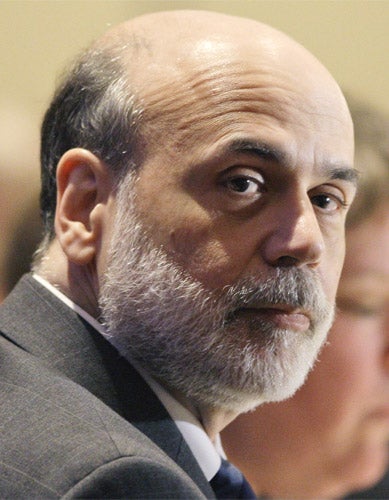

The Big Question: How successful has Ben Bernanke's first term as Fed chairman been?

Why are we asking this now?

President Obama interrupted his family summer holiday at Martha's Vineyard yesterday to announce the renomination of Ben Bernanke to the post of chairman of the Federal Reserve. Mr Bernanke's four-year term was due to expire in January. The re-nomination will require the approval of the Senate, but the President's declaration of intent, which amounts to a powerful endorsement of Mr Bernanke's proactive approach to policy-making, makes it likely that Mr Bernanke will get the nod. In any case, a majority of economists, central bankers, and investors support the reappointment.

What are his credentials?

When Mr Bernanke rose from the Board of Governors at the Fed to its chairmanship, replacing in Alan Greenspan a central banker of unprecedented power, George W. Bush could not have known how apposite Mr Bernanke's academic training would be for the post. Given the financial crisis and global slump that has accompanied his first term, it seems uncanny now that Mr Bernanke should have written his doctoral thesis on the Great Depression, and made that turbulent period his academic specialty for decades thereafter. The son of a chemist and former chairman of the economics department at Princeton University, his work on the Great Depression is widely feted, and among economists his research on the transmission of monetary policy, and the role of credit markets in the business cycle, is highly regarded. Both areas are crucial to the current crisis. And, as the President pointed out, his credentials for reappointment must be largely attached to his stewardship of the recovery. The argument goes that he must be allowed to finish what he has already started.

What action did he take?

Mr Bernanke's response to the collapse of Lehman Brothers on 15 September last year has been aggressive and forthright. International markets panicked at the bank's disintegration and, given the Fed was widely expected to intervene to save it, Mr Bernanke's failure to act in rescuing the bank drew anger. But his coordination of the Troubled Assets Relief Programme, which injected billions of dollars into the American economy, eventually placated many of those critics. TARP is credited with restoring stability to the US financial sector.

The Fed, along with the US Treasury, organised the $700bn (£430bn) bank bail-out plan in October 2008. It has since spent a further $3 trillion propping up credit markets and trying to boost the economy by sustaining flagging demand. His other main policy drive has been to slash interest rates to an unprecedented level of nearly zero, flooding the system with liquidity. Its balance sheet expanded from $600bn before the crisis to more than $2 trillion after.

What do the critics say?

They point out, quite reasonably, that Mr Bernanke shares responsibility for the loose monetary policy that many believe helped land the US – and by extension much of the world – into this mess. There is a broader ideological aversion to his approach too, which claims that by flooding the American economy with money he is storing up inflation further down the line, something his eventual succesor will have to deal with more than he has had to. And Mr Bernanke himself has been open in admitting that he, along with economists the world over, didn't recognise the hazards for American banking associated with the country's sub-prime market. Another branch of criticism focuses on his failure to save Lehman Brothers. In June, Jean-Claude Trichet, president of the European Central Bank, said that "the sentiment all over the world was that such a dramatic bankruptcy of a signature institution was impossible".

Some say Mr Bernanke overestimated the capacity of markets to regulate themselves. Others say he has not been transparent enough in providing either the public or congressional committees with information on trillions of dollars in loans that were made through the Fed's lending facilities. Then there are critics who point to his role in the debate over the TARP. Mr Bernanke played a central role in insisting that Congress should act immediately, not least because the market in commercial paper was closing down. But he failed to tell Congress that the Fed has the authority to buy commercial paper directly from businesses; indeed, he only announced this, critics say, the weekend after Congress approved TARP.

Has he changed the role of the Fed?

Many economists thought that Alan Greenspan's successor couldn't possibly be as omnipotent. Alas, the threat of a Depression averted that. Mr Bernanke has played a hugely prominent public role – and therefore a highly political one. Many claim that, though Mr Bernanke has been generally more eloquent and effective than his predecessor in relaying information to the public, he has not been clear enough about the powers the Fed must forego if it is to remain truly independent. These arguments were strengthened by a speech Mr Bernanke gave last Friday, in which he said that the US economy was on the road to recovery. Cynics claim this was a selfish ploy designed to show him up in a good light, ahead of President Obama's announcement this week.

Who were his rivals?

The names of those touted as potential successors to Mr Bernanke were either sober or very unlikely. Among those in the latter category were two avowedly liberal economists, Joseph Stiglitz and Paul Krugman, a former Nobel laureate in economics and a current one respectively. Also mooted, and far more reasonably so, were Alan Blinder, who holds a senior professorship at Princeton University (Mr Bernanke's alma mater), and Larry Summers, the mercurial director of President Obama's National Economic Council, who for a year and a half was Bill Clinton's treasury secretary. Yet for all the hype, few expected Mr Bernanke to be replaced.

What challenges await his second term?

The US economy is very far from being out of the woods: popular commentary focuses on whether its recovery will form a "U", "V", or "W" graph. There is a danger that, having pumped the economy with money, too much of it may chase too few goods, causing rampant inflation, which monetary policy will have to cope with. Then there is the appalling deficit in America. Figures released by the White House budget office on Monday predict a cumulative $9 trillion deficit from 2010-19, $2 trillion more than President Obama's administration predicted in May. By 2019, public debt will double and reach three quarters of the size of the entire economy. Mr Bernanke may be out of office by then, but it is within the context of such deficits, and high unemployment, that he will have to lay the foundations of the recovery.

Why would Obama want him to continue?

Choosing somebody else to replace Mr Bernanke, such as Mr Summers, may have been seen as injecting politics into a national crisis. The President knew that the reappointment of Mr Bernanke, who though a Republican is seen as a largely non-ideological figure, would reinforce his bipartisan credentials, while showing a steady hand on the economic tiller. What's more, given the widespread approval of Mr Bernanke's actions in economic and academic circles, the President could well do without the distraction of controversy over his replacement.

Does Ben Bernanke deserve to be reappointed as Fed chairman?

Yes...

* Economists, academics and investors have widely endorsed his actions as Fed chairman so far.

* Having taken the US economy through the first crisis phase, he has the experience to begin the recovery.

* His academic expertise in the Great Depression gives him intellectual authority in dealing with this crisis.

No...

* His approach of pumping liquidity into the economy is merely storing up inflation for the future.

* He has not been straight with the US public or politicians about trillions of dollars of Fed loans.

* His role in loose monetary policies and the failure to regulate the sub-prime sector helped cause the crisis.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies