The Independent's journalism is supported by our readers. When you purchase through links on our site, we may earn commission.

There’s much to admire about the German economy. But its massive trade surplus is not one of them

German politicians often look on their large surplus with a sense of pride, seeing it as a symbol of national prudence and export success – but underconsumption is nothing to be proud of

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Even stopped clocks are occasionally right, albeit by accident. Donald Trump has been complaining that Germany is “very bad on trade” and that the country’s whopping current account surplus (which hit $294bn last year, the biggest in the world) is a problem.

He’s right. Germany’s surplus really is economically harmful for the US. And, indeed, the surplus is a drag on the wider world too, not least the other members of the eurozone. But it’s not for the reasons Trump articulates.

For Trump and his advisers the surplus is evidence German politicians have been unfairly boosting the German export industry at the expense of US manufacturers. Yet that boost is really a by-product of large domestic imbalances in the Federal Republic, rather than the protectionist trick Team Trump imagines.

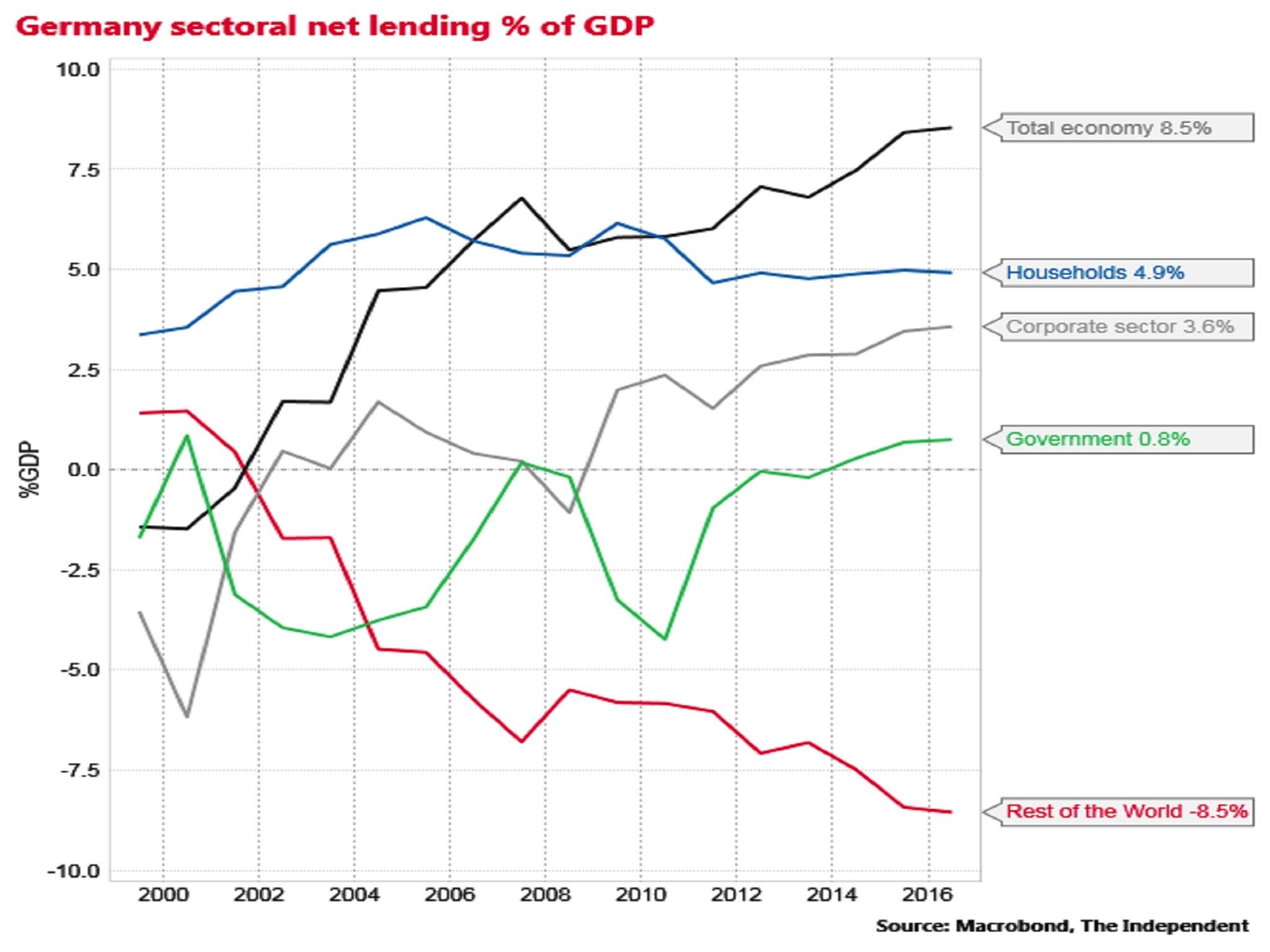

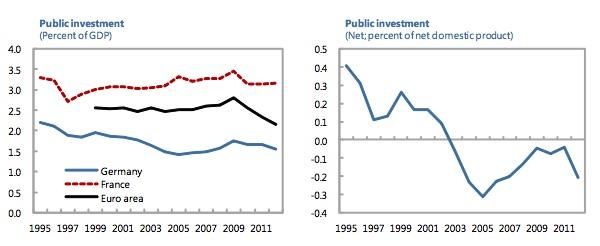

Here’s why. German households spend a relatively low proportion of their collective income. Private German businesses, in aggregate, invest considerably less than their collective profits. The German state’s infrastructure spending is also exceptionally weak as a share of GDP.

This economy-wide underspending means there is a chronic excess of national domestic saving over domestic investment in Germany. It follows as a simple accounting identity that this excess has to be exported abroad. There’s nowhere else for it to go. So Germany, through various means, acquires foreign currency assets on a massive scale every year.

For the likes of the US this pushes up the value of the dollar relative to the euro, imposing a headwind against growth in America. The same happens to the other countries whose currencies the Germans buy, including Britain. If the capital-absorbing countries want to offset that drag they have no choice but to borrow and spend more than their aggregate incomes, running current account deficits.

One of the consequences of those deficits and the undervalued euro is that demand for many German manufactured exports is artificially stimulated. Many German exports are, of course, famously high quality. But what matters is that the international demand for them is higher than it would be if Germans were not running such a large current account surplus.

The crucial point to recognise is that, as the economist Michael Pettis has long argued, outward capital flows predominantly drive the surplus nation’s net export performance. And it’s the domestic under-consumption that drives the capital flows. In the case of Germany this isn’t about rigged trade deals, as Trump seems to believe. It isn’t about crude protectionist currency manipulation either. It’s about too little spending within Germany.

Does it really matter though? Not in the near term. And it’s not plausible to blame economic weakness everywhere in the world on current account surpluses in Germany (and also China and Japan). There are plenty of other things going on too, not least excessively contractionary fiscal policies in many countries.

Too little total spending...

But those surpluses do encourage unbalanced growth, both in the deficit and surplus countries. In deficit countries sectors such as real estate are artificially boosted, while in Germany, China and Japan the manufacturers get a lift. The imbalances also lead to excess financial indebtedness in deficit countries, raising the risk of a messy unravelling down the line – if, say, foreigners suddenly attempt to deleverage all at once, or they lose the confidence of their overseas creditors.

Martin Sandbu, an economics writer at the Financial Times, has pushed back at multiplying complaints about Germany’s large surplus by pointing out that as long as the German current account surplus is stable, rather than growing, it is not subtracting from demand overseas. While narrowly true, this glides over the fact that Germany’s surplus has been rising steadily as a share of its GDP for almost two decades, shooting up from a deficit in 2001 to an 8.3 per cent surplus in 2016, and thus imposing a serious drag for much of the time.

And while it may not be subtracting from growth at this precise moment, the sheer size of Germany’s surplus represents the extent of economic benefit in terms of stronger demand and rebalancing that ought to flow to countries overseas. Some of the primary beneficiaries of healthier German domestic consumption would be its still-struggling eurozone neighbours such as Greece, Italy and Portugal. Every year the German current account surplus remains so high, means more debt has to be accumulated overseas.

...particularly state investment

So why is Germany underconsuming and underinvesting? Part of the answer is that the admirable consensus approach between workers and employers in Germany that I mentioned last week has actually worked too well. Workers have accepted extreme pay restraint since the advent of the single currency in 2000 (often settling for awards below productivity growth) thus helping to squeeze down the share of wages in German GDP.

An outbreak of social anxiety about the ageing profile of Germany has also encouraged households to save well in excess of what is needed to meet the actual fiscal challenges of retirement. Weak household consumption has discouraged German firms from investing at home. And the German government has compounded this savings frenzy by taking fiscal prudence to a fault, running an absolute budget surplus, ignoring its responsibilities (and indeed long-term self-interest) to help keep demand strong and balanced in the eurozone overall.

German politicians often look on their large surplus with a sense of pride, seeing it as a symbol of national prudence and export success. Germany’s consensual post-war economic and political institutions do indeed deserve the world’s admiration. But its chronic underconsumption and large surpluses deserve to be buried, not praised.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments