The GDP growth is good news on the economy, but let's not get carried away

This 0.3 per cent growth is hardly evidence of "healing" as the Chancellor has claimed. The best that can be said is the economy is still flatlining.

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The GDP numbers for the first quarter of 2013 were a welcome surprise. The market consensus was for 0.1 per cent growth and we got 0.3 per cent. The production industries grew by 0.2 per cent, private services by 0.6 per cent and public services by 0.5 per cent. The big pulldown once again was construction, which was down 2.5 per cent on the quarter. Construction of course was decimated by the Coalition's idiotic decision to slash public investment, which everyone now seems to recognise was a huge mistake. No public construction, no private construction.

This little bit of growth is hardly evidence though that the economy is “healing”, as the Chancellor claimed, given that it simply cancelled out the minus 0.3 per cent in the previous quarter, so no growth for six months is not exactly worth celebrating. The best that can be said is the economy is still flatlining. But a positive number is better than a negative one.

An ONS spokesman has confirmed to me that “the average revision to initial GDP data releases is 0.1 per cent since 2000 and since Q1 2006 the average revision between the first and the latest estimate is minus 0.03 per cent of GDP”. Most of the revisions were driven by methods changes such as the switch from RPI to CPI and updating annual weights. So they may not be a good guide to the size of potential future revisions. But on average the revisions tend to be small, although not at turning points.

The big problem in the Great Recession was the huge downward revisions to the data at the start of the recession – Q2 2008, Q3 2008 and Q4 2008 – the first estimates of 0.2 per cent and minus 0.5 per cent and minus 1.5 per cent respectively have now been revised downwards to minus 0.9 per cent, minus 1.8 per cent and minus 2.1 per cent. This is a total downgrade amounting to a 3 per cent drop in GDP. Over the last ten quarters the economy has grown 1.1 per cent, of which 0.9 per cent was accounted for by the Olympics. Five of the quarters were negative. The US, by contrast has grown by 4.9 per cent.

GDP is still 2.6 per cent below what it was at the start of the recession in Q2 2008, making this the slowest recovery in over 100 years. If the economy was to continue to grow at a pace of 0.3 per cent per quarter, by the time the election comes in 2015, we will have had data on an additional eight quarters, so output will still be below its starting level and well below the pre-crisis trend rate of growth would have left it. The Funding for Lending scheme has been extended to try to boost lending to firms, especially SMEs, which is still falling. It is hard to be optimistic that this time they have fixed it. The prospects are that the IMF will be highly critical of the UK’s economic strategy when it makes its regular visit to the UK in May.

It is hard to see where growth is going to come from other than government spending, which is likely to be cut further in June in the next spending round, given that the other three components of demand – investment, consumption and net trade – still show no sign of taking off. It also appears that there has been no transformation in business or consumer confidence. The Bank of England’s agents’ scores on business investment and employment intentions have shown no sign of picking up. The CBI Distributive Trades Survey for April reported a drop in sales on average for the first time in eight months in April, and the outlook for sales in the coming month was the gloomiest for 15 months. The squeeze on household finances intensified in April for the first time this year, according to Markit’s monthly Household Finance Survey. Households, according to the survey, “remain all too aware of the fragility of the economy and the lack of recovery”.

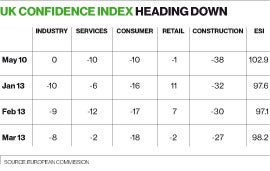

It also seems that there is little or no evidence that business or consumer spending is turning around – far from it. The table above illustrates using data from the European Commission’s monthly surveys of business and consumer confidence for the UK. The data are reported as balances – a higher number suggests improving conditions. I report five confidence measures for production industries; services, retail, construction plus a consumer confidence index. In addition I report the Economic Sentiment Index, which is a combination of the five scores, with the long run average set equal to 100. Data are presented from the date the coalition was formed in May 2010 along with the past three months of data. The overall ESI along with consumer confidence, industry and retail confidence are lower than they were when the coalition was formed. The services balance was lower last month than the starting value but picked up this month; the construction sector balance is above what it was in 2010 but is still abysmal. It certainly does look that George Osborne was right in his February 2010 Mais lecture when he said: “For it is the lack of a credible plan to deal with the deficit that is…undermining the monetary stimulus that is supporting the economy, and sapping the confidence of investors and consumers.”

Plus the news on the deficit reduction plan last week wasn’t good. Public sector current budget deficit was £10.6bn in March 2013. This is a £0.9bn higher deficit than in March 2012. After removing the effects of the transfer of the Royal Mail Pension Plan and the transfers from the Bank of England Asset Purchase Facility the first 2012/13 estimate of public sector net borrowing is similar in level to last year’s borrowing at £120.6bn, £0.3bn lower net borrowing than in 2011/12.

As Chris Leslie, Labour’s shadow financial secretary to the Treasury, colourfully noted: “Underlying borrowing was essentially the same last year as the year before and the OBR forecasts it will be around the same this year. And the lack of economic growth means the government is now set to borrow £245bn more than planned simply to pay for the costs of their economic failure. George Osborne no longer has a deficit reduction plan. In fact, at this rate, it will take 400 years to balance the books.”

So a little bit of good news for a change. But I certainly wouldn’t get carried away. The patient is still in intensive care and likely to stay there for a while.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments