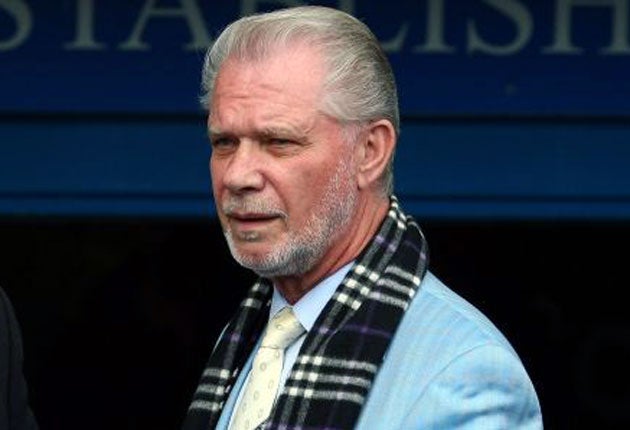

West Ham set to turn down 'rescue package'

Gold and Sullivan's offer guarantees £20m for players in exchange for full control

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.David Gold and David Sullivan will make a bid for West Ham United within the next 24 hours that will involve no money being paid directly to the current owners but will guarantee a cash injection for players and urgent debt repayments in exchange for a 50 per stake in the club, and effective control. Around £20m, contractually guaranteed in return for shares, would be invested in January, if a deal can be pushed through in time. Further funds would be committed later.

"This is almost a rescue package," said a well-informed source with knowledge of the bid. "Any money that they [Gold and Sullivan] put on the table will be used to build up the football club. It's not about helping the incumbents, but helping West Ham, and possibly saving them from relegation."

The offer is likely to be rebuffed. There is a huge disparity between what Gold and Sullivan feel is a sensible way forward, and how the Icelandic owners, CB Holdings, view the situation.

West Ham have £40m in debts in bank loans alone, plus at least another £30m in other liabilities, including some £19m to Sheffield United as a result of the Carlos Tevez fiasco. Yet CB Holdings appear to believe that even in the worst recession in decades, they can still calculate the value of the club using an "enterprise value" equation that adds debt and equity values.

In layman's terms, they see the debt as £70m, and would like to pocket £50m for themselves, and thus hope they can find a buyer who will effectively stump up £120m to take control.

Gold and Sullivan see things rather more starkly, viewing West Ham at a "tipping point" where a fall from the Premier League would be a precursor to the kind of financial meltdown seen by Leeds United and Southampton among others who have fallen to England's third division in recent years.

CB Holdings is 70 per cent owned by a bank, Straumur, to whom a large chunk of the club's loans are due. Gold and Sullivan ideally want Straumur to "park" West Ham's debt (pay the least amount required to service it), while most of their proposed investment would be spent on players, wages and infrastructure to help them stay in the Premier League.

The rationale is that Gold and Sullivan feel West Ham, debt free, would be worth around £60m or so, more in a boom, less now. As a stable Premier League club a few years down the line, it could be worth twice that. Their offer effectively asks the Icelandic owners to seek long-term stability and profit rather than risk the meltdown that would almost inevitably follow if West Ham were relegated.

West Ham's chairman, Andrew Bernhardt, has said there is no urgency to sell the club, and with talk of a mystery potential bidder from America waiting in the wings, is unlikely to relish the opportunity of taking on the Gold-Sullivan deal. The gamble is that West Ham will be left to founder without new cash, get relegated, and end up in a post-administration fire sale.

Gold and Sullivan will also outline how their experience in the game can assist West Ham, where Gold was a junior player, and where the pair co-owned a 30 per cent stake in the 1980s before selling up and investing in Birmingham. They subsequently bought the Midlands club for just £1, and after 16 years' ownership sold it earlier this year to Carson Yeung for £82m.

Gianfranco Zola's team currently sit one point above the relegation zone and are in desperate need of reinforcements to the squad during the January transfer window.

£82m

The amount that David Gold and David Sullivan sold Birmingham City for this year, having bought the club for £1.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments