Property news roundup: How to buy your house using your mobile phone

Plus, get your children to sell your home, and Scottish house prices

Support truly

independent journalism

Our mission is to deliver unbiased, fact-based reporting that holds power to account and exposes the truth.

Whether $5 or $50, every contribution counts.

Support us to deliver journalism without an agenda.

Louise Thomas

Editor

Barclays and Savills Auctions are collaborating on a project that enables customers to buy houses on their mobile phones using a special app.

The Barclays Pingit mobile payments service has already been used by buyer who put down a £23,000 deposit on a new home in Mitcham, South London.

Customers put down a deposit on a home by scanning a Savills QR code using the app which then shows the full transaction details and transfers the money in seconds.

Darren Foulds, Barclays Mobile Banking and Pingit Product Director said: "This shows the potential for mobile payments. For quick, secure transactions on the go, mobile is fast-becoming a trusted method of making payments, whether from person-to-person or, as in this case, to pay a business."

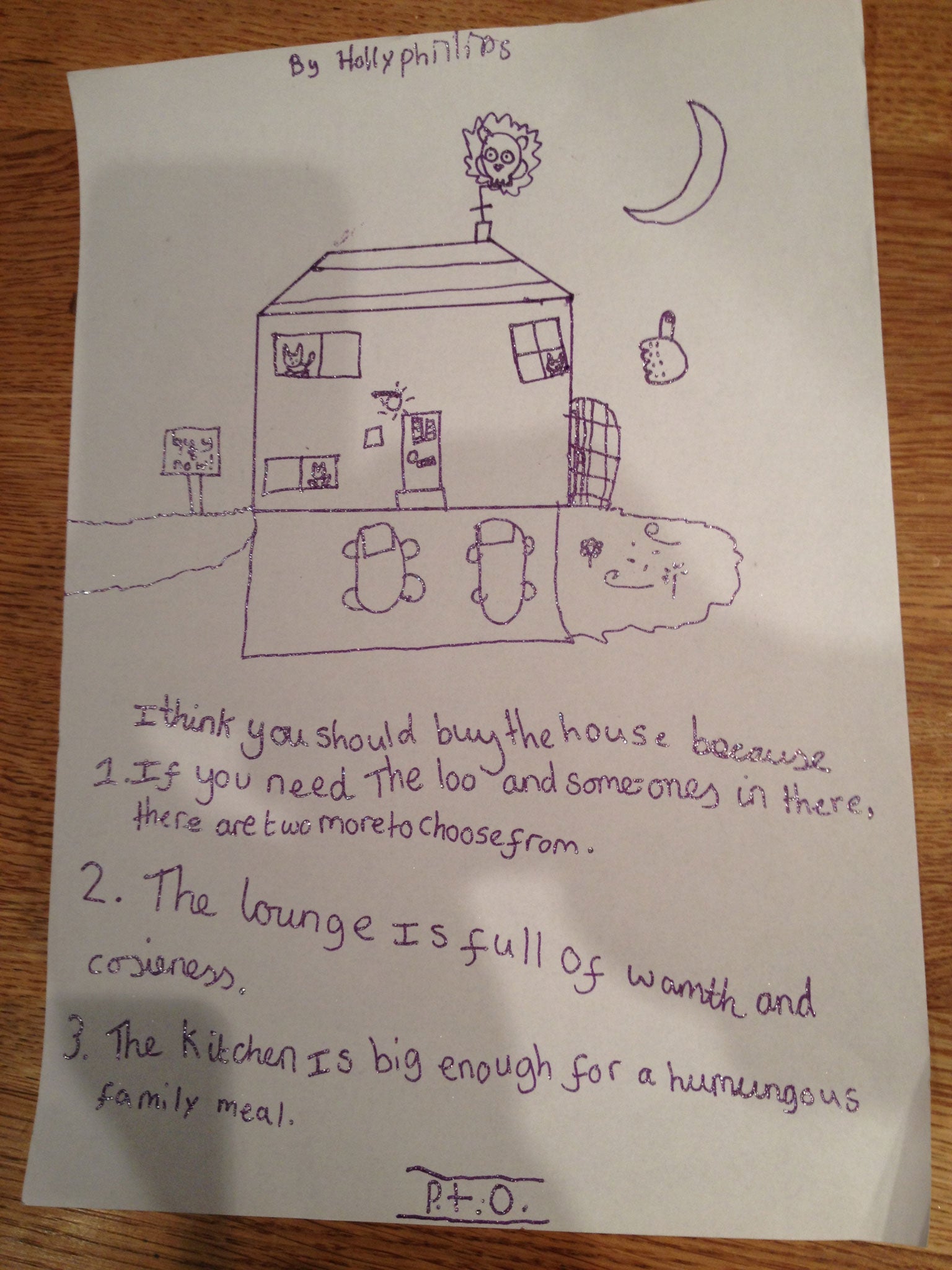

How your children could sell your home

Online estate agent Tepilo is now including a special 'children’s opinion section' encouraging sellers to include how their sons and daughters describe their home, including the option for handmade drawings to be uploaded.

Television property expert Sarah Beeny, co-founder of Tepilo, said: "No-one is more honest than children, right? So we thought the section would give the listing an honest and warming feel.

Scotland sees third highest house price growth in Britain

New figures from LSL Property Services show that only London and the South East experienced higher price rises over the last year with average Scottish house prices up in December by £5,131 or 3.6 per cent year-on-year.

Sales went over the 9,000 mark in December, the highest recorded in a single month since 2008, and there was a 27 per cent increase in properties sold compared to December 2012.

Gordon Fowlis, regional managing director of the Your Move estate agency chain that is part of LSL said: "The recovery of the Scottish housing market is bouncing ahead. The main force behind such staggering sales activity has been the dramatic return of the first time buyer. The Help to Buy scheme in Scotland jump-started first-time buyers into action by enabling more aspiring homeowners to enter the market.

"Areas like Edinburgh and parts of the East Lothian, home to scores of wealthier buyers, have seen resounding price rises over the past year. Yet in less affluent areas with high unemployment, activity has fallen which in turn has dragged down prices. But looking at the national picture as a whole, there is certainly a replenished level of confidence both from buyers and lenders.

"House building must be placed at the heart of the Scottish government's plans and will prove critical in driving the recovery forward at a viable rate. Similarly there are also concerns over the impact that Scottish Independence could have on house prices, especially when faced with the potential implications for Scotland’s economy if the UK pound is kissed goodbye."

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments