Greece elections: Who are Syriza and what effect will their new government have on Europe?

The party has formed a coalition government since winning Sunday's election

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Greece has a new government today as election victors Syriza thrash out a coalition deal with the right-wing Independent Greeks.

Who are Syriza?

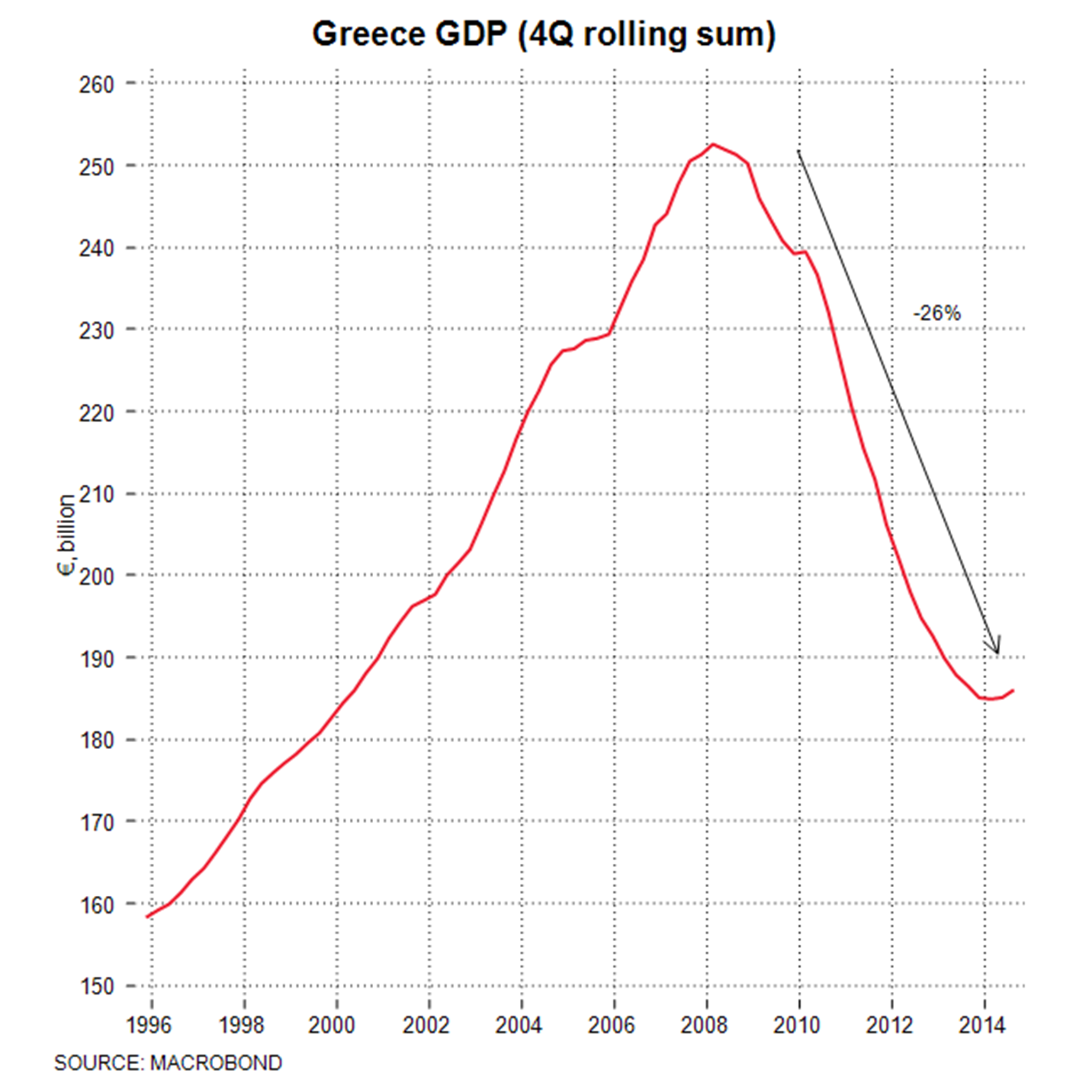

A Greek political party formed in 2004 as a coalition of radical left-wing groups, ranging from Greens to former Communists. Syriza’s popularity exploded after the collapse of Greece’s economy in 2010 and onerous terms were attached to the country’s bailout by the “Troika” of the European Union, the European Central Bank and the International Monetary Fund. The party, which is led by 40 year-old Alexis Tsipras, came very close to taking power in 2012’s general election. And now, three years on, it has succeeded. Syriza become the biggest party in the Greek parliament and will form a governing coalition with the right-wing Independent Greeks party.

Read more: Syriza forms coalition government

SYRIZA ON A COLLISION COURSE WITH THE EU

CAMERON: GREEK ELECTION RESULT WILL INCREASE ECONOMIC UNCERTAINTY

What are they planning to do?

Syriza said on the campaign trail that it will demand an easing in the terms of the Troika bailout, re-hire many fired civil servants, stimulate the economy and secure a reduction in Greece’s huge national debt.

What will happen if they do?

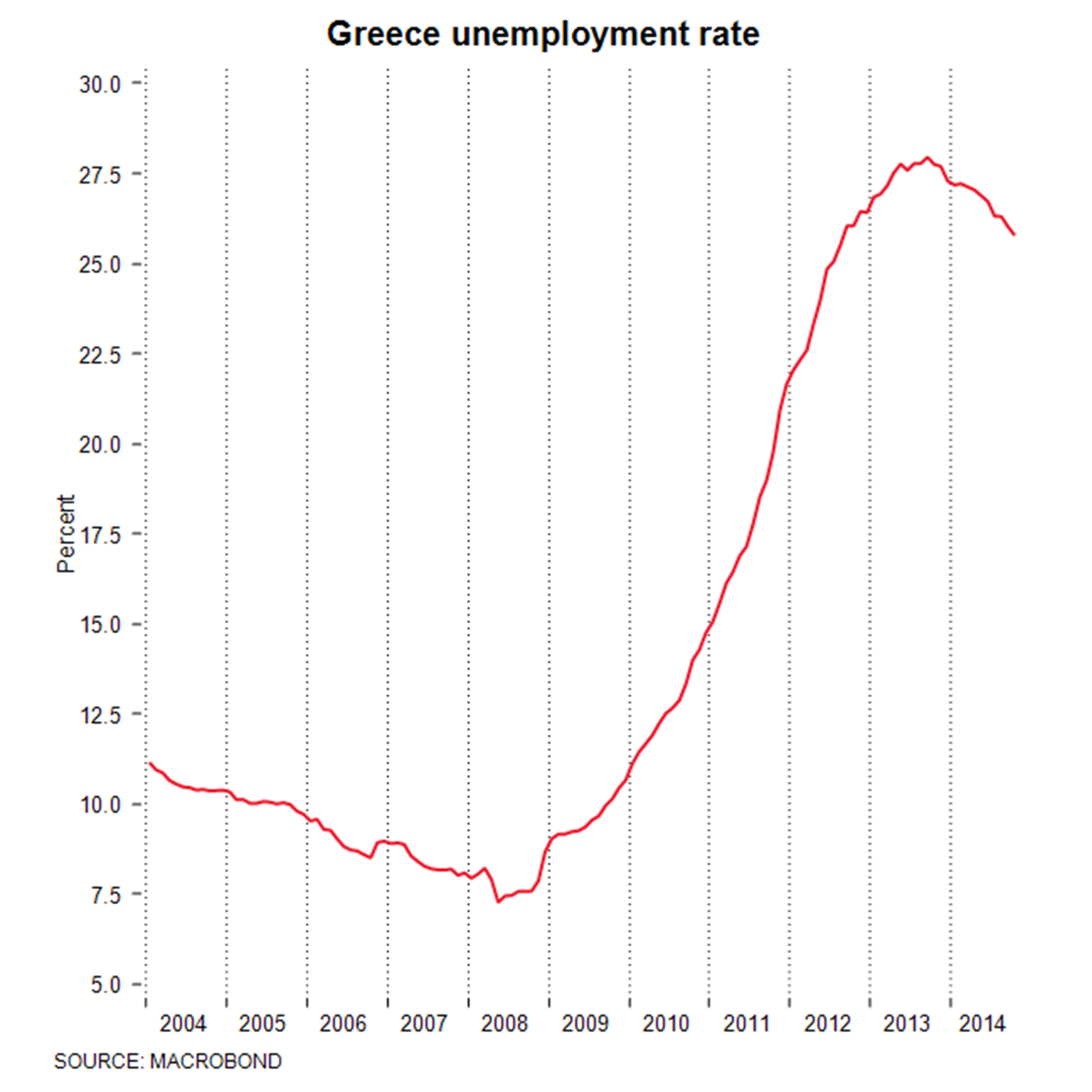

Syriza argues that the Greek economy, which has only just emerged from a four-year depression, will improve and that mass unemployment (currently at 25 per cent of the workforce) will fall.

Others say that the Troika will refuse to meet Syriza’s demands for a reduction in austerity for fear that it will encourage other bailed out European states to demand similar help. Either the new Greek government will have to backtrack on its promises, these critics say, or its financial system will lose access to emergency lending from the European Central Bank and the country will crash out of the eurozone. Syriza, however, believes it has a strong bargaining position because the Troika will be even more fearful of the knock-on economic and political effects of a Greece exit from the euro.

Is this a potential ‘catastrophe’?

There is a possibility that if Syriza takes Greece out of the eurozone its banking system would implode, the economy would sink back into recession, unemployment would shoot still higher and there would be severe civil unrest. The Greek people certainly still seem to think that life would be still harder outside the eurozone, with polls showing a large majority for staying in. Yet there is also a possibility that a “Grexit” would ultimately be economically beneficial for Greece, giving the country’s exports and tourism industries a massive boost from a lower currency exchange than it currently has in the eurozone.

What are the possible implications for Europe?

Politicians in Germany, the eurozone’s dominant economy, argue that even if Greece leaves the single currency it would not create any financial problems for the rest of the currency bloc. They say the Continent’s banking system has been successfully insulated over the past two years. But this might well be overoptimistic. There is a possibility a Grexit could reopen the Continent’s financial crisis if it prompted panicking people and companies to yank money out of perceived vulnerable European countries’ banks again.

What are the possible implications for the UK?

The eurozone crisis was a major factor in the weakness of the UK economy since 2010, hammering business confidence and hitting British exports. If the single currency area goes into another meltdown – or even just another prolonged period of uncertainty – it will almost certainly be bad for growth and set back the recovery.

Where could the contagion spread next?

Spain and Italy are the two states that are being most closely watched. Both have insurgent anti-austerity political groupings in the style of Syriza, Podemos in Spain and the Five Star in Italy. If the Greeks are successful in gaining concessions, those movements will undoubtedly be strengthened. The existing governments in Madrid and Rome will also likely start pushing for an easing of austerity and reform in order to protect themselves from being swept from office by an anti-austerity tidal wave.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments