Credit crunch hits value of Premier clubs

'Twenty per cent' drop likely to harm Liverpool most in search for buyer

Football's leading deal-broker yesterday declared that the global credit crunch means Premier League clubs seeking a buyer must expect a reduction of up to 20 per cent in price, a figure which would mean Liverpool's American owners barely covering the value of the bank loans they have taken out to finance their acquisition.

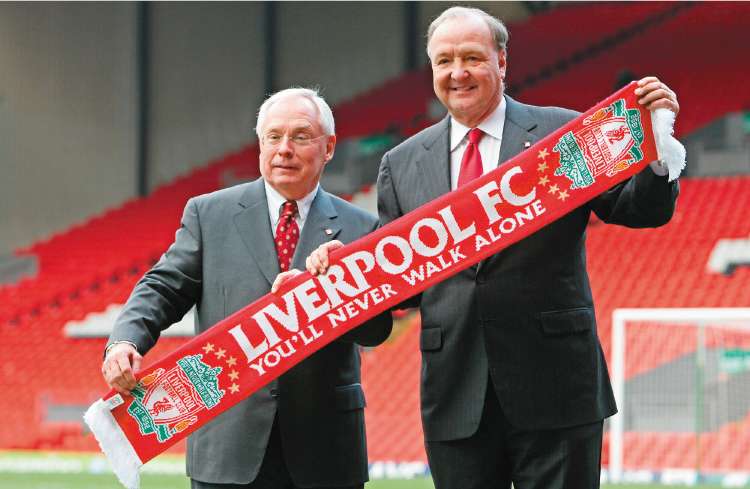

Tom Hicks and George Gillett are believed to have turned down an offer of around £500m for Liverpool, tabled by Dubai International Capital in February 2008 and the assessment of Keith Harris, who attempted to secure a Kuwaiti takeover of the club last July, would radically reduce that. Proprietors could expect "10 to 20 per cent" less for clubs they were trying to sell, Harris said. "The equity value of football clubs has declined over the last six to nine months. The run up to the end of the calendar year was appalling." His prognosis would mean the Americans securing barely £400m for Liverpool. The co-owners are currently assessing their entire range of global assets.

Harris, chairman of investment bank Seymour Pierce, also believes that there is far greater chance of Royal Bank of Scotland (RBS) and Wachovia – with whom Hicks and Gillett rescheduled their loans in January – agreeing to a further rescheduling in July. The awaited decision of the banks is a source of profound uncertainty at Anfield but Harris suggested that Stephen Hester, RBS's new chief executive, may not wish to put himself "out on the left wing" by generating a crisis at Liverpool. A negotiated settlement of the debt is a more likely outcome, Harris believes, though he also declared that the financial crisis means the age of the leveraged buy-out of football clubs is in the past. "It is over," he said.

Harris believes the prospect of Premier League clubs finding a buyer - Everton are another he has been engaged by in the last year – has brightened after a three-month period at the end of 2008 in which the business environment was "a disaster." In place of bank loans against the value of clubs, clubs must now seek institutions and corporations who have disposable cash.

Speaking on the sidelines at the Soccerex London Forum, Harris said: "There's a better feeling, a more encouraging environment to think about investment. The phone could not have been quieter than the last three months of last year. There's been a shocking fallow period, but just like you are seeking investors putting money into property companies and banks, people are investing again in football clubs."

That appears to offer some hope for Everton and perhaps Newcastle United owner Mike Ashley, for whom Harris has also sought new investment. Harris indicated that Newcastle was "not for sale at the moment" and suggested that Ashley was awaiting the outcome of the club's struggle against relegation. "They're just assessing what happens. Nobody can predict whether or not they will be in the Premier League. I don't think it's necessarily more difficult to sell a club that is in the Championship though inevitably there would be discussion on price because the revenues are so different on the two."

Harris is the financier who brought Thaksin Shinawatra to Manchester City in the summer of 2007, though he stressed that the size of investment did not guarantee immediate success – a fact which Thaksin did not seem to grasp. "I suspect City could spend a billion pounds and it would still take a while [to reach the Champions League]," he said. " Sven [Goran Eriksson] was famously asked by Thaksin: how far are you from a championship winning team – and he said 'four and half miles'. You have to work the asset with a good manager and good players, so that over seven or eight years you can have a good return." If clubs are treated "as empty tubes, with money coming in going out on transfer and wages, sooner or later they are going to go bust."

In the eye of the financial crash last November, Harris said he feared for Liverpool who might be forced to sell players without fresh investment. Liverpool's profit barely covers the huge interest payments with which Hicks and Gillett have saddled the club. Rafael Benitez has said he must sell to buy this summer.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments