Scottish Government given power to 'end bedroom tax'

Cap on discretionary payments to people affected to be lifted

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Scotland is being given more powers to mitigate the “bedroom tax” in a move expected to gain ground for the UK Government ahead of the vote on Scottish independence.

The Scottish Government will be able to set its own cap on discretionary payments to people affected by the spare room subsidy.

Although Scotland will not be given any funding for the change, it means the bedroom tax could effectively be ended by allowing councils to replace the housing benefit taken from families deemed to have spare rooms.

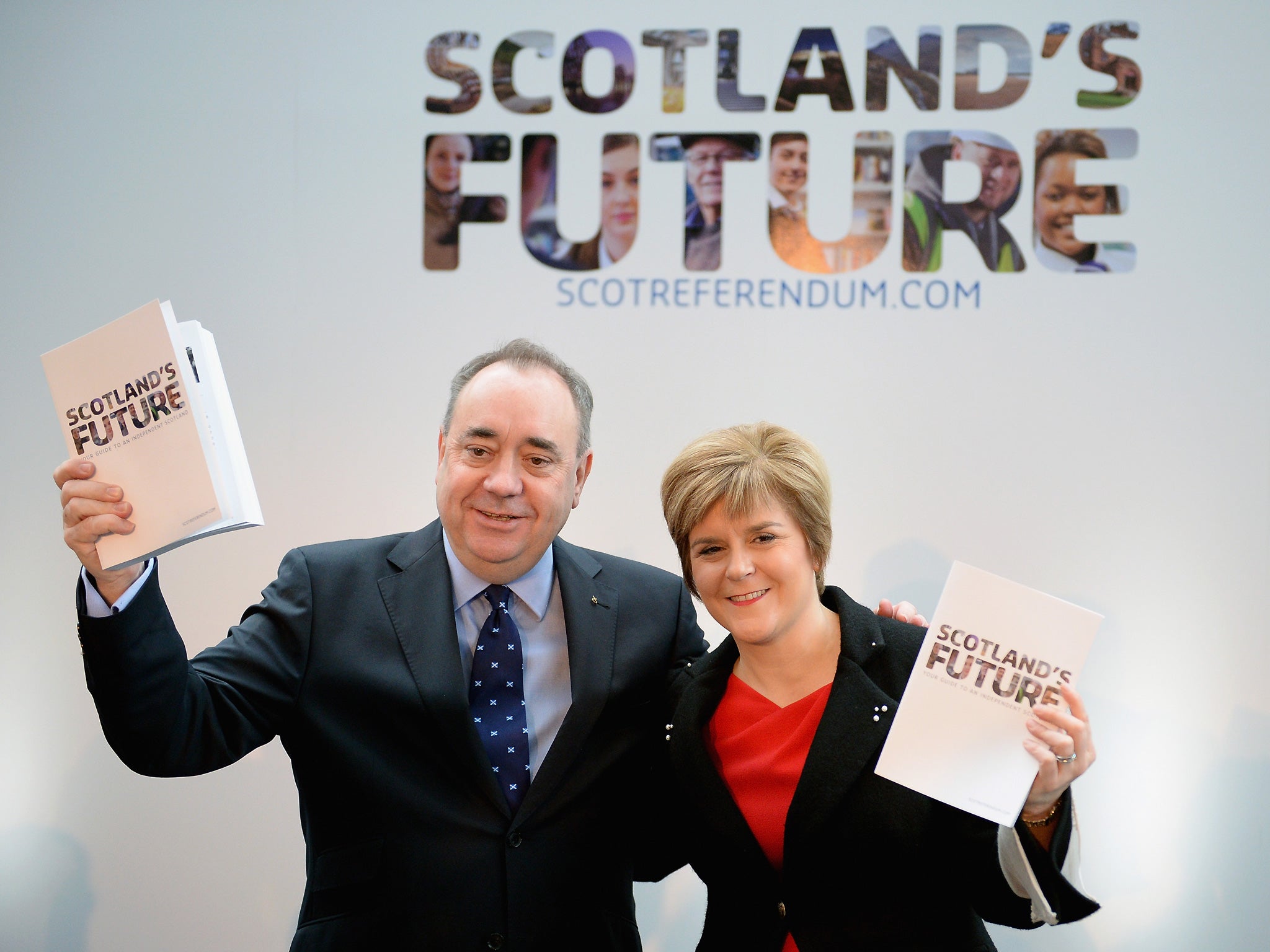

Alex Salmond’s Scottish National Party (SNP) had pledged to abolish the bedroom tax within a year of independence if it is achieved by the referendum later this year.

The policy was one of the party’s key manifesto pledges for an independent Scotland and had been used as an example of Westminster imposing unpopular policies on the country.

He said: “I have completed a programme of visits to all Scottish local authorities and believe that transferring this power to the Scottish Government is the correct thing to do.

“The UK Government believes in taking a pragmatic approach to devolution and we believe in a United Kingdom that gives Scotland the best of both worlds.”

The Scottish Government had already spent up to the limit set by Westminster to mitigate the effects of the policy, dubbed a “bedroom tax” by critics.

Once the powers are transferred, £50 million can be invested to help the estimated 72,000 households under the cap.

Scotland’s Deputy First Minister, Nicola Sturgeon, welcomed the move but said it had taken too long to change the “unfair” policy.

“We will never turn our back on people in need, and I am pleased to finally be able to get on and help people,” she added.

“The only way to get rid of the ‘bedroom tax’ for good is through the powers of an independent Scottish Parliament.”

Housing charities and homelessness groups have also praised the change.

Mary Taylor, chief executive of the Scottish Federation of Housing Associations (SFHA), said: “We are pleased to see that Holyrood will now effectively have power to ease the worry of the ‘bedroom tax’ for social housing tenants in Scotland.

“We still wish to see the ‘bedroom tax’ repealed by the UK Government, so that tenants in other parts of the UK can be relieved of this iniquitous burden.”

The subsidy came into effect in April 2013 as part of a raft of welfare reforms under Work and Pensions Secretary Iain Duncan Smith.

The Government claimed it would make social housing fairer by encouraging tenants to downsize if they did not need larger properties, freeing up space.

Anyone deemed to have spare rooms faced losing a percentage of housing benefit and could apply for a discretionary housing payment to make up the shortfall.

Foster carers and families with children in the armed forces are among those exempt from the changes but critics argue it does not properly take account of people’s needs and leads to debt and evictions.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments