George Osborne on course to privatise more public assets than any Chancellor since 1979

Exclusive: Privatisations outstrip even those made by Margaret Thatcher's Chancellors Nigel Lawson and Geoffrey Howe

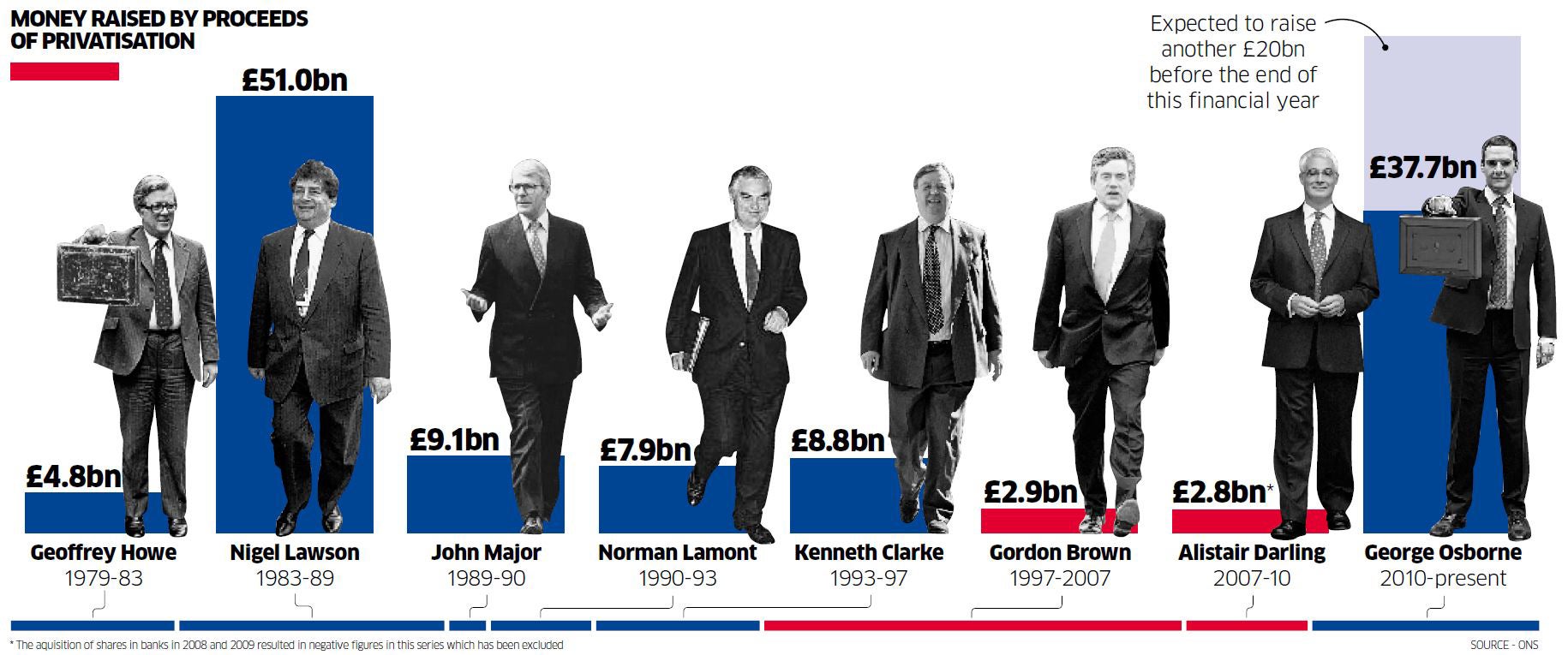

George Osborne is on course to sell off more public assets than any Chancellor of the Exchequer for more than 30 years – including all those who served under Margaret Thatcher. New figures from the House of Commons library reveal that in the five-and-a-half years Mr Osborne has been Chancellor he has made £37.7bn in privatisations – and intends to sell off another £20bn by the end of the next financial year.

This is more than any Chancellor since 1979, including Nigel Lawson, who controlled the nation’s finances from 1983-89, during the height of Mrs Thatcher’s reign. Under the Tory Prime Minster’s first Chancellor, Geoffrey Howe, between May 1979 and June 1983, government privatisations brought in £4.8bn in today’s prices.

Nigel Lawson, now a Conservative peer, sold off public assets worth £51bn during his spell at the Treasury.

John Major took over as Chancellor for a little over a year in 1989, privatising a further £9.1bn of government-owned companies.

Between 1990 and 1997 the pace of privatisations slowed considerably. In the first three years, under Norman Lamont, the Government disposed of £7.9bn of assets before Kenneth Clarke – who was Chancellor from May 1993 to May 1997 – managed another £8.1bn.

After Labour came to office in the 1997 landslide, government privatisations almost ground to a halt. In Gordon Brown’s 10 years in the Treasury he sold off only £2.8bn worth of public assets – or £280m a year compared with Nigel Lawson’s £8.5bn a year.

Alistair Darling continued the trend, selling £2.8bn in state-owned stocks and shares. This figure, however, does not include the historic bank bailouts that effectively nationalised large parts of the banking sector. But after Mr Osborne became Chancellor in 2010 the rate of privatisations began to rocket again, hitting levels last seen under Mr Lawson.

The Office for Budget Responsibility expects the Chancellor – if he remains in the Treasury until the next election – to have sold off assets worth an eye-watering £98bn.

In total, Mr Osborne has already overseen privatisations worth £37bn, but he is expected to make a further £20bn this year followed by £41bn over the remainder of this parliament to 2019-20.

These figures exclude the value of land or buildings sold off by the Government, but do include sales in the bailed-out banks Lloyds and the Royal Bank of Scotland.

In the first two years of the coalition, the Government did not make any privatisations. But from 2012, Mr Osborne began a rapid sell-off of government-owned stocks and shares. In 2012 he made £14bn from privatisations, followed by £7bn in 2013, £5bn in 2014 and then a further £11bn this year.

The shadow Chancellor, John McDonnell, claimed the figures were “damning” evidence that the Government was not “trying to sell anything that’s not nailed down while he thinks no one’s looking”.

He said: “The Chancellor doesn’t have a real plan for recovery so he’s is simply selling off anything he can lay his hands on to massage the figures, and with the planned sale of the Land Registry he is even selling the ground from under our feet.

“This privatisation of public assets is being done, as in the case of the Royal Mail, at a loss to the taxpayer, and it’s being driven for ideological and personal ambitions of George Osborne.

“The problem is the Tories can only sell these assets once, and if there’s not a proper plan to lay the foundations for the economy of the future, then they’ll create a deficit with the future, that the next generation will have to pay down.”

But Mark Littlewood, director general at the free-market Institute of Economic Affairs, told The Independent on Sunday that Mr Osborne should be “proud” of his record delivering the “largest privatisation proceeds of any Chancellor”.

Mr Littlewood said: “Much of the income comes from banking, an inherently risky sector which the Government has been involved with for too long. The costs of those risks should be borne by private individuals who choose to own shares; taxpayers’ money must not be used again to bail out banks that make destructive decisions.”

A Treasury spokeswoman also defended the Government’s privatisations. “As the Chancellor has said, if we want a more productive economy, then we should get the Government out of the business of owning great chunks of assets that should be in the private sector.

“That is why we are determined to deliver the biggest ever sale of publicly owned corporate and financial assets in 2015-16, exceeding £30bn in real terms for the first time. It’s all part of our long-term plan to deliver economic security for working people and pay down our national debt,” she said.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

0Comments