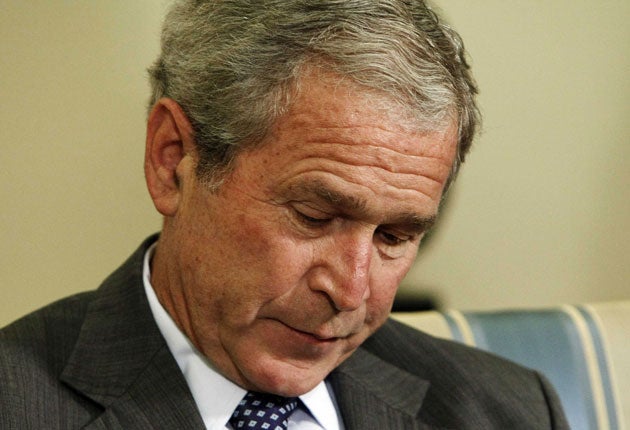

The President: Bush risks wrath of Main Street to save the banks

A populist leader has been forced to put the interests of Wall Street ahead of public opinion, says Rupert Cornwell

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A fictional scenario of financial collapse could not improve on the perfect storm that is battering the US economy. The crisis has been a decade or more in the making, but the hurricane has struck with its full fury at the worst imaginable moment.

The least trusted and mostunpopular president in the country'smodern history is serving his final months, his credibility and moral authority close to zero as he tackles a disaster partly, at least, of his own making. In the partisan heat of the campaign to replace him, politics cannot but intrude on the most sober judgement.

Proof of that came last night when, after a bailout deal seemed close, Republican Congressmen rebelled – against a measure urged by a Republican president. Suspicions were rife that their resistance was largely aimed at giving cover to John McCain, who had rushed back to Washington only for an outline agreement to be reached without him.

Mr McMcCain and Barack Obama affect to be putting country ahead of party and their own ambitions. In fact of course, their every move is coloured by calculations of electoral advantage. They would not be human if they acted otherwise. What politician seeking office can ignore the mood of the people whose votes he is seeking to win?

And that mood is the third ingredient in this rancid witches' brew. Well before the convulsions of Black September 2008, public confidence in the country's future was at a 30-year low.

For many ordinary Americans, the colossal bailout of Wall Street and the overweening financial sector proposed by George Bush is the last straw – in a country where the gap between rich and poor is wider than at any time since the crash of 1929, where real incomes for average workers have stagnated while high finance has feasted. The titans of Wall Street are too big to fail, Americans are told by their rulers. The unspoken corollary is that the ordinary guy is too small to matter.

That is one reason why Congress – where every one of the 435 members of the House and a third of the Senate is also up for election in 40 days' time – has bridled at the initial bailout plan. That is why it is insisting on oversight, and help for homeowners facing foreclosure.

The second reason of course is that, having been sold so many duds in the past by Bush, including the excesses of the post-9/11 Patriot Act, Saddam's mythical WMD and a ruinous war in Iraq, they are not going to buy yet another one on the basis of scaremongering by the White House, without a semblance of due diligence.

In their presentation of the rescue plan, Henry Paulson, the Treasury Secretary, and the rest of the administration displayed a tin ear to the public rage. It took Bush almost a week to address the nation on the crisis, and then only because congressional leaders told him that unless he did so, the package would not pass. But still there has not been a word of contrition from those responsible from the mess.

Pressed by senators during this week's hearings on Capitol Hill, Mr Paulson finally admitted his "embarrassment" at what had happened. As a former chairman of Goldman Sachs, he might well be. On Wednesday evening, the President, too, seemed to imply the crisis was nothing more than a regrettable accident. He mentioned some "instances of abuse", and made a nod towards greater regulation of financial markets. Basically, however, a man incapable of acknowledging error put the whole sorry mess down to the propensity of the rest of the world to lend vast sums of money to the US.

In fact, it was lunatic sub-prime lending that set a match to the fuse, but the fuse itself stretches much further back, to the only semi-purged excesses of Wall Street in the late 1980s, through what Alan Greenspan, the former Fed chairman, once termed the "irrational exuberance" of the 1990s, and the Enron and other corporate scandals of 2001 and 2002, culminating in the exotic financial instruments supposed to eliminate risk (and keep Wall Street in gravy for ever) – but which in fact created risk on an unprecedented scale.

We have been here before, in the financial panic of the 1890s, in the excesses of "robber baron" capitalism that were curbed by Theodore Roosevelt, and in the crash of 1929. Thus far at least, the 2008 version pales in comparison. But it is increasingly clear that the next President will have to introduce some form of New Deal, as Franklin Roosevelt did when he became president in 1933, in the depths of the Depression.

If history is any guide, that President will be Barack Obama. Most of America's 20th-century financial crises have come on the Republican watch, from 1929 to the savings and loan mess under Presidents Reagan and the first George Bush, to the current debacle. Each was followed by a period of Democratic rule.

Politics is a funny old business, and some foreign drama may yet reshuffle the cards. But it is hard to imagine a 72-year-old Republican, who admits economics is not his strong suit, being entrusted the job of leading the US through its worst economic crisis in generations. The next President must start by telling Americans the unpalatable truth Mr Bush refuses to utter, that the country has too long lived beyond its means. He has to tell them that the tax cuts and grandiose spending projects bandied around on the campaign trail cannot be afforded without serious sacrifice.

Right now, everything is at risk – the dollar, US global leadership, even the US model of capitalism. But if the 44th president tells the truth, the country will swing behind him. America's political mood is shifting to the left.

"We are all taxpayers now" is the mantra of the struggle for a rescue package that is fair to all. Under Bush, Americans have been let down by their government. They yearn nonetheless for a government that works, even one that is ready to take over swathes of the banking sector to get the taxpayer some return for his money. For banks and citizens alike, in a financial storm this fierce, government is the only safe harbour.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments