The Panama papers tax avoidance scandal shows just how powerless Cameron and Osborne really are

The contrast between the pathetic attempts of supposedly mighty elected leaders to address tax avoidance and the mountain of documents from one law firm showing how tax is easily avoided becomes one of the great emblematic sagas of our times

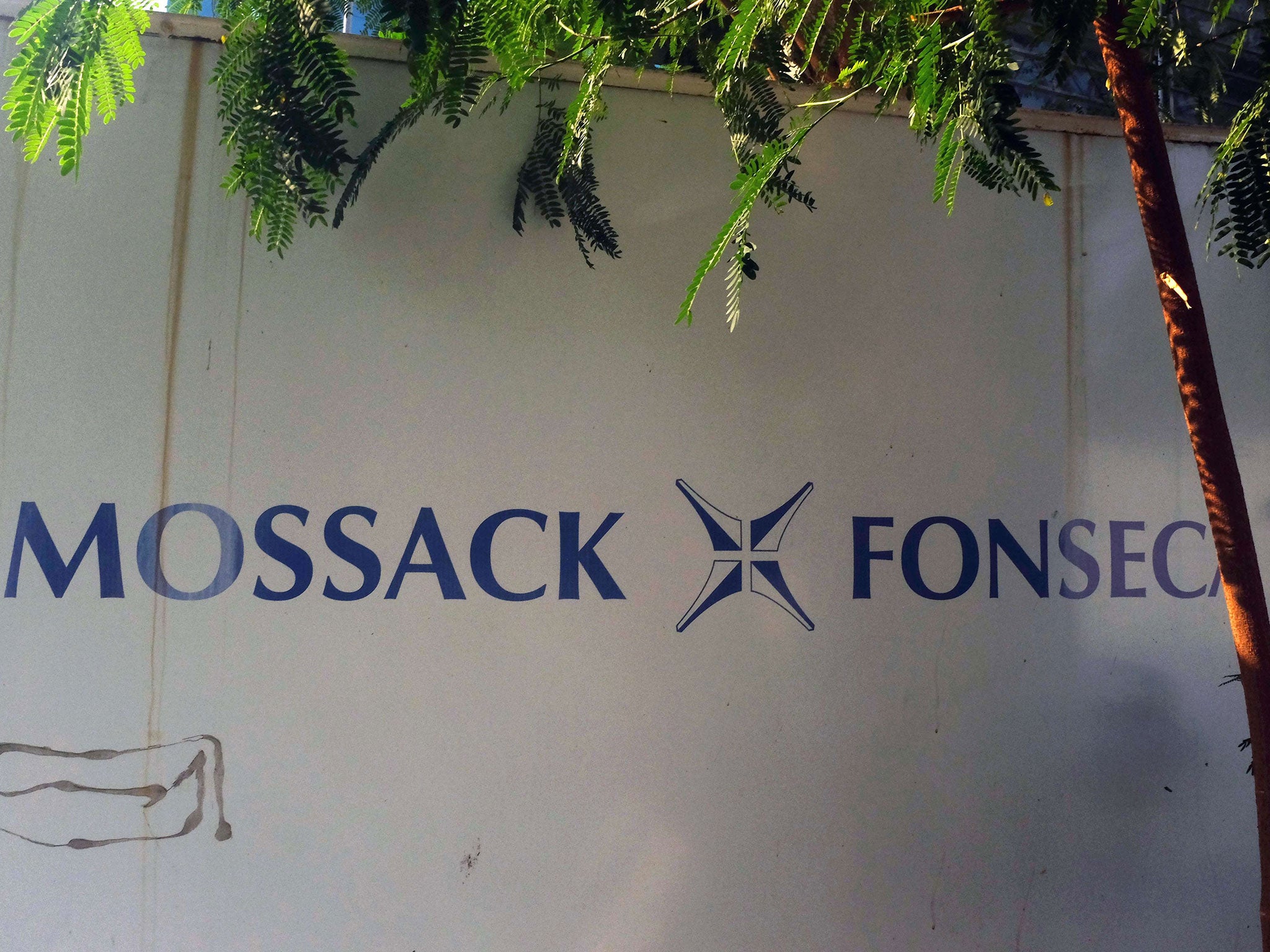

Economies are fragile. Public services creak. Aggressive tax avoidance and tax evasion continue to boom. The mindboggling scale of the industry aimed at minimising the tax bills of the rich is laid bare in the leaks from the Panamanian law firm Mossack Fonseca.

The story is global and the leaks suggest that some of those that govern are as culpable as those that are merely super-rich. The documents allegedy linked to Vladimir Putin’s associates attract most attention. The Prime Minister of Iceland has questions to answer. From a UK perspective, the fact that David Cameron’s father and three other senior Tories are allegedly cited in some of the documents serves only to illustrate the scale of the challenge for elected governments.

Cameron cannot be held responsible for his father’s financial arrangements and nor can he monitor the activities of every senior party member seemingly acting as many wealthy earners do around the globe, legally minimising their tax bills. The issue for Cameron - as it will be for his successors, Tory or Labour - is what if anything individual governments can do when money is moved from haven to haven with the click on a computer and the expertise of a Panamanian law firm.

The answer is that, acting alone, governments cannot do very much at all. Unsurprisingly, the mountain of leaks has caused a political furore. It would be bizarre if there were not an outcry when debates rage in the UK about widening inequality.

There is also theoretical agreement across the political spectrum that “aggressive” tax avoidance from the wealthy is immoral and irresponsible while tax evasion is illegal. So far that consensus has achieved virtually nothing.

Before each UK general election, in the pantomime known as the ‘tax and spend’ debate, the main parties pledge to clamp down on tax avoidance. They do so partly because this is in effect a popular tax rise that few voters would oppose.

The shadow chancellor John McDonnell makes the pledge now when asked how he will pay for some of his current spending plans. George Osborne has targeted tax avoidance in recent budgets. Gordon Brown did the same in virtually all his budgets.

Most budgets since 1997 and before have included new proposals to tackle tax avoidance. In between the budgets and those ‘fantasy tax and spend debates’, a bleak reality intervenes. Tax avoidance thrives.

Perhaps if Labour had been elected last year, UK tax havens really would have been ‘blacklisted’ - but when the party was in power for thirteen years, it came up with endless schemes to curb tax avoidance. Tax avoidance still flourished. Since then, Osborne has fumed against “aggressive tax avoidance”. Now we have leaks that show the aggression breaks new bounds.

The contrast between the pathetic attempts of supposedly mighty elected leaders to address tax avoidance and the mountain of documents from one law firm showing how tax is easily avoided becomes one of the great emblematic sagas of our times. In the UK and elsewhere, tackling inequality, fair taxation and the need for civilised levels of public spending are almost becoming part of a new political zeitgeist.

But each government scheme aimed at addressing avoidance is countered by 10,000 - or perhaps 11 million - ways of stashing vast sums away in arrangements that minimise tax responsibility.

So far, 11 million documents have been leaked. No doubt the UK governments - Labour in the past and the Conservatives in the present - could have done more, but given the futility of so many sincere attempts in the last 20 years, it is depressingly safe to assume the equivalent of a Panama law firm will have had an answer.

For all the machismo of UK politics, there is not even much of a pretence that governments can do very much once elections have passed and budgets have been delivered. Osborne’s opposition to the 50p top rate for high earners is based on the premise that those liable will find legal ways of not paying it. Minimising liability for a top rate of income tax is child’s play compared with the absurd but highly effective contortions of a Panama law firm.

Once more we are reminded of the powerlessness of elected power. Alastair Campbell noted that when he travelled as Tony Blair’s Press Secretary to gatherings of G20 leaders, he was supposedly observing the most powerful human beings in the world - and yet the reality was very different. He observed nervy, insecure leaders grappling with impossible problems and looming elections in which they could well be removed from power.

In the global economy, the powerlessness increases. When the super-rich have the power to avoid their fair share of tax, the elected rulers become even more constrained.

Tax avoidance or evasion is occurring on a global scale and can only be solved effectively by measures agreed at an international level. The UK is living proof of the need for a global response. Many chancellors have tried and failed to address the issue in isolation.

As the UK prepares to vote on whether or not to stay in the EU, the explosive issue of tax avoidance is a vivid illustration of why going it alone is not a viable option for a medium-sized economic power. To make some sense of a wildly destabilising global economy, governments must act together on many fronts, including ensuring the super-rich pay their share.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies