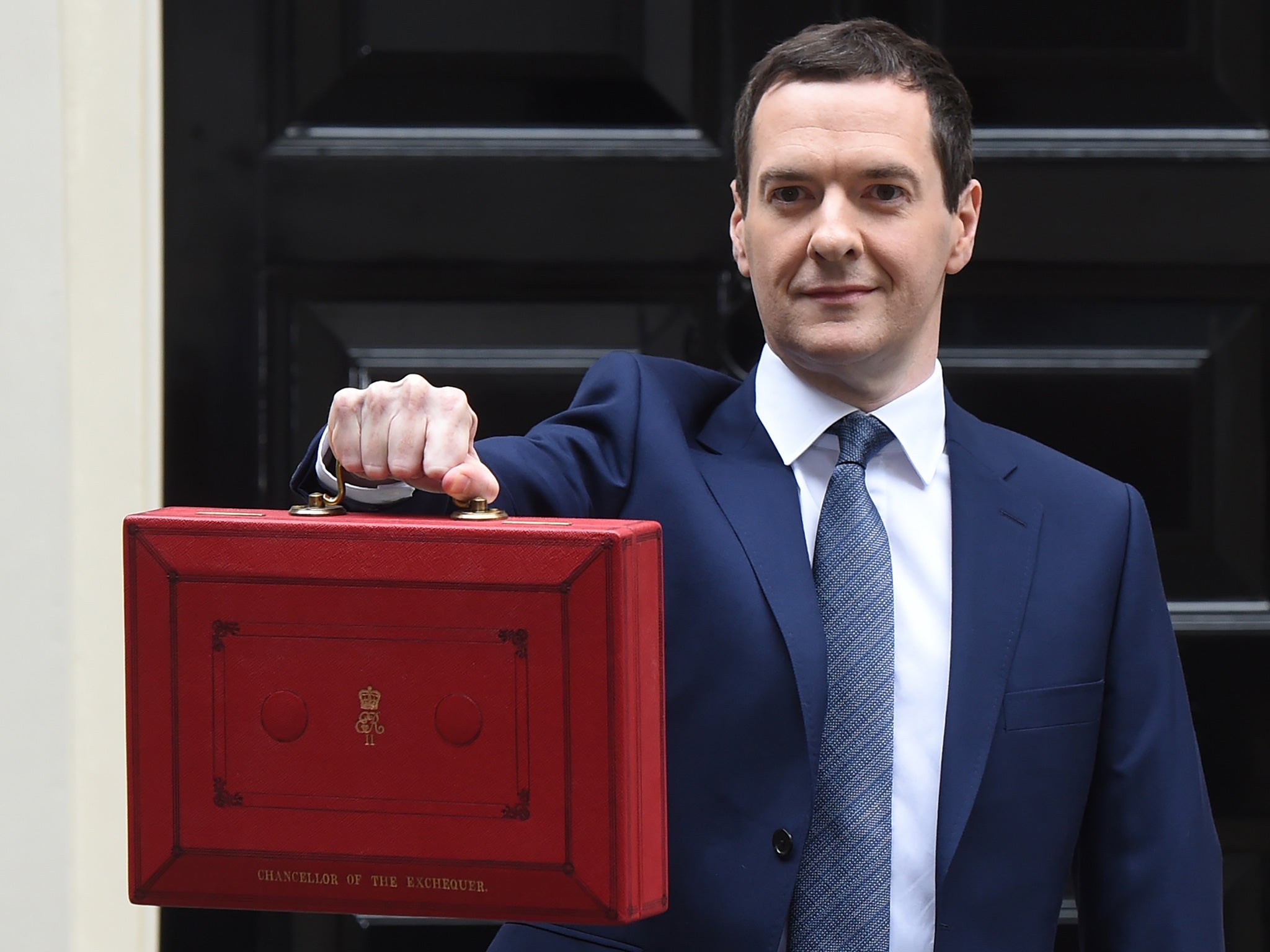

Budget 2015: Small businesses bear brunt of living wage

The £9 hourly rate for the over-25s did not enamour Osborne to start-ups and SMEs

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne’s message to British business – big and small – was clear: you can keep more of your profits through lower taxes and more dividends, but you’ve got to share the proceeds with your colleagues by paying the living wage.

This was great “ we are in this together” politics from the Chancellor, and got the cheers he wanted from the government benches and the snarls he expected from the opposition ones, from where he stole the policy. Yet the new £9 hourly rate for the over-25s did not enamour him to the thousands of start-ups and SMEs in the country for whom employment is often the biggest cost – the very companies which Mr Osborne hopes will be producing his target of two million new jobs over the next few years.

The new living wage is undoubtedly a positive social move but it may be bad economics. As Chris Rowley of the Cass Business School immediately asked, does it make sense to have the same hourly rate in the Orkneys as in London? Surely regional variations are needed in pricing labour as much as in goods? It’s the right question and one that critics of the euro raise when they ask why a cup of coffee costs the same in Athens as Paris.

So no surprise that the right-wing Adam Smith Institute condemned the move out of hand, describing it as a disaster that will put thousands out of work, particularly the young and the low-skilled. On a politer tone, John Allen, chairman of the Federation of Small Businesses, also warned that many SMEs, specifically in retail and the service sector, will find the new rates challenging.

Bang on cue, the National Hairdressers’ Federation came out blazing, claiming hairdressers would have to either take a razor to staff or cut their hours, and would be less likely to take on apprentices. Not quite the sort of new haircut the Chancellor was looking for.

There’s no doubt these salary rises will hit many smaller firms in the lower-paid service industries. Frank Nash, tax partner at Blick Rothenberg, estimates that the new minimum hourly rate means that the real cost to employers who pay their trainees the minimum wage will be as much as 4 per cent more, after inflation, per annum. And they will lead to price rises that in turn may feed through into inflation.

Yet the Institute of Directors, which has thousands of small and medium-sized business members, says it is happy with the new rate as nearly all of its members already pay that much anyway. It’s too early to say which is right.

Budget 2015: The story of the Budget in four charts

"'Pay to stay' will bring about the death of social housing"

Watch Iain Duncan Smith perform double fist pump during Budget

Three ways the Budget announcement is bad news for students

What Mr Osborne also made abundantly clear in this Budget is that he is serious about One Nation Toryism – and his pitch to be the next PM – and has obviously taken great care to address many of the blatant inequalities in the tax treatment of companies and individuals.

Nor has he let small business owners off the hook either. Quite the reverse. On the one hand, they will have corporation tax cut again in the next few years to 19 per cent, but they will also have money taken away from them by a new tax on dividends. Indeed, if you are a small business owner with a company making about £50,000 a year profit, you will be paying more tax than before but about the same as if you were a sole trader. That’s fair.

But Mr Osborne may have missed a trick in helping boost manufacturers, especially those involved in his pet project, the Northern Powerhouse. His decision to introduce a permanent annual investment allowance of £200,000 per annum for companies will have helped small firms.

But that’s nowhere enough for the big manufacturers and civil engineering project managers which need to plan many years ahead. Blick’s Nash has worked out that Mr Osborne has saved himself about £3.8bn over the next five years by not keeping the allowances at previous levels. Not so clever.

Twitter: @maggiepagano

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments