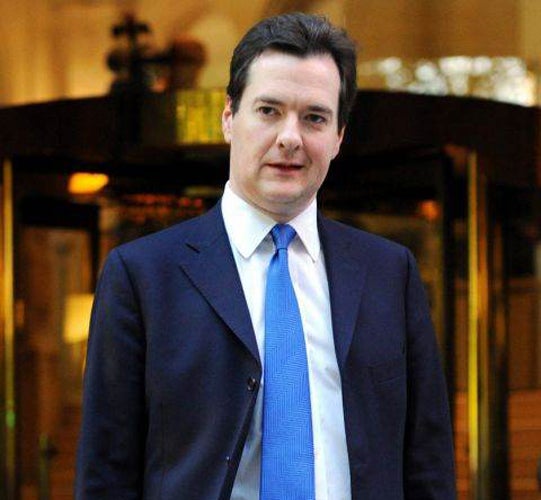

Osborne softens 'tough' stance on bank bonus rules

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne, the Chancellor, wants backing from EU finance ministers before imposing new bank bonus rules, in what is being seen as a further attempt to downplay the Government's "tough on banks" stance in response to City pressure.

The move comes as it has emerged that officials are in talks with the banks over a contribution of around £1bn to a "Big Society bank", that would go towards community projects in exchange for the Government quietly agreeing not to impose new rules without international agreement. Critics have reacted furiously, accusing the Government of "going soft", despite pledging a "get tough" stance on banks in the run-up to the General Election.

Mr Osborne is writing to the EU's financial services chief Michel Barnier and his fellow finance ministers to seek support to force banks to disclose in progressive "pay bands" how many people they pay more than £1m .

The plan was put on the statute book by former Chancellor Alistair Darling. The attempt to involve Europe means that British banks will now almost certainly escape the rules for this year's bonus round and possibly beyond.

Sir David Walker, the City grandee and former Morgan Stanley banker, who came up with the idea in a review of the way banks were governed, has now said it should not be implemented without international agreement.

A Treasury spokeswoman said yesterday: "The Chancellor will be writing to his EU counterparts to suggest new EU-wide transparency rules on bankers' bonuses, in line with Sir David Walker's recommendations."

Treasury sources insisted that Mr Osborne had still "not ruled out unilateral action", but they indicated that it was now Government policy to seek EU agreement first. This is despite a statement calling for greater disclosure by Business Secretary Vince Cable earlier this week.

The move will delight the industry, which has been desperately trying to persuade the Government not to impose any new rules without international agreement. Senior bankers would, however, also like to ease tensions with a hostile public. The main initiative they have been trailing has been talks about cutting the overall level of bonus payouts, and issuing a joint statement about it and the tax paid by the industry, including the £2.5bn levy, and the possibility of the "Big Society bank".

American banks operating in the City will have no truck with the former, though, and neither will Standard Chartered, which is listed on the London Stock Exchange but mainly operates in Asia. It argues that it needs to pay up to compete with Asian banks, which are under no such strictures.

Even if the banks do agree to a "Big Society bank" – and nothing has yet been signed – that would raise just £3.5bn when combined with Mr Osborne's derided banking levy, only a tiny fraction of the £1 trillion of tax-payer-funded support that has been pumped into the sector since the financial crisis began.

Banks will also be substantial beneficiaries of the Government's decision to cut corporation tax from 28 per cent to 24 per cent over the next four years.

TUC General Secretary Brendan Barber said: "We can't make any progress on regulating the banks unless we begin to tackle the issue of remuneration. If George Osborne is going to fall for the claim that bankers will leave the UK every time we attempt to make banks more open, progress will never be achieved.

"It is high time the Chancellor called the bankers' bluff – they've been hit by the supposed bombshells of the 50p tax and the bonus levy and there's still no City exodus in sight."

Gavin Hayes, head of the left-wing think tank Compass, said: "This Government has gone soft. The levy will raise less revenue than the one-off bonus tax introduced by Alistair Darling and it is absolutely minuscule when compared with the cuts that they are imposing on the rest of us.

"It's worth saying that Margaret Thatcher in the early 1980s imposed a windfall tax on banks that raised significantly more than this Government will raise, despite the massive influx of taxpayers' cash to prop up the banks."

The British Bankers Association is understood to be aware of the secret Government talks but is not directly involved. The main mover behind them is thought to be John Varley, the chief executive of Barclays, who is planning to step down next year in favour of the controversial investment banking chief Bob Diamond.

Angela Knight, head of the British Bankers Association, said: "We have said repeatedly that the banks understand the public mood with respect to remuneration, and the banks also understand their societal responsibilities. It is not surprising therefore that we are talking with the Government. The banks are aware of the role that they must play."

BBA's policy director Irving Henry argued that publishing pay scales could be seen by bankers as providing "benchmarks" for what they should be paid, and end up with bigger bonuses.

What they said – and what we got

What they said "We will bring forward detailed proposals for robust action to tackle unacceptable bonuses in the financial services sector... we will ensure they are effective in reducing risk." Page 9, Chapter 1 of the Coalition document.

What we got Still waiting. Scaled back disclosure requirements. Replaced bonus tax with one on bank balance sheets which will raise less than half when implemented.

What they said "We will not allow money to flow unimpeded into huge bonuses if that means money is not also flowing out in credit to the small businesses who did nothing to cause this crash and suffered the most in it." George Osborne.

What we got Still waiting. Small business groups still argue not enough is being done.

What they said "There should be a day... when we would not flinch from spelling out the rightful consequences of irresponsible behaviour." David Cameron.

What we got Still waiting. Government policy now to seek European support for any new rules.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments