Tax credits: Lib Dems table ‘fatal motion’ to stymie George Osborne's cuts

Baroness Manzoor’s actions could cause a constitutional crisis, Tories claim

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A constitutional crisis sparked by the Liberal Democrats’ tactics in opposing government welfare cuts in the House of Lords would be “good” for democracy, Tim Farron has argued.

Conservatives are furious that the Lib Dem leader has asked his peers to vote against legislation they said was trailed in the Government’s general election manifesto, which, they argue, is a breach of the Salisbury Convention. The convention, agreed by Labour and the Conservatives during the post-Second World War government led by Clement Attlee, is that the unelected House of Lords refrains from blocking manifesto promises made by a winning party.

Mr Farron insists that, in this instance, he is not challenging the convention because David Cameron had said before the election that he would not cut tax credits.

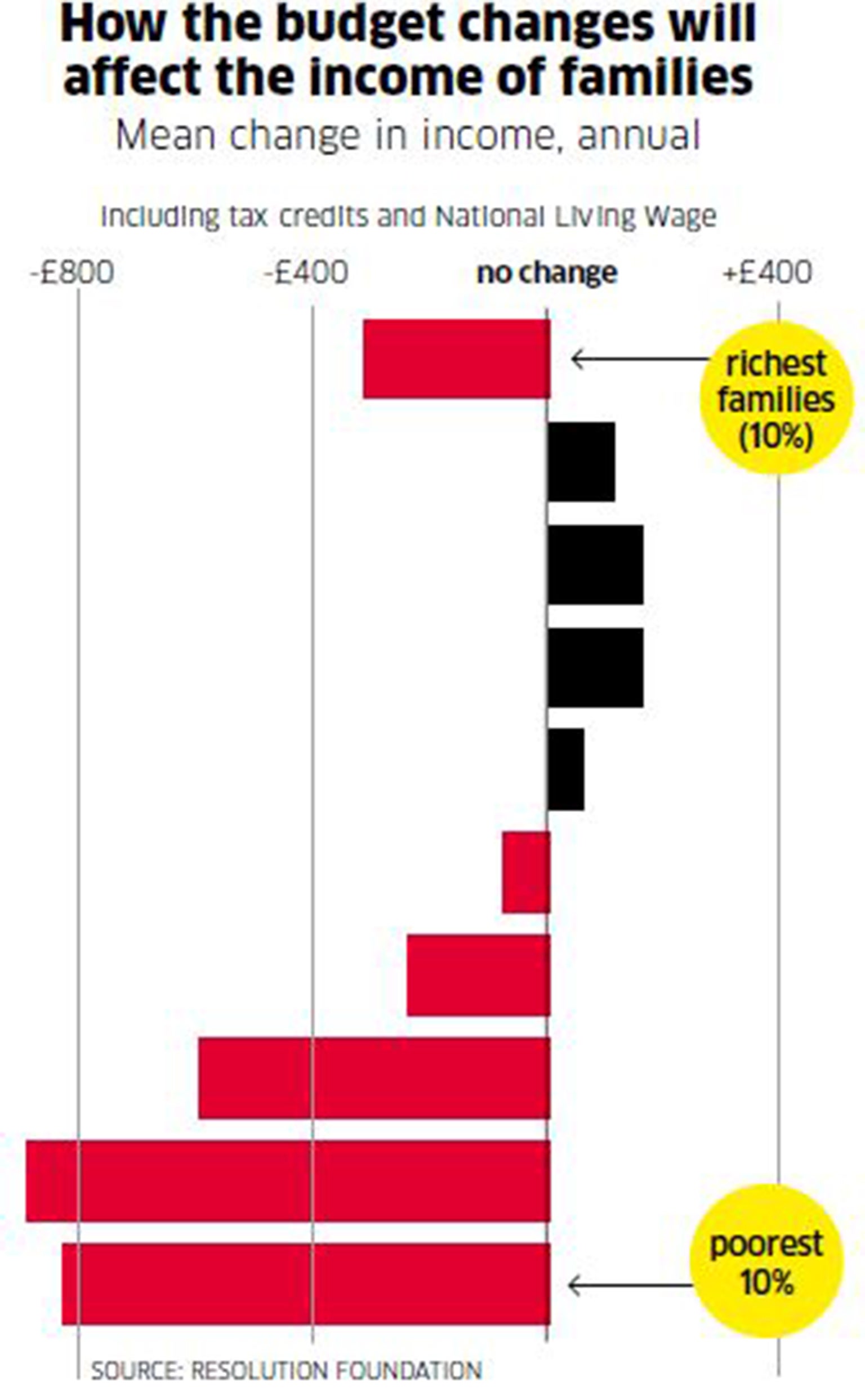

However, the Chancellor, George Osborne, insisted last week that the cuts had been “signalled” at the time – the Conservatives have defended the decision, saying they had pledged to find £12bn of welfare savings in their manifesto. The details of the cuts were not specified.

Despite the Lib Dems’ dreadful election result, which saw the party reduced to just eight MPs, they remain a force in the upper chamber, with more than 100 peers and the former leader Sir Menzies Campbell among the recent inductees.

Lib Dem peer Baroness Manzoor is introducing what is known as a “fatal motion”, a highly unusual measure, which, if successful, would see the process of enacting the cuts restarted in the House of Commons. The Conservatives do not command a majority in the Lords and defeat could see £4.4bn of cuts, due to come into effect in April, delayed.

“Technically, we never signed the convention,” said Mr Farron, who added that 3,500 families in his Westmorland and Lonsdale constituency would be hit by the reforms. “These aren’t exactly rules, they’re more like guidelines – and some aspects of the convention seem out of date.

“The claim that David Cameron has any mandate for these cuts is inaccurate. If you make me choose between a 70-year-old, historic convention and three million hard-working people, then I’m going to choose the latter. If this does create a constitutional crisis, then it puts the House of Lords into the spotlight – and that’s a good thing, too.”

Mr Farron hopes that a side-effect of blocking the legislation in the unelected chamber will be to force the Government to reform the Lords and make it democratic. However, it is feared that Mr Cameron could simply appoint a swathe of new Conservative peers to what is already the world’s biggest legislative chamber outside of China.

But Mr Farron’s plan has been hit by Labour’s decision to not whip its peers into backing the fatal motion. Labour’s Baroness Hollis has submitted a separate motion, which asks the Government to provide guarantees that tax credit claimants will be protected for three years.

If their fatal motion fails, the Lib Dems are likely to back this and another, narrower motion introduced by crossbencher Baroness Meacher. The Bishop of Portsmouth has also put down what is known as a “motion of regret”, which simply criticises the cuts.

Cat Smith, the shadow women and equalities minister, has also discovered that the Government has made no assessment of the impact the changes will have on abortion rates. Under the changes, parents will not be able to claim tax credits for newborn third children.

In a written parliamentary answer, Damian Hinds, Exchequer Secretary to the Treasury, said: “No assessment has been made of the potential effect of proposed changes to tax credits and housing benefit in the summer Budget 2015 on the number of abortions in the UK.”

Ms Smith, who is Christian but pro-choice, said: “The Government prides itself on its claims of being family friendly, yet clearly what hasn’t been considered is the effect tax credit changes will have on families. They have not even considered the choices women face if, for example, they are pregnant with their third child.”

Labour has also used Commons Library research to argue that school support staff could lose more than £2,000 per annum next year because of the cuts, rising to around £2,500 by 2020. The research also shows that teaching assistants could lose £1,800, on average, in 2016-17.

Lucy Powell, the shadow Education Secretary, said: “Among those hardest hit by the Tories’ tax credit cuts will be thousands of teaching assistants and other school staff who are working on the frontline to help ensure children receive the best possible start in life.

“It’s vital that David Cameron and George Osborne think again ... and finally start to recognise the contribution that hard-working staff in schools make to delivering for the next generation.”

In an article for independent.co.uk, Seema Malhotra, the shadow Chief Secretary to the Treasury, and Owen Smith, the shadow Work and Pensions Secretary, say: “It takes a master politician to unite the whole of the left of British politics with The Sun, The Spectator magazine, a sizable proportion of the new intake of Tory MPs, as well as the Bow Group and the Adam Smith Institute. So credit where it’s due to the Chancellor, who has pulled off that seemingly impossible feat with his plans to cut tax credits.

“The Tories have claimed there are no grounds for a challenge to the tax credits cuts from peers, as they have a clear public mandate for the changes. This ... is nonsense.”

Una Summerson, head of policy at Contact a Family, the disabled families charity, commented: “Our research shows that even before the planned tax credits cuts, many families with disabled children are being forced to extremes like regularly going without food and heating. We estimate around 150,000 working families with disabled children could be affected by tax credit cuts, adding unnecessary extra pressure on families whose finances are already stretched to the limit and beyond.”

Mr Farron is visiting the Greek island of Lesbos this week to observe the extent of the refugee crisis, having previously visited the camps at Calais. He said: “I’m expecting to see something even more distressing than Calais. There, at least, they have a roof over their heads, a meal a day, and some rudimentary healthcare.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments