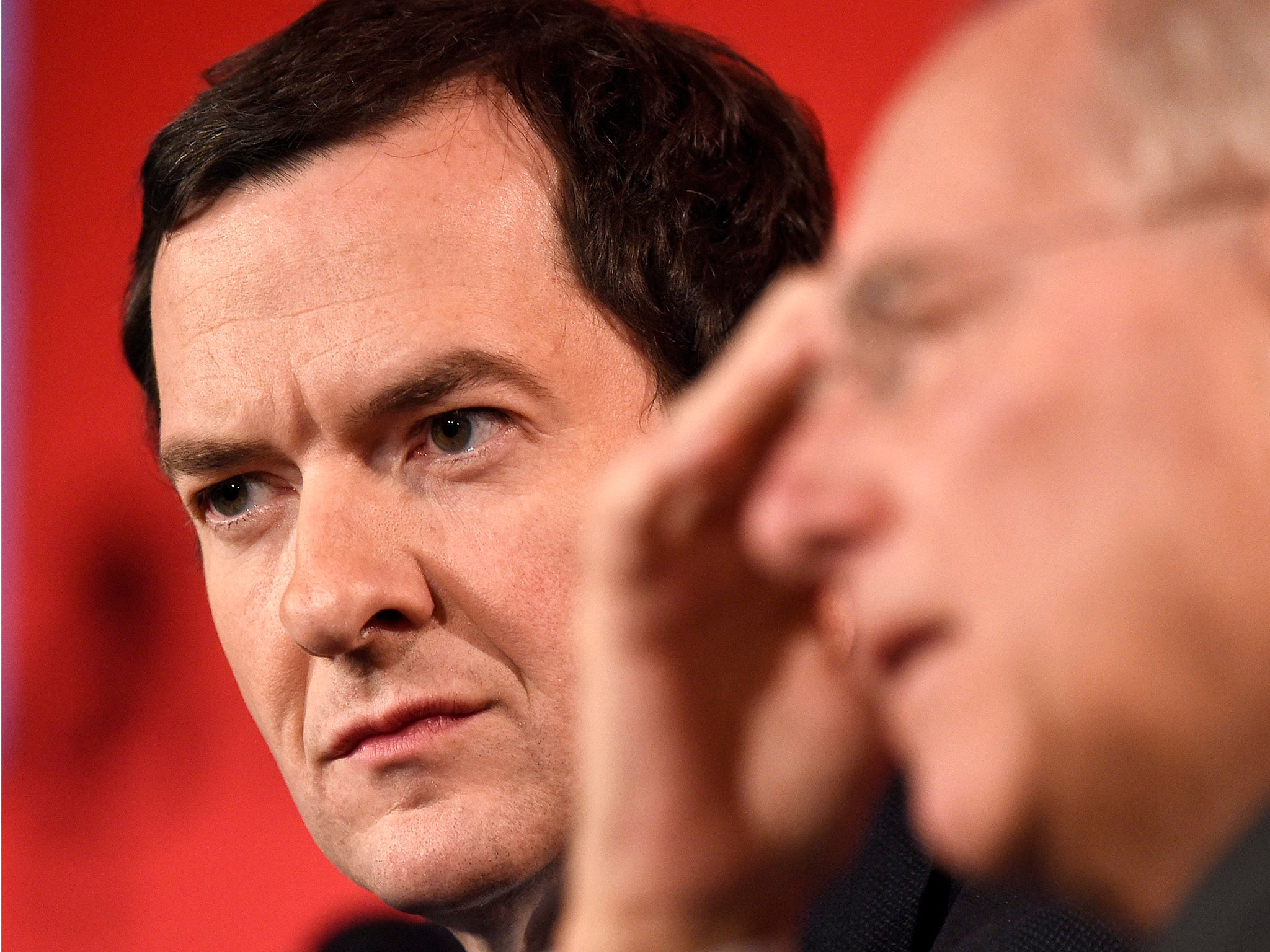

Budget 2016: It would be a mistake for George Osborne to use pensions as a device to balance the books

It is in their long-term interests for the Tories to end this divisive generation game

One safe bet about the 16 March Budget is that George Osborne will hail it as a “Budget for savers”. Chancellors usually do, even when interest rates are at an historic low as they are now.

In the run-up to his Commons statement, Mr Osborne has been agonising over a huge decision. He wants to announce reforms to pensions but is caught in a cross-current of conflicting advice from fellow ministers, Conservative MPs and the pensions industry. Late on 4 March there were growing signs that the Chancellor is getting cold feet and may put off a final decision until another day.

Two big ideas are on the Treasury table. The first would make the £21bn-a-year system of tax relief on pension contributions fairer. At present, it is skewed towards the better-off because higher earners get tax relief of 40 or 45 per cent and lower earners 20 per cent. So while basic-rate taxpayers make 50 per cent of total pension contributions, they receive only 30 per cent of pension tax relief. About 50 per cent goes to taxpayers on the 40p higher rate and 20 per cent to those on the 45p top rate for incomes of more than £150,000 a year.

During the Coalition Government, Steve Webb, the impressive Liberal Democrat pensions minister, lobbied Mr Osborne to bring in a 33 per cent rate of relief for everyone, giving those on lower incomes more help but taking some away from the better-off. But what Tory-supporting newspapers would attack as a “raid on middle-class pensions” was deemed too risky before last year’s general election.

Now the Chancellor has revived the idea, and if he goes ahead will doubtless claim it as his own. It would fit with the Tories’ claims to be the “party of working people” and David Cameron’s One-Nation bucket list. And flat-rate tax relief of between 25 to 35 per cent could save the Treasury £6bn a year.

However, the Chancellor now appears to be retreating in the face of dire warnings of a backlash from Tory MPs. “This is an Exocet missile aimed at our people,” one growled. “If Osborne wants to be [Tory] leader, he needs to think again.”

The second option is to scrap upfront tax relief in favour of “pension Isas”, under which people would not pay any tax when they drew their pension. One attraction for Mr Osborne is that this could save the Treasury between £20bn and £30bn a year in the short term, a timely boost as he raises the prospect of further spending cuts to balance the nation’s books.

But it would mean lower tax revenues eventually at a time when an ageing population would need more state support for health, social care and the basic state pension. And it could deter people from saving for their retirement as a future chancellor might decide to tax people’s pension pots. The move is opposed by Ros Altmann, the feisty pensions minister, and some Tory MPs, who fear the middle classes would see the loss of tax relief as a tax hike and a broken promise. During last year’s election campaign, the Tories said: “We believe the pensions tax relief system will be fair and affordable and we will not propose any further changes to that system during the next parliament.”

There are signs that Mr Cameron is urging caution. With Tory MPs split down the middle on whether to leave the EU and some still making up their minds, the Prime Minister needs friends rather than more enemies. So it now looks likely that the Budget will do very little on pensions. Mr Osborne could play for time and return to the issue after the EU referendum.

Other Tories hope the Chancellor will press ahead. David Willetts, the former minister and peer who chairs the Resolution Foundation think-tank, says that pension reform could be “progressive”, but that “the crucial test” will be whether young adults are given more incentives to save – such as beefing up the programme under which workers are automatically enrolled into a pension scheme and making pensions more flexible so they can be drawn in an emergency before retirement.

Mr Osborne should resist the temptation to use pensions as a cash cow – and remember how he and other Tories attacked Gordon Brown for doing so. If he wants to further Mr Cameron’s One-Nation agenda, the Chancellor should use any savings to bridge the worrying divide between the old and the young.

This is being fuelled by policies such as the £6bn “triple lock” on the basic state pension (under which it rises by earnings, prices or 2.5 per cent, whichever is higher). It is being funded by the taxes of today’s hard-pressed young adults. Pensioner poverty has been virtually abolished but the state still cossets better off pensioners with perks such as winter fuel allowances they do not need. In contrast, benefits for working-age adults have fallen since the 2008 financial crisis, and most payments are frozen until 2020. The switch from maintenance grants to loans for university students from poor families could leave them with debts of £50,000 when they start work. What chance then of putting money into a pension, or getting on the housing ladder?

Mr Osborne will doubtless claim that his eventual pension reforms would help the young generation to save. But I can’t think of a better use of any windfall he has than to tackle the housing crisis for young people, which would mean helping those who rent as well as buy. The Tories might think it makes electoral sense to woo older people because they vote in far greater numbers than the young ones. But it is in their long-term interests to end this divisive generation game.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies