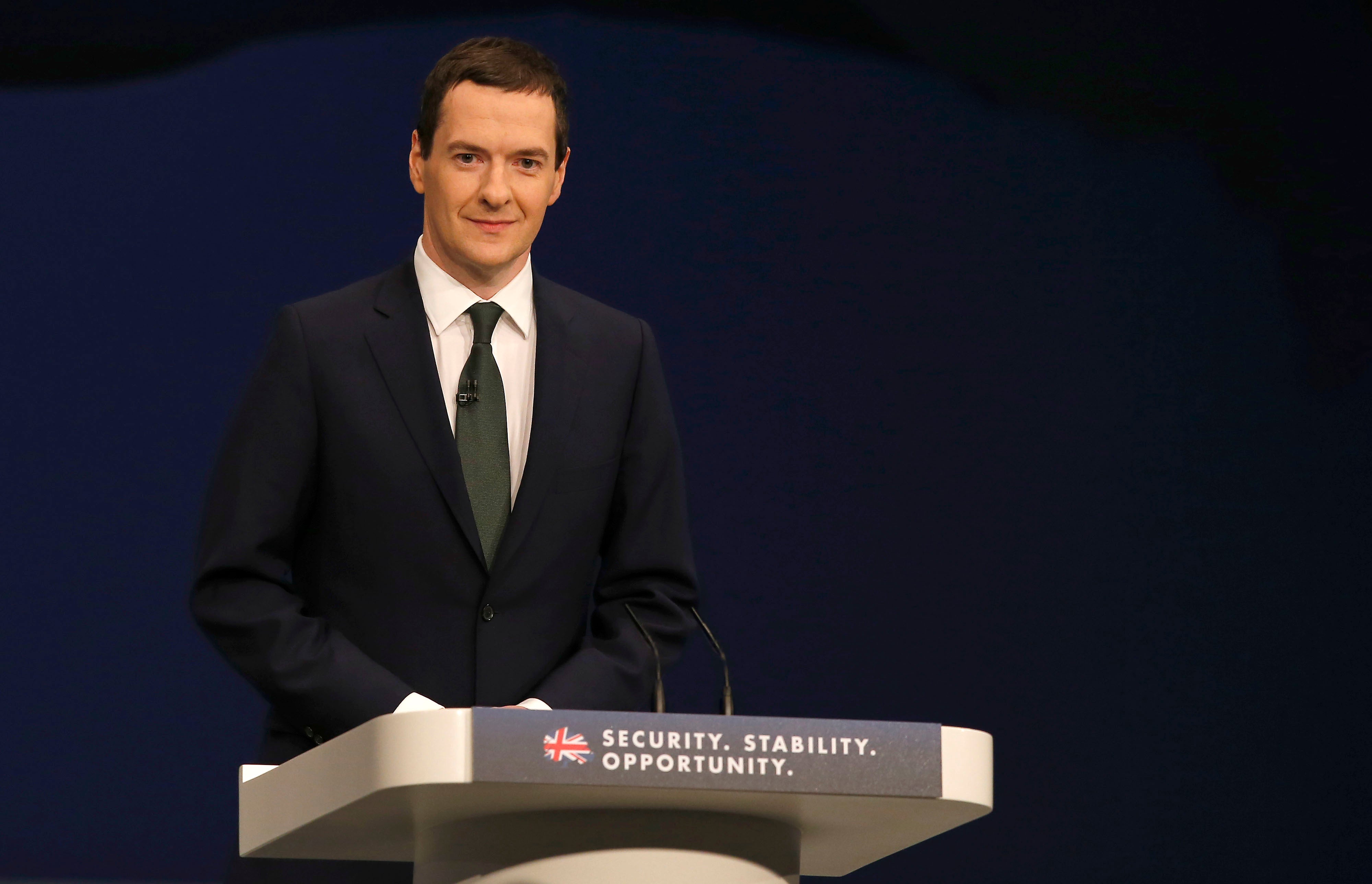

George Osborne accused of covering up impact of 'eye-watering' tax credits cuts

A newly-published Treasury report on the cuts failed to provide details of how they would affect different income groups

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.George Osborne has been accused of trying to cover up the impact of his controversial £4.4bn cuts to tax credits on the lowest earners.

Despite pressure from MPs, a Treasury report on the cuts published on 15 October failed to provide details of how the squeeze on the state-funded wages top-ups would affect different income groups. The Chancellor surprised MPs by not including the usual breakdown when he announce the controversial cuts in his July Budget.

The study covered only families already receiving tax credits rather than the population as a whole. Matthew Whittaker, chief economist at the Resolution Foundation think tank, said: “Government analysis of how the Summer Budget will affect households was conspicuously absent in July. This may, in part, be due to the eye-watering cash losses that millions of working households will experience due tax credit cuts – despite the welcome introduction of the National Living Wage[worth £7.20 a week from next April]. The Government’s latest analysis still fails to show the full distributional impact of its welfare changes. It should focus instead on easing the losses that working families will face in April.”

Andrew Tyrie, Conservative chairman of the Commons Treasury Select Committee which requested the figures, has told Mr Osborne that the new statistics are inadequate. One committee source said: “This is an obvious sleight of hand”.

Frank Field, Labour chairman of the Commons Work and Pensions Select Committee, said: “The Chancellor is trying to bamboozle his way out of a corner by saying ‘eight out of 10 working households’ will be better off overall by 2017-18. But it is doubtful that any of the tax credit claimants affected by these cuts will be among this group.”

The figures may fuel criticism of the cuts by Tory MPs. Labour will stage a Commons debate and vote on the issue on 20 October.

The Treasury said: “The 10 per cent of tax credit claimants on the highest incomes are contributing nearly four times as much as the poorest tax credit claimants to welfare savings. Average household income in the richest 10 per cent of tax credit claimants is £42,000 per year; significantly above average household income of £25,000 per year. Sixty per cent of the tax credit savings come from the half of tax credit claimants with the highest income.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments