Pensioner bonds: Sales of high-interest bonds for pensioners to be extended, says Osborne

More than 600,000 over-65s have snapped up the market-leading savings opportunity since they were first offered last month

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

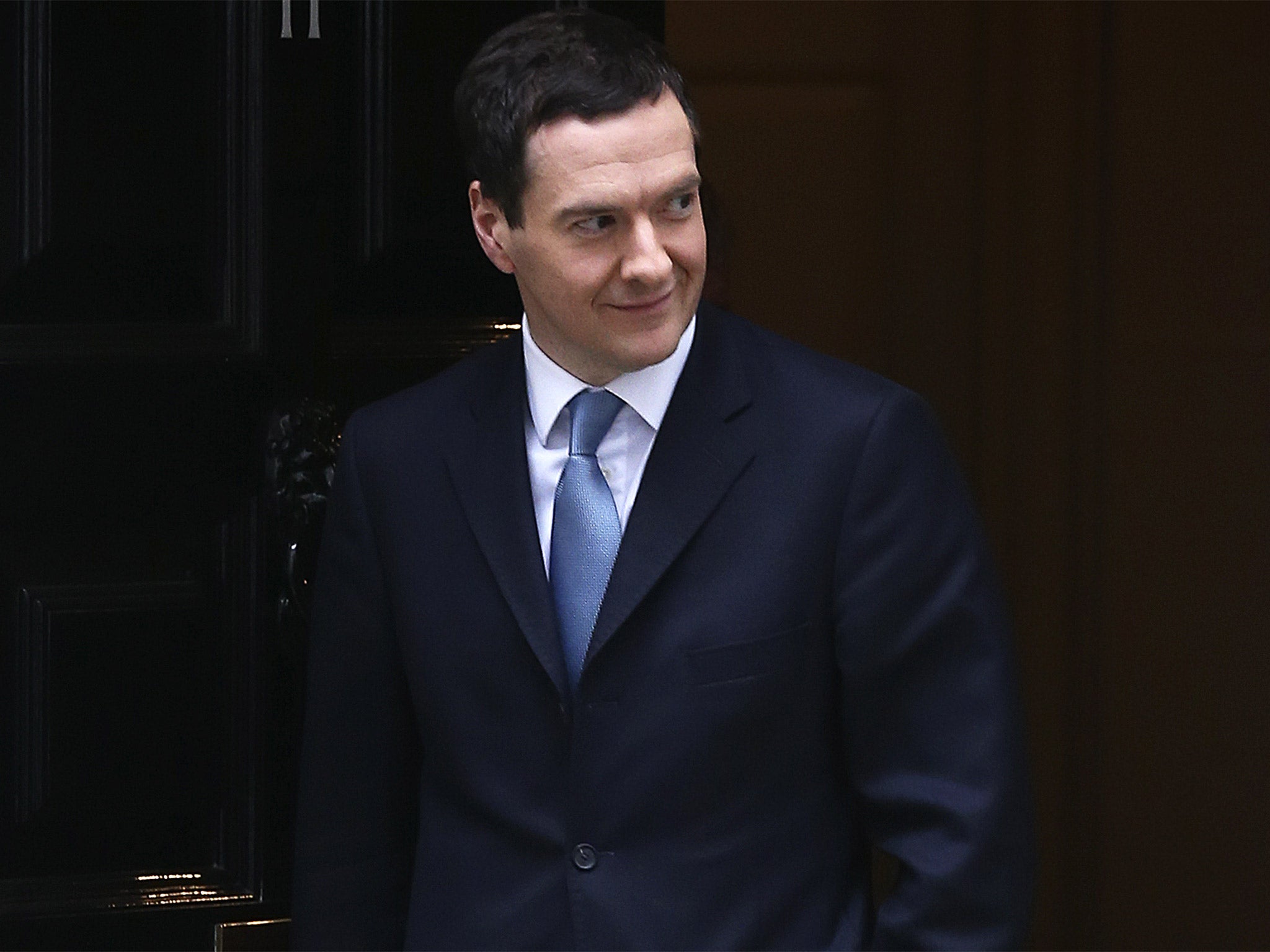

Your support makes all the difference.Sales of high-interest bonds for pensioners will be extended for three months following unprecedented demand, George Osborne said.

More than 600,000 over-65s have snapped up the market-leading savings opportunity since they were first offered last month.

The rush to take advantage left some consumers struggling to get on the website as well as finding the phone lines jammed.

A pot of up to £10 billion has been put aside for the 65-plus bonds and the opportunity cost to the taxpayer of the state borrowing from pensioners rather than the capital markets runs into “hundreds of millions of pounds”.

The Chancellor told BBC1's Andrew Marr Show that it was important to the economic recovery to encourage savers.

“Our 65-plus pensioner bond has been the most successful savings product this country has ever seen. Over 600,000 pensioners have benefited from it.

”What I can confirm today is that we are going to guarantee that it remains on sale for another three months.“

Mark Littlewood, director general at the Institute of Economic Affairs, said: ”This announcement well and truly proves that we are not all in it together.

“Borrowing more expensively than the Government needs to is effectively a direct subsidy to wealthy pensioners from the working-age population.

”Pensioner bonds have never been anything other than a gimmick that will benefit pensioners at the expense of the taxpayer, and it beggars belief that the Government is prolonging such a foolish policy. It's high time our politicians stopped buying votes with subsidies for the old and rich.“

The Treasury said £7.5 billion in bonds - which offer annual interest rates of 4% over three year bonds and 2.8% for the one year - have been sold so far, with the total anticipated to double by the end of the period.

PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments