Here’s a way to end our slump: give away money

Why not give significant tax cuts to the low end of the income distribution rather than the top end?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The horrid latest gross domestic product (GDP) numbers inevitably resulted in the Coalition coming under pressure from all sides to do something to get the economy moving.

Some on the right, such as Allister Heath from City AM, has suggested the correct approach is to cut corporation and capital-gains taxes, which would clearly be a stimulus and better than nothing. My concern, though, is that this would take a considerable time to have any effect, would raise inequality further and would have little impact on consumption anytime soon. Such tax cuts would also increase the capital share of GDP, which has risen inexorably over the labour share for the last few years.

In the 1970s it was clear labour was taking too large a share, in part driven by the big increase in the proportion of workers who were members of unions, and hence in workers’ bargaining power. In 1969, 9.9 million workers were members of unions, but by 1979 that number had risen to 13.2 million. Today the reverse is the case, as union density has now fallen sharply and workers’ bargaining power has weakened because of globalisation and job insecurity. There is a clear need to get back to a better balance again and move resources in the opposite direction, from capital to labour. According to the Certification Office, in 2009-10 7.3 million people were members of unions. The proportion of workers who are union members in the private sector has fallen from 21 per cent in 1995 to 14 per cent in 2011, and from 61 per cent to 57 per cent in the public sector. This is not just a British phenomenon; in the US, private-sector membership rates have fallen sharply downwards to 6.6 per cent and public-sector rates are at 35.9 per cent.

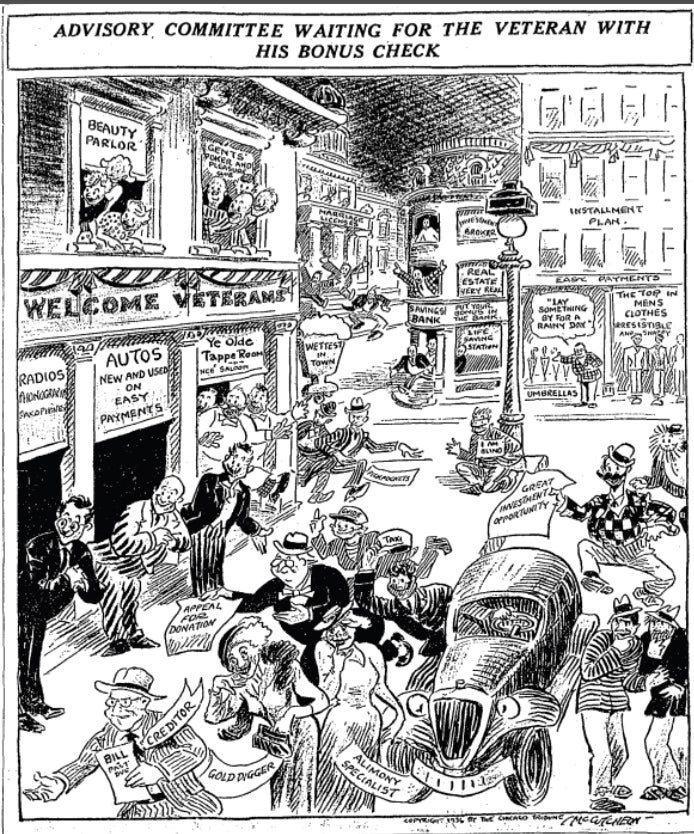

As I noted in this column last week, the big issue that has to be confronted is that workers have been hit by a 10 per cent real wage cut and are unlikely to start spending in the near future. One way to do this would be to give significant tax cuts to the low end of the income distribution rather than the top end. The poor have higher marginal propensities to consume than the rich do. A possibility would be to reduce VAT significantly, say by 5 per cent. Another idea would be to give a significant, one-off bonus to deserving groups who are not well-off such as the young who have been especially hard hit by the recession or to military veterans. There is a precedent from the 1930s for a burst of fiscal stimulus, which turns out to have had a major positive impact on spending, unemployment and growth.

Conventional wisdom has it that in the 1930s fiscal policy did not work because it was not tried. A new paper by Joshua Hausman from UC Berkeley shows that fiscal policy, though inadvertent, was tried in 1936, and a variety of pieces of evidence suggest it worked. Unemployment was high in 1936 although it should be said that growth had been very strong since 1933. Year over year, real GDP growth was 10.9 per cent in 1934 and 8.9 percent in 1935. After years of demonstrations and lobbying by veterans’ groups in 1936, the US Congress authorised a deficit-enhanced payment of $1.8bn to 3.2 million First World War veterans who were to receive cash and bond payments. This totalled 2.1 per cent of GDP, which in the UK would now amount to around £30bn and in the US is equivalent to more than $300bn (£190bn). The typical veteran received a payment of $550, more than the annual per capita income of $535, and enough money to buy a new car; the price of the cheapest Ford at the time was $510. Within six months of receipt veterans spent the majority of their bonus. The size of the stimulus was roughly of the same magnitude as annual spending from the American Recovery and Reinvestment Act (the Obama stimulus) in 2009 and 2010.

Mr Hausman looked at a detailed, household-consumption study cross-state and cross-city, aggregate time-series econometric analyses, and an American Legion survey of veterans to examine the impact of the bonus. The evidence paints a consistent picture in which veterans quickly spent the majority of their bonus. Narrative accounts support these results. Mr Hausman calculated the bonus added 2.5 to 3 percentage points to 1936 GDP growth and lowered the unemployment rate by 1.3 to 1.5 percentage points. Spending was concentrated on cars and housing. For every additional veteran living in a state, 0.2-0.35 more new cars were sold in 1936. If veterans only bought the cheapest Fords or Chevrolets, then an additional veteran raised new car spending by $140. Spending on residential construction for each additional veteran in a state rose by $120-$200. The American Legion survey shows that out of every dollar veterans planned to spend 60 cents and it appears in the end they actually spent around 70 cents in the dollar.

Plus there was lots of other anecdotal evidence supporting Mr Hausman’s findings.

The LA Times wrote on 19 June 1936, four days after the bonus was distributed “All signs yesterday pointed to a real spending spree by veterans… Downtown department stores reported yesterday’s sales were more than 30 per cent above a week ago.” The Wall Street Journal reported a couple weeks later, on 3 July 1936: “Unusual gains in retail sales of new passenger cars... No doubt the bonus had something to do with pushing sales into new high ground.”

So here is an idea to get the economy moving. The Government could issue a £30bn bond and the Bank of England’s monetary policy committee could buy it as part of quantitative easing. The Government would then pick a well-deserving group and give them a big bonus, which is the equivalent of a tax cut.

How about, as a starter, distributing it among all our military veterans, including those from Afghanistan for their service to the nation, rather than giving tax cuts to the rich?

Giving a million people £30,000 each would undoubtedly get the economy moving. We could also give perhaps a smaller bonus to youngsters whose lifetime earnings, research shows, will be lowered simply because they were teenagers during a once-in-a-hundred-year recession. Looks a better idea than making the rich richer.

Joshua K. Hausman (2013), ‘Fiscal Policy and Economic Recovery: The Case of the 1936 Veterans’ Bonus,’ University of California, Berkeley.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments