Return to growth will help Brown

Prime Minister will claim credit for blunting impact of recession

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A sharp jump in economic optimism among business leaders has been revealed in The Independent's "green shoots" index as the end of the recession is formally announced today.

The survey of 185 business leaders by ComRes found that the proportion who detected signs of economic optimism in their sector rose from 36 per cent last month to 48 per cent this month. The number who spotted no "green shoots" dropped from 53 to 46 per cent, while the "don't knows" fell from 11 to 6 per cent.

Official figures to be published today by the Office for National Statistics are expected to show that the economy grew by about 0.3 per cent in the final three months of 2009, bringing an end to an 18-month recession.

The economy has moved to the heart of the general election debate. In an attempt to revive Labour's prospects, Gordon Brown will claim that government intervention had blunted the impact of the recession and kept down unemployment. But the Conservatives will argue that Mr Brown's legacy will be "the great recession" because his record as Chancellor and Prime Minister made the downturn in Britain worse.

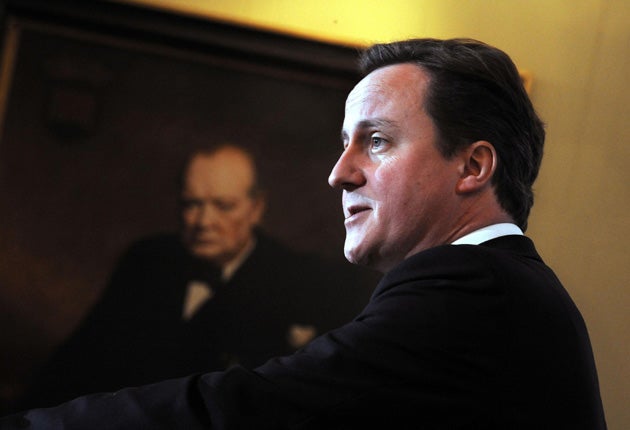

There are signs in the ComRes survey that the return to growth may help Labour's standing. The proportion of business leaders who have confidence in Mr Brown and the Chancellor, Alistair Darling, rose from 17 to 24 per cent and 20 to 29 per cent respectively. But David Cameron enjoys a 62 per cent rating, and the shadow Chancellor, George Osborne, 42 per cent. Some 73 per cent of business leaders believe that Mr Osborne lacks experience, and 42 per cent think he is out of his depth. But a majority – 62 per cent – believes he would make a better Chancellor than Mr Darling.

Labour hopes to get a boost from the recovery, with those voters in work who are better off in the downturn due to lower interest and mortgage rates possibly giving Labour a "thank you" vote of confidence now the recession is over.

However, an ICM poll for Channel Four News last night found that one in five people attribute the return to growth to the Government and just 12 per cent say the recovery will make them more likely to vote Labour. Some 10 per cent say it will make them less likely to support Labour, while a majority (72 per cent) say it will not affect how they will vote in the election.

Yesterday, Mr Brown said the "biggest mistake" post-recession Britain could make would be to put the recovery at risk by starting to cut public spending this year, as the Tories demand. He insisted that he was ready to take difficult decisions on spending cuts in low priority areas.

But, at a rival press conference, Mr Cameron said that without immediate action, Britain's credit rating would be downgraded, interest rates would rise, the cost of a £150,000 mortgage could go up by £200 a month, the cost of credit for businesses would also go up, and more jobs would be lost.

The Tory leader said: "We'll only get this recovery right if we start right now on a proper debt reduction plan."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments