This pick-up owes diddly squat to Osborne’s austerity

No ifs or buts: the Chancellor’s policies have failed catastrophically

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.There have been a few signs recently that the UK economy at long last may have turned a slight corner – maybe. Business and consumer surveys have picked up, as has official data on industrial production, retail sales and exports. The Tory spin machine is going full-steam ahead claiming the economy is soaring. However, two data points don’t make a trend.

We shouldn’t get too carried away as the economy is still 3.2 per cent below the starting level of output in the first quarter of 2008 and the public finances show little sign of improvement. The economy grew under Alastair Darling by an average of 0.6 per cent over the year from quarter three 2009 to quarter three 2010, but over the 11 quarters since then growth has only averaged 0.2 per cent a quarter, even including the 0.7 per cent in quarter three 2012 down to Labour’s investment in the Olympics.

Alan Taylor of the University of California, Davis, recently estimated that Mr Osborne is directly responsible for a shortfall in GDP of at least 3 per cent. If growth had continued at the Darling rate, which is what the Office for Budget Responsibility was forecasting in June 2010, then the Chancellor has been responsible for reducing GDP by 4.8 per cent.

No ifs or buts; austerity failed catastrophically. The suspicion is that such progress we have seen is from another slasher U-turn via his artificial boost to house prices (the kind of thing he would have opposed forcefully in opposition).

The latest labour market data produced something of a mixed bag. While the claimant count continued to fall the unemployment rate was unchanged at 7.8 per cent, while long-term and youth unemployment both increased. Of particular concern is that there was a marked increase in the unemployment rate of minorities.

Overall, the unemployment rate of whites is down 0.4 per cent on the year whereas that of Indians is up by 0.4 per cent, Bangladeshis +4.5 per cent and Pakistanis +3.3 per cent and Black/Afro Caribbean +1.6 per cent.

The number of self-employed whites is down 0.7 per cent on the year whereas the number of self-employed Indians and Bangladeshis is up by 15.6 per cent and 12.5 per cent respectively. The suspicion is these new minority self-employed have less hours than they would like plus low earnings.

Sadly, it remains rather unclear what the unemployment rate in the UK is due to the poor quality of the data. As in every other advanced country a survey of individuals is used to calculate it as the proportion of the labour force (the sum of workers and the unemployed).

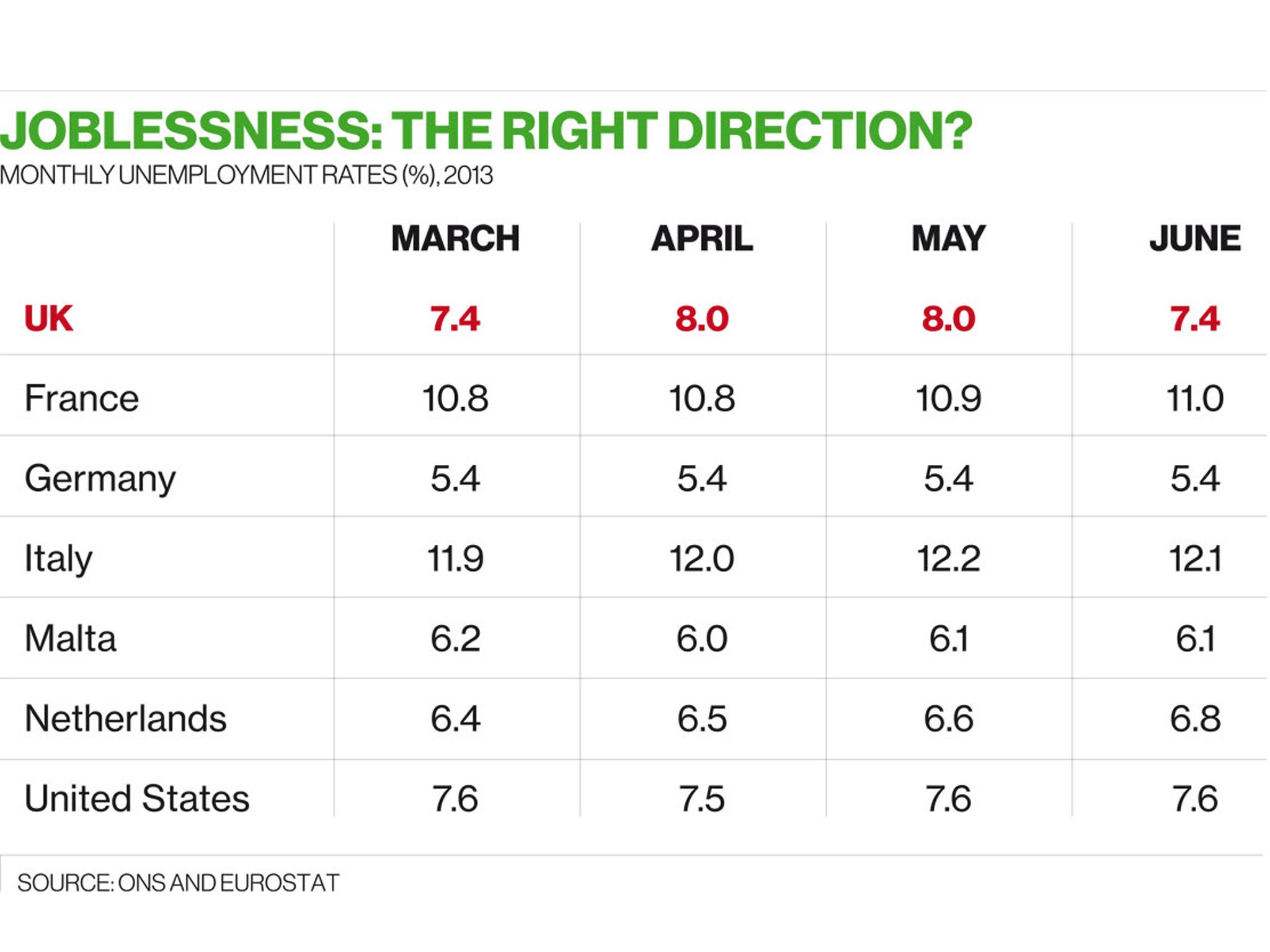

Currently, the official rate of 7.8 per cent is for “May” calculated as the average for the three months of April-June. No other advanced country in the world publishes its official unemployment rate this way, which turns out to make it almost impossible for labour economists like me to know what is going on. The main reason this is done, as the table shows, is that the single monthly data show much more variation than in any other country, so much so they are not terribly credible and this needs to change swiftly. This means it will be hard for the Bank of England’s Monetary Policy Committee to know when the economy has actually hit the 7 per cent unemployment threshold. The most plausible measure available this month shows UK jobless went up by over 8,000, even though official estimates say it went down by 4,000.

Let me explain. Over the last four monthly readings, the unemployment rate in the UK, impossibly, has readings of 7.4 per cent for March and June and 8 per cent for both April and May. The most recent estimate of 7.8 per cent is calculated as the average of the most recent three months: 8 per cent, 8 per cent and 7.4 per cent. The March estimate of 7.359 per cent was dropped and a 7.392 per cent added for June, suggesting the unemployment rate actually rose slightly.

In terms of numbers that is exactly what happened: 2,369,961 was dropped from March and 2,395,841 was added for June so the three-month moving average increased by 8,626.

Despite this the Office for National Statistics (ONS) told us that unemployment had fallen by 4,000. It gets this by comparing the average of the last three months, April-June (2,514,091) with the average for January-March (2,518,214). But it is more appropriate to compare it to the average for March-May (2,505,464).

Even the ONS concurs that the single month estimates are preferred: “The movement in the latest single-month figures is, in theory, a better indication of the latest change in the labour market than the difference between the latest two, overlapping, three-month periods.”

It adds that “improvements to the methodology for producing the single-month estimates have been identified and work is ongoing to implement them in the future”.

That is welcome, but it needs to be implemented fast to stop this big monthly variability and confusion.

The other major concern is that real wages continue to tumble, especially for part-timers who we know are hours constrained.

The most recent data for May 2013 suggest mean, gross-hourly earnings of full-time employees over the last year rose by 2.1 per cent, well below the most recent rise in inflation. For part-timers, mean nominal hourly earnings actually fell by 0.4 per cent, so real hourly earnings dropped by more than 3 per cent on the year.

Since May 2010, when Mr Osborne became Chancellor, full-time, nominal earnings are up 4.9 per cent and part-time nominal earnings are up 2.7 per cent compared to a rise in the CPI of 10 per cent. This is a sharper decline in real earnings than in almost any advanced country including Spain and Ireland. Only the Greeks, Portuguese and Dutch have had a steeper decline.

Standards of living for the average Independent reader have crumbled over the last three years and the blame for that rests squarely at Slasher’s 11 Downing Street door. He gets to claim credit for diddly squat.

Of course it feels good when you stop hitting yourself in the head. The best that can be said is the UK economy has started to heal slowly from a self-inflicted wound. Early days.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments