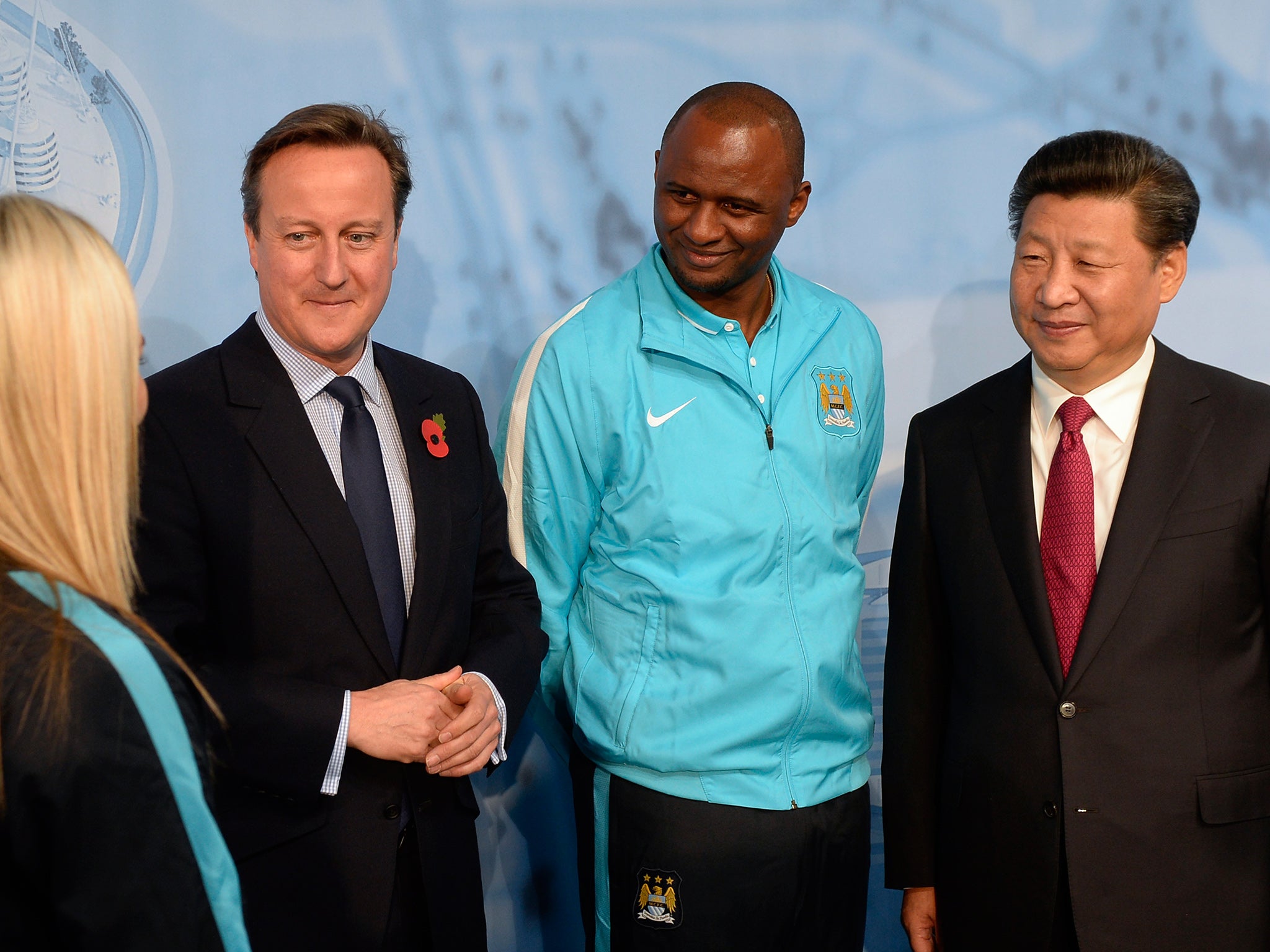

Manchester City's Chinese investors have close links to Beijing government

Who are the the new investors who have bought a 13 per cent stake in the club?

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Who are the Chinese investors who have bought a 13 per cent stake in Manchester City’s parent group? The consortium is made up of China Media Capital (CMC) and CITIC Capital, two private equity funds with close links to the Beijing government.

CMC is a Shanghai-based fund founded in 2009 with backing from the Chinese state. Its portfolio is largely made up of sporting and entertainment assets. This year it signed a deal with the Hollywood studio Warner Bros to launch a Chinese language film production venture, and it also recently completed a deal with the UK theme park owner Merlin to develop a Legoland resort in Shanghai.

The CMC founder and chairman is 46-year-old Li Ruigang, a former government official in Shanghai and friend of overseas media tycoons. Li has a record for arguably overpaying for assets. CMC recently paid RMB8bn (Yuan Renminbi) (£800m) for the right to show Chinese Super League football matches for five years. Those rights had previously been sold for just RMB50m (£5m) a year. “It is a really high price, but we are really looking for something that changes behaviour,” said Li.

The steep price represented a bet from Li that football will explode in popularity in China. The investment in the Manchester City ownership company seems to be a move designed to help make that bet pay out. Li is fluent in English and briefly studied at Columbia University in New York. He will represent the Chinese investors on the City Football Group board.

CITIC Capital was founded in 2002. It claims to manage $5bn (£3.3bn) of capital on behalf of investors and invests in real estate and other illiquid assets. Those investors include the state-owned investment conglomerate CITIC Group and China Investment Corporation (CIC), the country’s $650bn (£430bn) sovereign wealth fund. Qatar Holdings also has money invested in the fund. It employs 200 staff globally and claims to have “a deep knowledge of the Chinese business and financial markets”.

CITIC Group itself dates back to the dawn of China’s economic opening-up and was founded by Rong Yiren in 1979 with the approval of the country’s supreme political leader Deng Xiaoping. The CIC wealth fund is charged with getting a decent return on a portion of China’s massive pile of foreign exchange reserves. It aims to do this by buying stakes in growing foreign companies, rather than letting the cash languish in low-yielding foreign government debt.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments