Biden proposes new $7.3trn budget beefing up border security and raising taxes on wealthy

House Republicans immediately reject the proposal as ‘a roadmap to accelerate America’s decline’

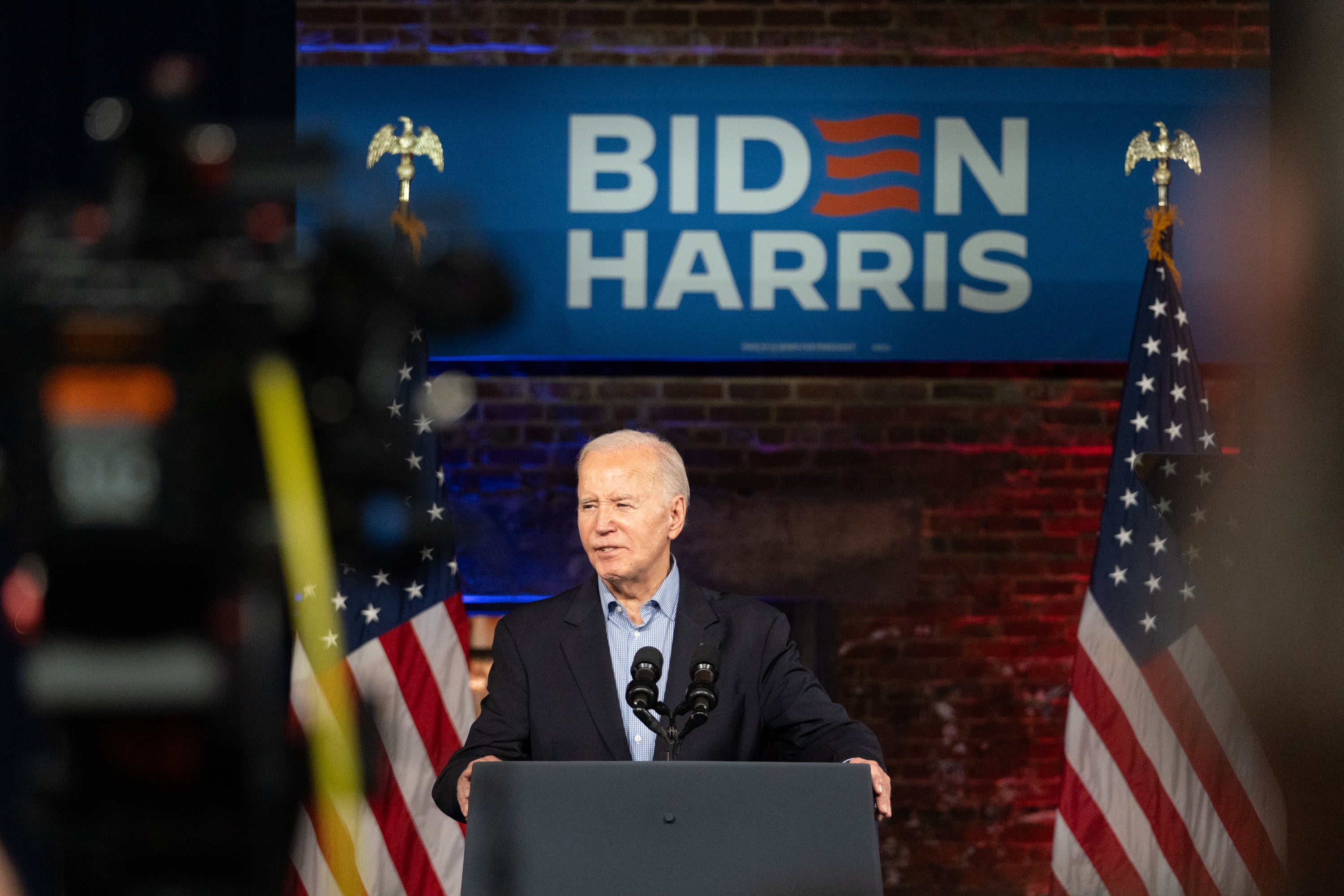

President Joe Biden released his $7.3tn budget proposal that proposes vastly increasing security provisions at the US-Mexico border and raising taxes on the wealthy on Monday. But the proposal faces steep opposition from the Republican-controlled House of Representatives.

The president’s budget proposal is almost never fully implemented even under a trifecta given that Congress--specifically the House of Representatives--controls spending.

The proposal proposes restoring the expanded child tax credit that Mr Biden signed as part of the American Rescue Plan that expired at the end of 2021.

The proposal would expand the credit from $2,000 per child to $3,000 for children who are six years old and above and $3,600 for children who are younger than six. In addition, the proposal includes a comprehensive paid family and medical leave program as well as paid sick days that the US Social Security Administration would administer.

Mr Biden’s budget also includes allocating $2.9bn to the Department of Homeland Security for border security and to combat the trafficking of fentanyl. Specifically, the proposal includes $405mn to hire 1,300 Border Patrol agents; $239mn to hire 1,000 US Customs and Border Protection officers to stop the flow of fentanyl from the US-Mexico border; $100mn for Homeland Security Investigations to investigate international criminal organisations and drug traffickers; and $849mn for detection technology at the border.

The proposal comes a month after Republicans in the House and Senate vehemently opposed a bipartisan piece of legislation that would have increased security provisions at the US-Mexico border and restricted immigration in exchange for providing aid to Ukraine, Israel and Taiwan.

Mr Biden also proposed creating a minimum tax of 25 per cent for billionaires and a 25 per cent as well as quadruple the charge on stock buybacks. The proposal would also raise the corporate tax rate from 21 per cent to 28 per cent and also raise the minimum tax on corporations valued at at least $1bn pay at least 21 per cent in corporate taxes. In 2022, the Inflation Reduction Act put in place a 15 per cent minimum tax on corporations.

The proposal comes after months of protracted fights in Congress about spending bills. A group of eight House Republicans and every Democrat removed Kevin McCarthy as House speaker after he passed a continuing resolution rather passing 12 individual spending bills. In turn, House Speaker Mike Johnson pledged to not govern through using stopgap spending bilsl but has so far passed multiple continuing resolutions, including one late last month.

Last week, the House and Senate voted to pass six of the 12 spending bills that for the 2024 fiscal year. Congress is set to pass the additional six spending bills by 22 March.

But Mr Johnson--along with House Majority Leader Steve Scalise, Majority Whip Tom Emmer and Republican Conference Chairwoman Elise Stefanik--lambasted Mr Biden’s budget proposal.

“The price tag of President Biden’s proposed budget is yet another glaring reminder of this Administration’s insatiable appetite for reckless spending and the Democrats’ disregard for fiscal responsibility,” they said. “Biden’s budget doesn’t just miss the mark — it is a roadmap to accelerate America’s decline.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies