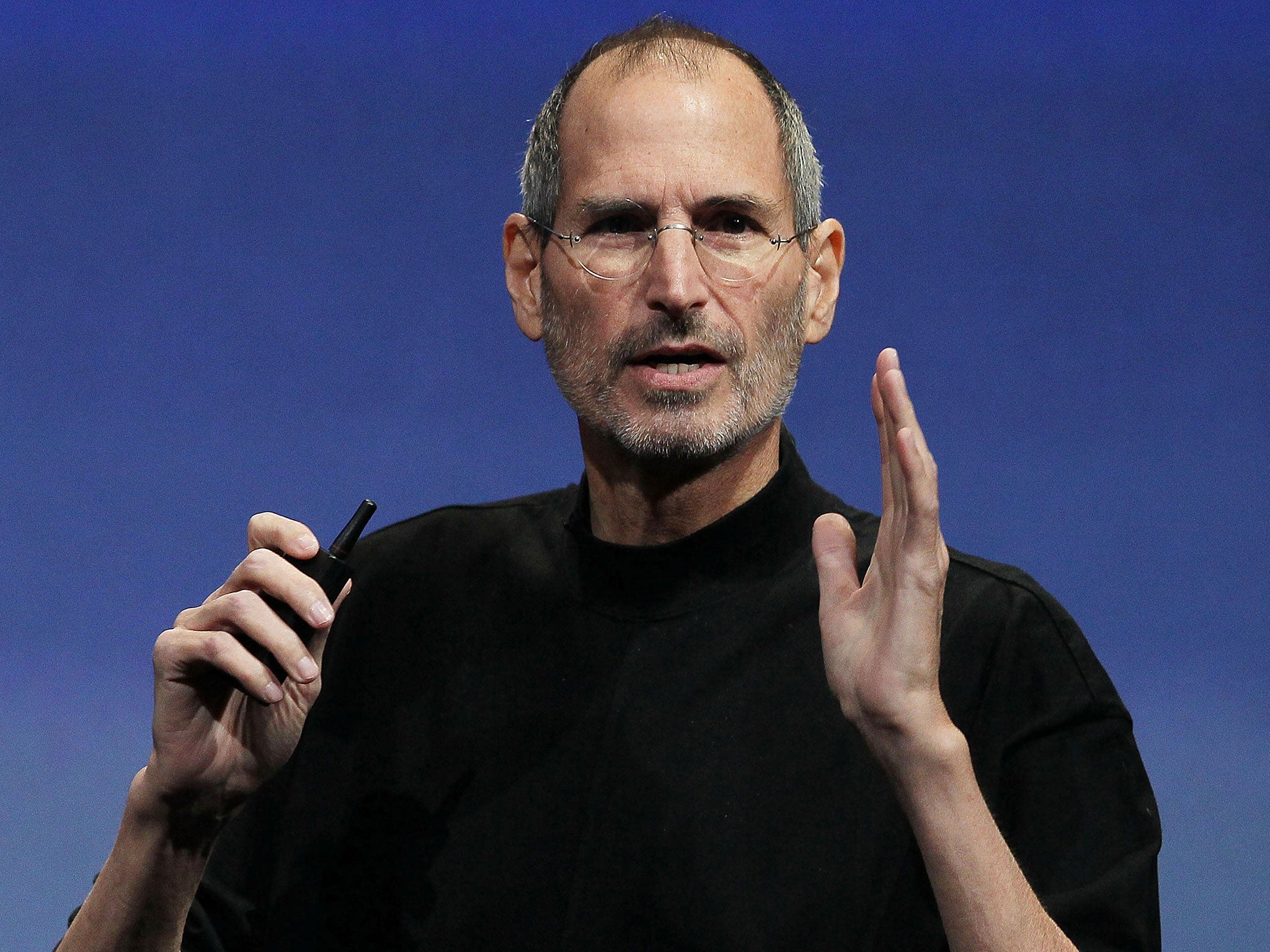

But isn’t the marginal product of bosses, who make big strategic decisions, easier to measure? The ASI cites the late Steve Jobs of Apple as an employee who was clearly worth a lot. However, there are plenty of other chief executives whose individual contribution is impossible to measure. Yes, the company’s share price might have gone up. But was this because the boss was smart? Or just lucky?

Another market argument is that the pay of top bosses is set by an international market for talent. But leaving aside the point that there is scant evidence of a genuine global market for bosses, this tells us nothing about whether the average level of pay is economically justified.

The ASI argues that one important check on excessive executive pay in listed companies is the shareholders. They would surely not pay more for bosses’ labour than strictly necessary because that means they get less profit for themselves. Yet this assumes ordinary shareholders, the people who own stakes in listed companies, have any real say over what a company pays its bosses. Many of you will have shares in FTSE 100 companies via your pension funds. But have you ever voted on a remuneration proposal?

Markets are indeed often better than the alternatives. And marginal productivity theory is useful as a rough description of how relative wages are determined. People with more relevant skills tend to command higher wages, as do people in managerial positions. But it’s very far from being an economic justification for the size of individual rewards, particularly at the top end of the scale. The economist Dani Rodrik, in his latest book Economics Rules, argues that such broad theories of income distribution by the market are best viewed as intellectual “scaffolding”, adding: “They are shallow approaches that identify the proximate causes but need to be backed up with considerable detail”.

And there are other theories of wage determination that are likely to be relevant. One important one is bargaining theory. This suggests that those who have political power within a firm can extract more than those without it. Maybe the reason chief executives tend to get paid ever growing multiples of the pay of the average worker is not because they are “worth it” but because they are powerful. As the economist JK Galbraith put it: “The salary of the chief executive of a large corporation is not a market award for achievement. It is frequently in the nature of a warm personal gesture by the individual to himself.”

Another theory is shifting social “norms” – changing perceptions among the people who set top pay over what is an acceptable gap between rewards for bosses and ordinary workers.

In the end all this theory needs some empirical ballast. As the High Pay Centre has shown through its own research, the average pay of FTSE 100 bosses has risen far faster than the average value of their companies in the past two decades, despite the insistence from boards that executives are only ever rewarded for performance. And there are countless examples of rewards for corporate failure. That pattern fits bargaining theory much more closely than marginal productivity theory.

So next time you’re down the pub and someone tells you to pipe down about executive pay because the market tends to be right, try asking them what economic model they’re using.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments