Get off your high horses, lefties – Big Government, not 'austerity', has brought Greece to its knees

The seeds of the current crisis were sown in the 1980s, and have been nurtured by economic illiteracy ever since

What I admire about the anti-capitalist left is their ability to present their ideas as somehow "unorthodox" and "anti-mainstream", when they are clearly nothing of the sort. Go to any high street bookstore, and you will find that the politics section consists of little else but the tomes of Naomi Klein, Noam Chomsky, Russell Brand, Owen Jones, Ha-Joon Chang, George Monbiot and the other usual suspects. If that is a "neoliberal hegemony", I dread to think what a left-wing hegemony would look like.

Still, I am amazed by how the British left has managed to convince themselves that Syriza somehow represented a break with "neoliberal politics" in Greece. According to Zoe Williams, what Syriza and other far-left parties in Europe have in common "is that they reject the prevailing economic verities”. Meanwhile, Owen Jones has trumpeted that “Outside the Greek finance ministry are cleaners who used to work there […] There is a real sense that maybe – just maybe – the likes of these sacked middle-aged cleaners could be the new masters now.” He adds: “No wonder so many [European] leftists [...] travelled to Athens for this moment. For many of them, neoliberalist triumphalism is all they have ever known.”

Yet after three and a half decades of economic statism and hyperinterventionism, how exactly is a party that stands for economic statism and hyperinterventionism a "break" with anything? Ever since the PASOK victory of 1981, Greek politics has been Fifty Shades of Red, and Syriza merely represents a more glaring shade in this spectrum.

The seeds of the current crisis were sown in the 1980s, when PASOK built up a huge client state, buying the support of various electoral groups through selective subsidies and favours. Other parties soon joined them in this endeavour, turning Greek politics into a bidding war, and the Greek state into a patronage machine. Between the late 1970s and the early 1990s, government revenue surged from under 25 per cent of GDP to over 35 per cent, but client states are expensive to maintain, and government favours fuel demand for more government favours. So the money was never enough, and the shortfall was made up by borrowing and printing more of it. Government debt increased from less than 20 per cent of GDP to more than 100 per cent, and inflation jumped from less than 5 per cent to more than 10 per cent, while growth largely stalled.

The Greek economy had become a rent-seeking economy, in which economic activity is not about creating wealth, but about extracting wealth from others through the political process. If you’re afraid of dog-eat-dog capitalism, you haven’t seen dog-eat-dog socialism yet.

A particularly popular form of favouritism has been to restrict entry into various professions. This benefits incumbents, because it wards off competitors, and drives up the value of their licence. But their gains come at the expense of consumers and of would-be entrants. Every country has some protected sectors, and as long as there aren’t that many of them, it does not matter hugely. But when over a hundred professions are closed off, as is the case in Greece, the cost to consumers becomes unbearable, even before taking into account the decline in labour mobility and productivity.

At the same time, the economic policy fundamentals – essentially, the rule of law and the quality of institutions – have been undermined, or at least utterly neglected. In the World Bank’s "Ease of Doing Business" rankings, Greece ranks 155th out of 189 countries in the crucial “enforcing contracts” category, just a few places above Zimbabwe and Sudan. In the "registering property" category, Greece comes out 116th, behind Pakistan, Ethiopia and Cambodia. The Fraser Institute’s "Economic Freedom" index shows a similar picture. In all-important categories like "judicial independence", "impartial courts", "protection of property rights" or "reliability of the police", Greece looks more similar to Latin American than to the rest of Europe.

Presumably, a correction would eventually have been inevitable. But the country’s ill-advised admission into the Eurozone flooded it with cheap credit, which led to a fake boom that magnified the worst elements of Greek politics.

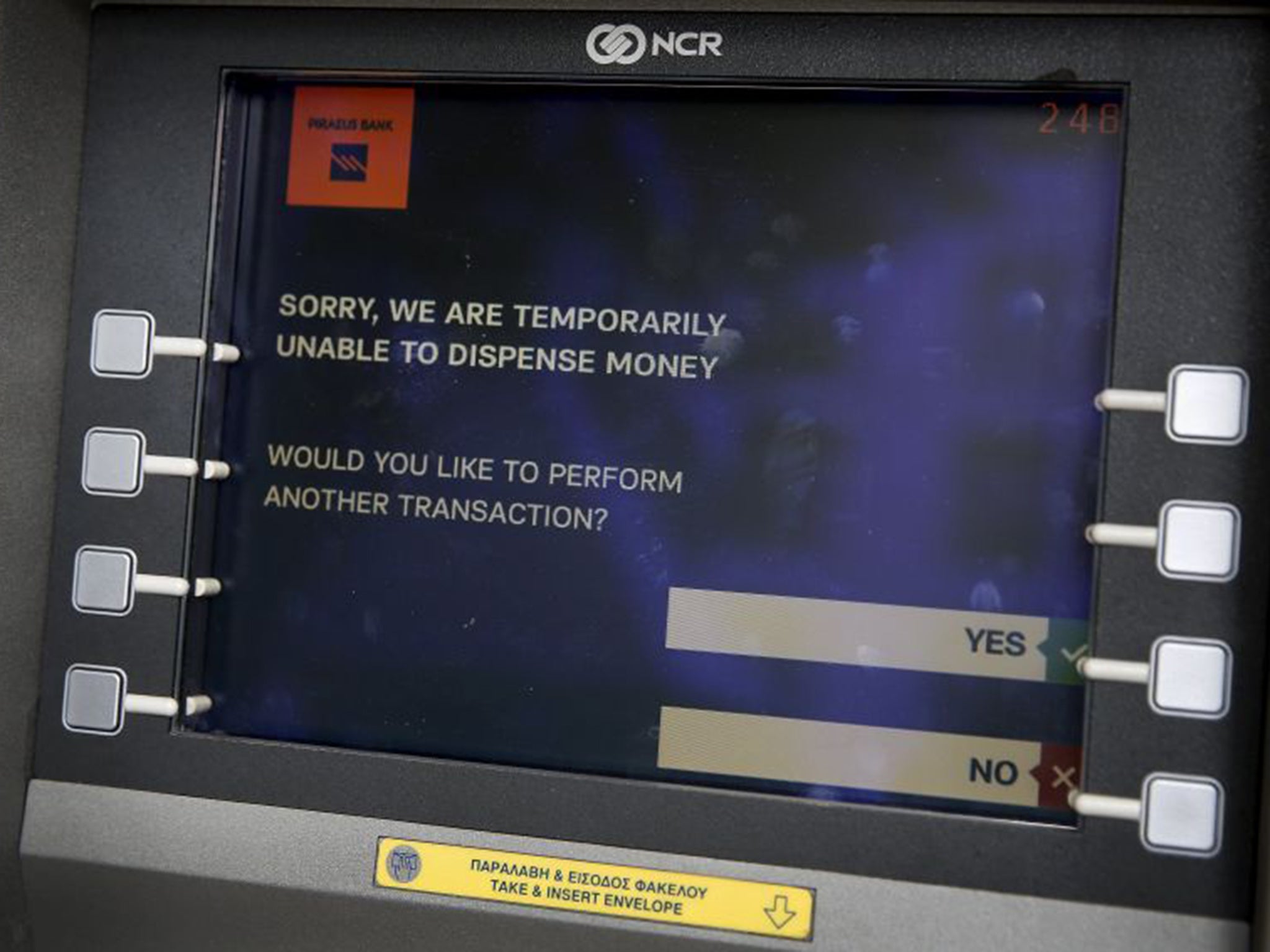

Unfortunately, the time for good solutions has now expired. The least bad solution would be a not-too-disorderly exit from the Eurozone, a return to the Drachma and effectively a sharp devaluation, followed by a partial or even full sovereign default. That, of course, would mean more austerity, not less.

Greek wages and prices would fall steeply in real terms, and the Greek government would be locked out of capital markets for the foreseeable future. But the Greek economy would price itself back into international markets, and structural reforms might finally become feasible if they could no longer be presented as an imposition from you-know-who. Greece’s political class would run out of excuses, and that can only be a good thing.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments