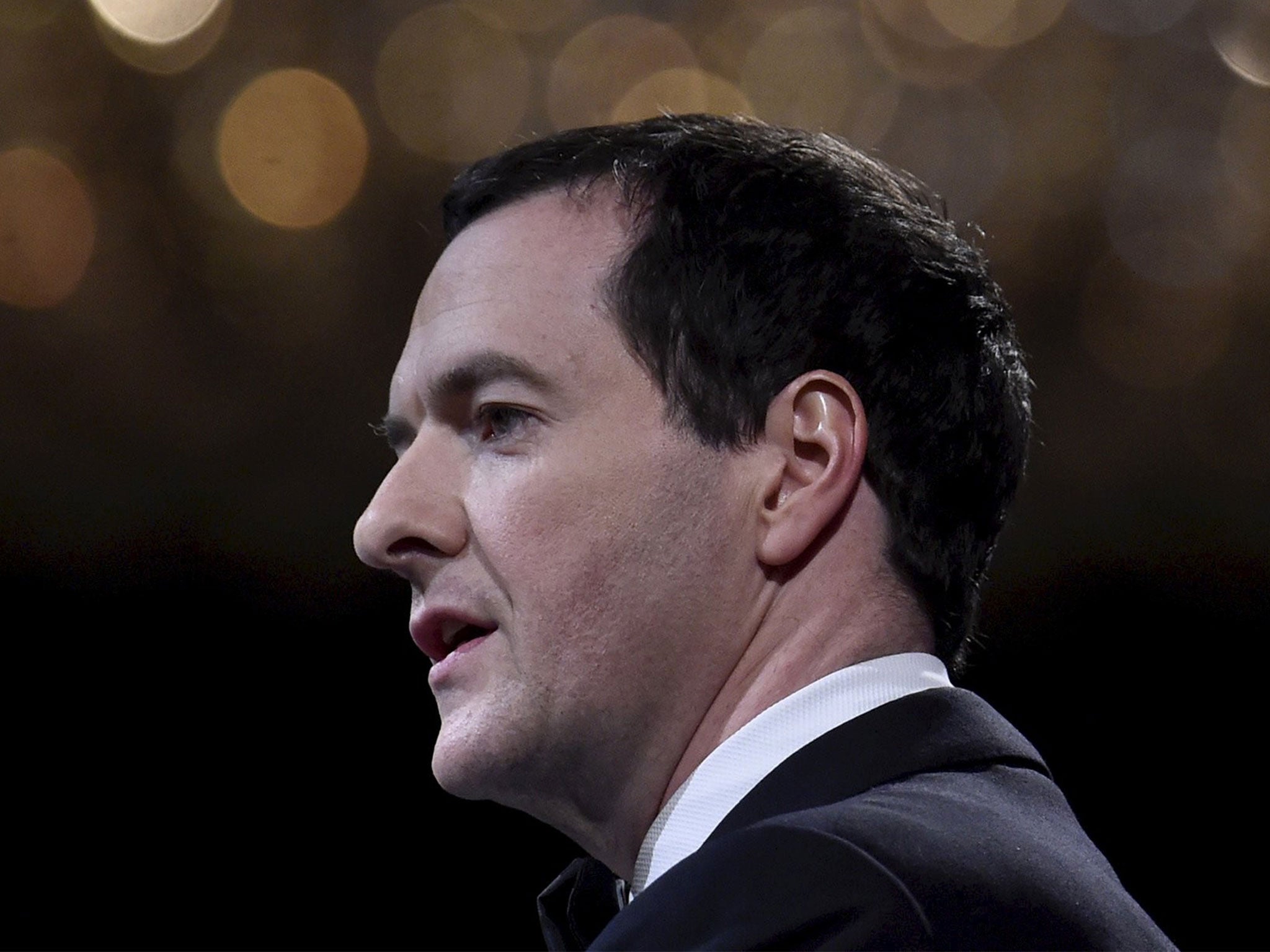

Autumn Statement: Osborne's plan is a hall of smoke and mirrors

What kind of ‘devolution’ plan starts with splashing central government money about?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.One of the good ideas in yesterday’s Autumn Statement was the scrapping of a previously announced bad idea, namely the tax credit changes announced in the Summer Budget. Under those plans, the rate at which tax credits are withdrawn with income would have been raised from 41% to 48%, and the income level above which that rate applies would have been slashed from £6,420 to £3,850. The savings this would have produced would almost certainly have been of the ‘false economy’ variety, because it would have undermined work incentives. Low-paid employees would have lost 80p for every £1 in extra gross earnings. Sure, spending on tax credits would have gone down. But it would also have led to lower work levels, and therefore, eventually, to higher spending on other types of benefits.

The single best measure in the autumn statement is the announcement to devolve business rates to local councils. This may not sound like exciting stuff, but it will, for the first time in ages, introduce a dose of tax competition into our rigid system of local governance. The UK is currently one of the most centralised countries in the world. The national level accounts for 95% of all tax revenue, which is a higher share than in France; a degree of centralisation that would have made Chairman Mao proud. This arrangement destroys the link between economic activity and tax revenue at the local level. From a council’s perspective, ‘revenue’ is not something that is generated locally through commerce and enterprise, but something that is handed down from the top. This allows them to be obstructionist: They can afford to treat economic activity as a nuisance to be fended off, rather than as something desirable to be facilitated.

On its own, the devolution of business rates is a sensible step towards changing those dynamics. The problem is the overall inconsistency: this measure remains an alien element in an otherwise heavily Whitehall-centric Autumn Statement. In the same breath, Osborne also announced a raft of discretionary spending measures concerning issues that are intrinsically local or regional in character. £12 billion for a “Local Growth Fund”, an increase in transport capital spending of about £20 billion, £300 million on cycling schemes, £2 billion on flood protection, plus extra spending on Hull’s “year of culture”, on “Northern Powerhouse” projects, on a large number museums and academies, and so on. A consistent plan would be to devolve tax-raising powers and the corresponding spending powers together, as a package, so that local communities and regions can spend their own tax money according to their own priorities. What kind of ‘devolution’ plan starts with splashing central government money about?

And while it is all well and good that local authorities should compete for businesses, it is even more important that they should compete for residents: One of the main reasons why we are not getting any houses built is that our hypercentralised tax system allows local authorities to treat potential new residents as hostile invaders. It pays for local politicians to pander to small groups of professional Nimbys, which is why these groups have hijacked housing and planning policies almost entirely.

What the Chancellor will do, instead, is channel more money towards construction companies, apparently under the assumption that developers are simply unwilling to build houses, and need to be coaxed into doing so. This is total nonsense. Building houses is not rocket science, and neither construction costs nor land costs are especially high in the UK. Even when house prices stood at their peak, a hectare of land in the South East typically cost less than £7,500. However, the moment planning permission was granted, the price instantaneously shot up to over £3.3 million. This means that 99.8% of the price of land is currently explained by a slip of paper which says ‘planning permit’. That slip of paper so expensive because we are hardly printing any of them, so the solution is to print more of them.

Now imagine local authorities had to finance all of their expenditure from their own tax revenue, and imagine a large chunk of that revenue came from, say, a local Land Value Tax (LVT). They would then have a strong incentive to grant planning permission more liberally, because this would be an easy way to broaden their tax base. That is the way to solve the housing crisis – not subsidising developers, and not subsidising homeownership.

All in all, then, it was a typical Osborne budget: A few bright spots, but mostly gimmicks and tokens.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments