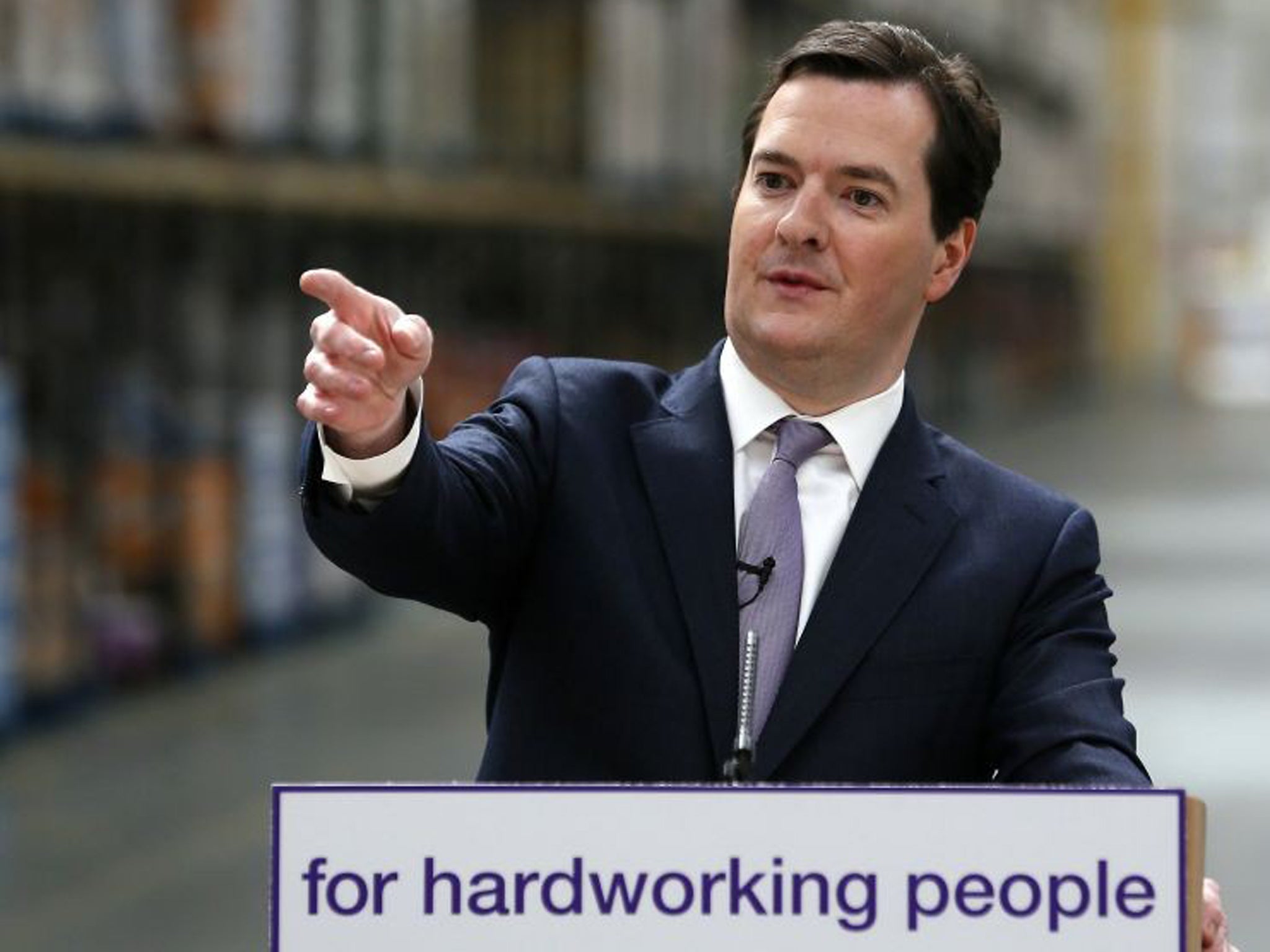

George Osborne mounts fierce defence of 'essential' cut in top tax

Chancellor was also fiercely critical of churches and charities that oppose Government's welfare cuts

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne mounted a fierce defence today of his decision to lower the top rate of tax from 50p to 45p, insisting it was essential to help get the economy growing.

The Chancellor was also fiercely critical of churches and charities which have opposed the Government's welfare cuts, describing them as simply "vested interests" reacting with "depressingly predictable outrage" to necessary change.

With a host of benefit changes coming into force this month, Mr Osborne claimed critics were "defending the indefensible" and warned that protecting "every item" of welfare spending was not credible in the current economic environment.

He also used a speech in Sittingbourne, Kent, to justify cutting the top rate of income tax on salaries of more than £150,000 to 45p. The reduction comes into effect on Saturday.

Acknowledging the move was "controversial", he added: "If we're serious about Britain succeeding in the world, it's an economic essential.

"In a modern global economy, where people can move anywhere in the world, we cannot have a top rate of tax that discourages people from living here, setting up businesses here, investing here, creating jobs here."

The Chancellor cited France, where the Government is planning to "whack up their top rate of tax" and job creation rates were falling as business leaders left the country.

"The opposite is happening here because we are welcoming entrepreneurs and wealth creators - and the jobs they bring with them," he said.

He said the 50p rate - brought by Labour weeks before the election in 2010 was a "con" as amounts of tax collected fell.

"We got the worst of both worlds: a tax rate that discouraged enterprise and didn't raise more money from the rich. You can't pay down the deficit with that. You can't fund the health service with money that never arrives."

Mr Osborne said the welfare system was "fundamentally broken" and hit out at critics of the Government's plans accusing them of talking "ill-informed rubbish".

He said ministers were simply trying to restore "some common sense and control on costs" in a system which had become unaffordable.

He was speaking the day after his cabinet colleague Iain Duncan Smith claimed that he could live on £53 a week in benefits.

The Work and Pensions Secretary's attempt to justify the benefits changes he is introducing appeared to backfire when he was challenged on whether he could live on £53 a week. "If I had to, I would," Mr Duncan Smith replied testily, before saying the changes were necessary to ensure that "taxpayers' money was not being misspent".

More than 124,000 people had signed a petition on the influential website Change.org this morning calling on Mr Duncan Smith to live on £53 a week for a year - equivalent to £7.57 a day, and a 97 per cent reduction on his current income of £1,581.02 a week after tax.

Both Mr Osborne and Downing Street - speaking on behalf of David Cameron - sidestepped questions on whether they could live on £53 a week.

Mr Osborne is the latest and highest-profile minister to defend the welfare changes, which, it has been predicted, will leave some families nearly £1,000 a year worse off. It comes after the Conservative Party chairman Grant Shapps faced scorn when he used the fact that his own two sons share a room in justifying the "common sense" crackdown on spare rooms. It later emerged that his house is large enough for each of his three children to have their own room if one were not used as a study.

The Treasury Secretary Danny Alexander, a Liberal Democrat, has also attracted criticism for referring to "bedroom blockers" in a column for The Sun on Sunday.

Mr Duncan Smith's 16th-century Tudor house in the Buckinghamshire village of Swanbourne is said to be worth £2m - but technically he is just a tenant. The Grade-II listed property, which includes a swimming pool, tennis courts and three acres of grounds, belongs to the family of his wife, Betsy. Mrs Duncan Smith's father, John Tapling Fremantle, the fifth Baron Cottesloe, moved out of the house with his wife several years ago, and Mr Duncan Smith and his wife and four children moved in.

Mr Osborne warned that the economic situation means that the welfare bill is unsustainable.

In an attack on Labour he claimed that politicians cannot just "wish away" Britain's debt problem and take the "cowardly" way out.

And he claimed that new Treasury figures show that, as a result of the changes in last month's Budget, nine out of 10 working families are actually better off than they were last year.

However he admitted that an out-of-work couple without children will lose £150 year. "Those who defend the current benefit system are going to complain loudly," he will say. "These vested interests always complain, with depressingly predictable outrage, about every change to a system which is failing. [But] defending every line item of welfare spending isn't credible in the current economic environment."

Mr Osborne's claim that nine out of 10 people will be better off as a result of the Budget is based, in part on his announcement that the level at which people start paying income tax will rise to £10,000 next year.

But an analysis by a senior academic for the Resolution Foundation thinktank, released today, concludes that most of the gains for low to middle-income families will be wiped out by the Government's new universal credit programme which is being rolled out across the country from this month.

Universal credit combines all benefits and tax credits into a single payment automatically linked to earnings. But because payments are calculated on the basis of income after tax, any tax cut that boosts income will reduce universal credit support.

Thus while a tax allowance hike of £1,000 would be expected to lead to a gain of £200 in post-tax income, £130 would be reduced from universal credit payments, leading to a net gain of just £70. This was not the case under the previous tax credit programme.

Labour, meanwhile, renewed its attack on the benefit changes. The shadow Chancellor Ed Balls said that, according to the Institute of Fiscal Studies, the poorest 10 per cent of households will lose an average of £127 under this year's changes, while the richest 10 per cent will gain almost 10 times that, or £1,265. And families with children would be hit harder, Mr Balls said, with the poorest 10 per cent losing £236 a year. "It's appalling, it's shocking, it's immoral," he told the Daily Mirror, adding: "What planet are they on? I can't believe they are so callous."

The cross-bench peer Baroness Grey-Thompson said the welfare reforms would be "really hard" on many disabled people. "It's not just the change in social housing; it's the effect of the change in disability allowance. There's going to be a huge number of people who don't make the transition to personal independence payment; but it's also the changes to legal aid. So disabled people are going to be hit in a number of ways and we're not really going to see the effects of it for about two years."

Chris Leslie, Labour's shadow Treasury minister, said Mr Osborne had to explain "how it can be fair" to give a £3bn tax cut to top-rate taxpayers while "millions of working families pay the price for his economic failure". "The benefits bill is rising under this Government because our economy is flatlining, prices are rising faster than wages and unemployment is high. And it is this Government's cuts to tax credits which have left thousands of working parents better off if they quit their job."

Case studies: Effects of the bedroom tax

Jimmy Daly, 50, Stoke-on-Trent: 'These costs mean I can't support my disabled son'

I live on £71 a week. Now I've got two taxes coming up: the bedroom tax, which is an extra 14 per cent of my rent I have to pay – about £10 a week – plus the additional council tax payments, around £30 a month. Then I spend around £15 a week on diesel.

My son is 9, he has Hydrocephalus, which is water on the brain, epilepsy, cerebral palsy, he has no use of his right arm and very limited use of right leg, which means he is totally dependent on me. On top of that, he has learning difficulties. He lives with me 3 nights a week but legally his bedroom is deemed a spare room.

When my son is here I have the heating on, which costs around £15 a week. Right now the heating is off, I've got three pairs of socks on, three sweatshirts, four t-shirts, and my fingers are still cold.

I've worked for 10 of the last 11 years, paid taxes. After being laid off from teaching horticulture, next week I'm starting work as a seasonal gardener with the council.

When I hear the Government talk about the poor being scroungers I think they've lost the plot. Social welfare is there for people who fall on hard times. I don't drink, smoke or do drugs. It's a safeguard so you don't starve and get cold and so you can support your family.

Iain Duncan-Smith says he could live on £53 a week. Anybody can live on £53 for one week. I challenge him to do it for months on end, and then you know what it's really like.

Janet Mandeville, 50, Truro: 'Iain Duncan Smith probably spends £53 in one shop'

It is mad that they are punishing people for having extra [bedroom] space but offering no suitable alternatives. I live in a two-bed bungalow, which is wheelchair-adapted and part of a housing association. I move with the help of walking frames. As of yesterday, the Government wants an extra £13.22 rent a week and £26 towards council tax a month, from me. I've been sick with worry. My best friend, who is also my unofficial carer, lives next door. Originally, I didn't want to move house. Now, I just want to get it over with. I'm trying to find out whether any help is going to be offered with the cost of moving. Are we expected to move in a wheelbarrow?

When I heard Iain Duncan Smith say he could live off £53 a week, well, I've only just stopped laughing. Prove it. He probably spends that in one shop. He doesn't know what he's talking about.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments