'I'm scandalised': Cable condemns taxman's let-offs

Business Secretary claims lack of scrutiny into 'cosy' deals for large firms shows preferential treatment

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.A new rift opened in the Coalition yesterday when Vince Cable said he was "scandalised" by the apparently preferential treatment given by tax chiefs to large firms in paying their bills.

The Liberal Democrat Business Secretary spoke out hours after Downing Street strongly denied that managers at HM Revenue and Customs bent its rules to favour major companies.

Both were responding to a scathing report by the Commons Public Accounts Committee, published yesterday, which said that HMRC is chasing £25bn in unpaid tax from big companies and attacked the "unduly cosy" links that HMRC officials have with them.

HMRC retorted that the MPs' report was based "on partial information, inaccurate opinion and some misunderstanding of facts". It received heavyweight backing from the Prime Minister's official spokesman who insisted all taxpayers were treated evenly by the HMRC. "They collected a record amount of tax last year – £468bn of taxes," he said. "They have been developing a new approach to dealing with large corporate taxpayers and that approach has resulted in additional revenues coming in."

But Mr Cable struck a different note when asked during a webchat with Gransnet whether he was "scandalised" by the MPs' conclusions. He replied: "Yes, I am scandalised when I discover that leading companies are dodging taxes." He added that ministers had imposed tougher controls on the banks who committed "industrial-scale tax-dodging" and now needed to target "very rich individuals who don't pay their share".

Rachel Reeves, the shadow Chief Secretary to the Treasury, called for the Government to act to ensure that decisions over large companies' tax bills were made more transparent.

Graham Black, president of the Association of Revenue and Customs, which represents HMRC managers, said the problem was not tax inspectors being "cosy" with big business, but a shortage of them. "Resources are too stretched to battle the major companies advised by an army of expensive advisers," he said.

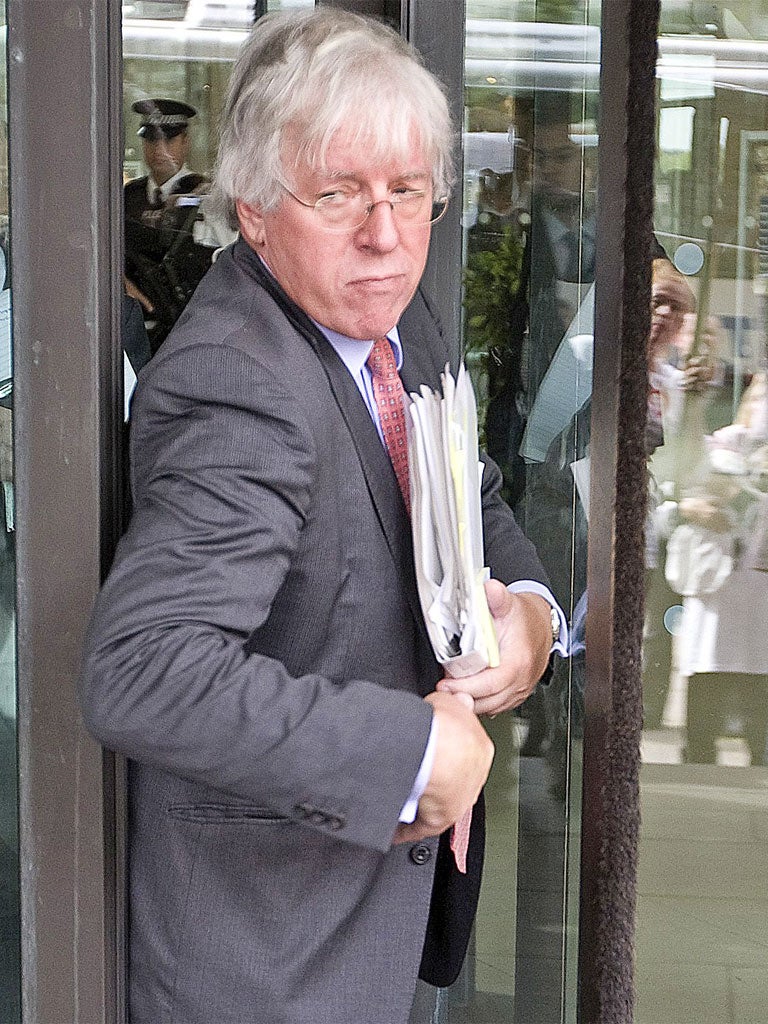

Meanwhile, the law firm McGrigors called for an overhaul of the HMRC's operation in a move to end fears over "sweetheart" tax deals. It cited the disclosure that Dave Hartnett, the HMRC's Permanent Secretary for Tax, had lunch or dinner with companies, tax lawyers and tax advisers 107 times over a two-year period.

James Bullock, Tax Partner of McGrigors, said: "Wining and dining must be kept to a minimum. It is neither good governance, nor good for businesses, that those frequently on opposite sides of such important negotiations are also spending so much time together in a convivial environment."

The PAC report follows widespread criticism of two deals struck by officials led by Mr Hartnett. Vodafone is alleged to have been allowed to pay £1.25bn in a tax, despite a potential bill of £8bn, while a mistake enabled Goldman Sachs to pay an estimated £20m less in tax.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments