Be warned George Osborne: more home owners just really means higher unemployment

An increase in people acquiring property cuts labour mobility and the number of new firms

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Unemployment is a major source of unhappiness and mental ill-health.

Yet after a century of economic research, the determinants of unemployment are still imperfectly understood, and unemployment levels in the industrialised nations are around 10 per cent, with some over 20 per cent.

The historical focus of the literature has been on which labour market characteristics – trade unionism, unemployment benefits, job protection, etc – are particularly influential. Contrary to what many on the right have claimed, they aren’t.

In a new paper Professor Andrew Oswald from the University of Warwick and I propose a different approach to the problem by exploring the hypothesis that high home ownership damages the labour market. Our study provides evidence consistent with the view that the housing market plays a fundamental role as a determinant of the rate of unemployment.

We find that rises in the home ownership rate in a US state are a precursor to eventual sharp rises in unemployment in that state. A doubling of the rate of home ownership in a US state is followed in the long run by more than a doubling of the later unemployment rate. We also find that high home ownership lowers employment rates. These effects do take some time to develop – roughly of the order of five years.

What mechanism might explain this? Our argument is not that owners themselves are disproportionately unemployed. They have higher employment rates than renters. But the evidence suggests, instead, that the housing market can produce negative “externalities” upon the labour market. We show that rises in home ownership lead to three problems: (i) lower levels of labour mobility, (ii) greater commuting times, and (iii) fewer new businesses. And so official policies that boost the amount of home ownership in a country are likely to inflict damage on the labour market.

We examined a century of unemployment and home ownership data for the states of the USA from 1900 to 2010. Combining those numbers with modern data on millions of randomly sampled Americans, we show there is a powerful link between the housing market and the later, worse, health of the economy.

Rises in home ownership in a US state are followed by substantial increases in the unemployment rate of the state, a fall in the mobility of its workers, a rise in commuting times, and a drop in the rate of new business formation. We carefully check, and replicate, our findings for different periods of US history.

We are agnostic about some of the underlying mechanisms, but we believe that high home ownership in an area leads to people staying put and commuting further and further to jobs, creating cost and congestion for firms and other workers. It leads to NIMBY (not in my back yard) activities, where home owners block new businesses. Finally, it contributes to an ossification of the mobility and dynamism of an economy.

In our study we found, for example, that the states that had the highest change in home ownership (an average of +23 per cent in Alabama, Georgia, Mississippi, South Carolina and West Virginia) since 1950 had a rise in the unemployment rate of 6.3 percentage points between 1950 and 2010. By contrast, the five states that had the lowest increase in home ownership over the period 1950-2000 (an average of +1 per cent in California, North Dakota, Oregon, Washington and Wisconsin) saw a rise in unemployment of 3.5 percentage points over the 60 years from 1950-2010. These numbers should be seen against the background of the unusually high national unemployment rate in 2010. Over the last five years the US has also seen a big decline in the home ownership rate – down from 69 per cent in Q3 2006 to 65 per cent in Q1 2013.

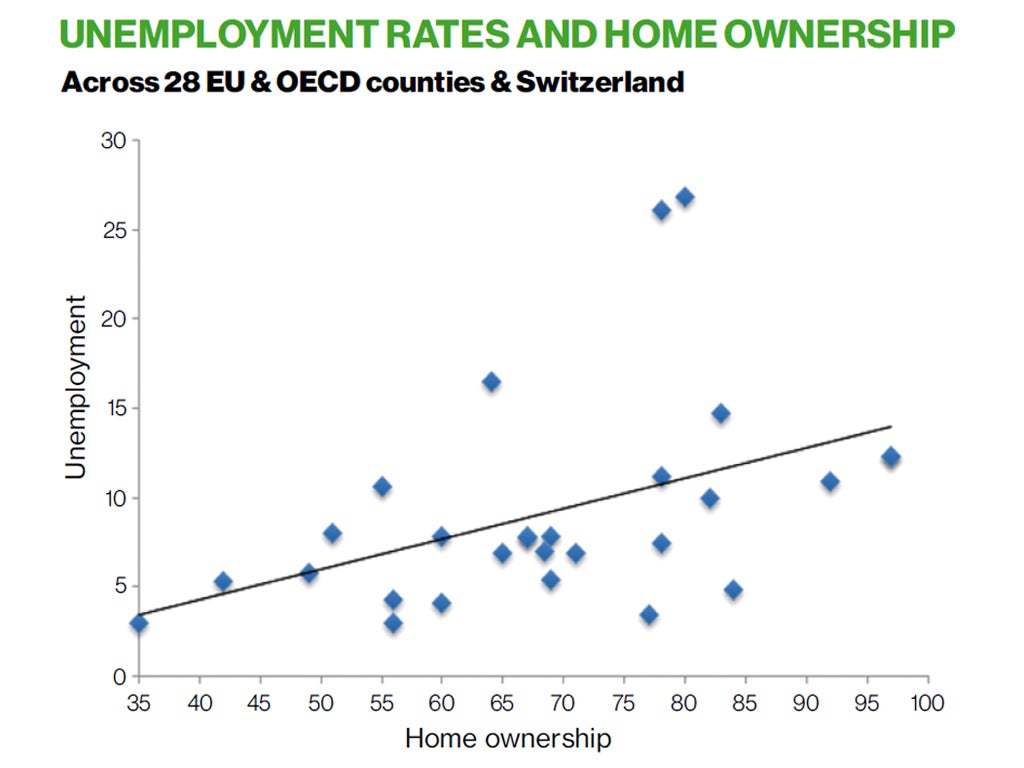

The chart above shows that the idea seems to apply equally well to Europe where there is also a positive relationship between the home ownership and unemployment rates. Countries like Spain and Greece famously have high home ownership (80 per cent plus) and high unemployment (20 per cent plus), and are the two plots at the top right of the chart.In contrast nations like Switzerland, Germany are notably low on both – they are the two plots at the bottom left of the chart.

Home ownership rates in the UK increased after 1945, reaching 50 per cent by 1971 and ultimately peaking at 69 per cent in 2001. Over the last decade it has fallen back to 64 per cent, very close to the US rate. The rapid increase in the number of households privately renting could be explained by high house prices, since most Britons still say they want to own their own homes.

It is odd that the British seem to believe that renting has to be a low quality alternative to buying. Switzerland, Austria, and Germany show that isn’t true. And why should people spend a lifetime buying a house and then leave all the capital to someone else when they die? But, whatever, the renting trend has likely improved the workings of the UK labour market.

George Osborne’s latest scheme to underwrite £130bn of mortgages with public money, intended to increase the number of home owners, could raise unemployment. As my old friend Rachel Lomax said last week, offering more “hair of the dog that bit you” looks like a really dumb idea.

David G. Blanchflower and Andrew J. Oswald (2013), “Does High Home Ownership Impair the Labor Market?” Peterson Institute for International Economics Working Paper 3-13

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments