Miliband stands by Commons tax avoidance claim – and challenges Cameron to defend Tory donor Lord Fink

Backed down from suggestion he would sue Ed Miliband over 'dodgy' bank account claims

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

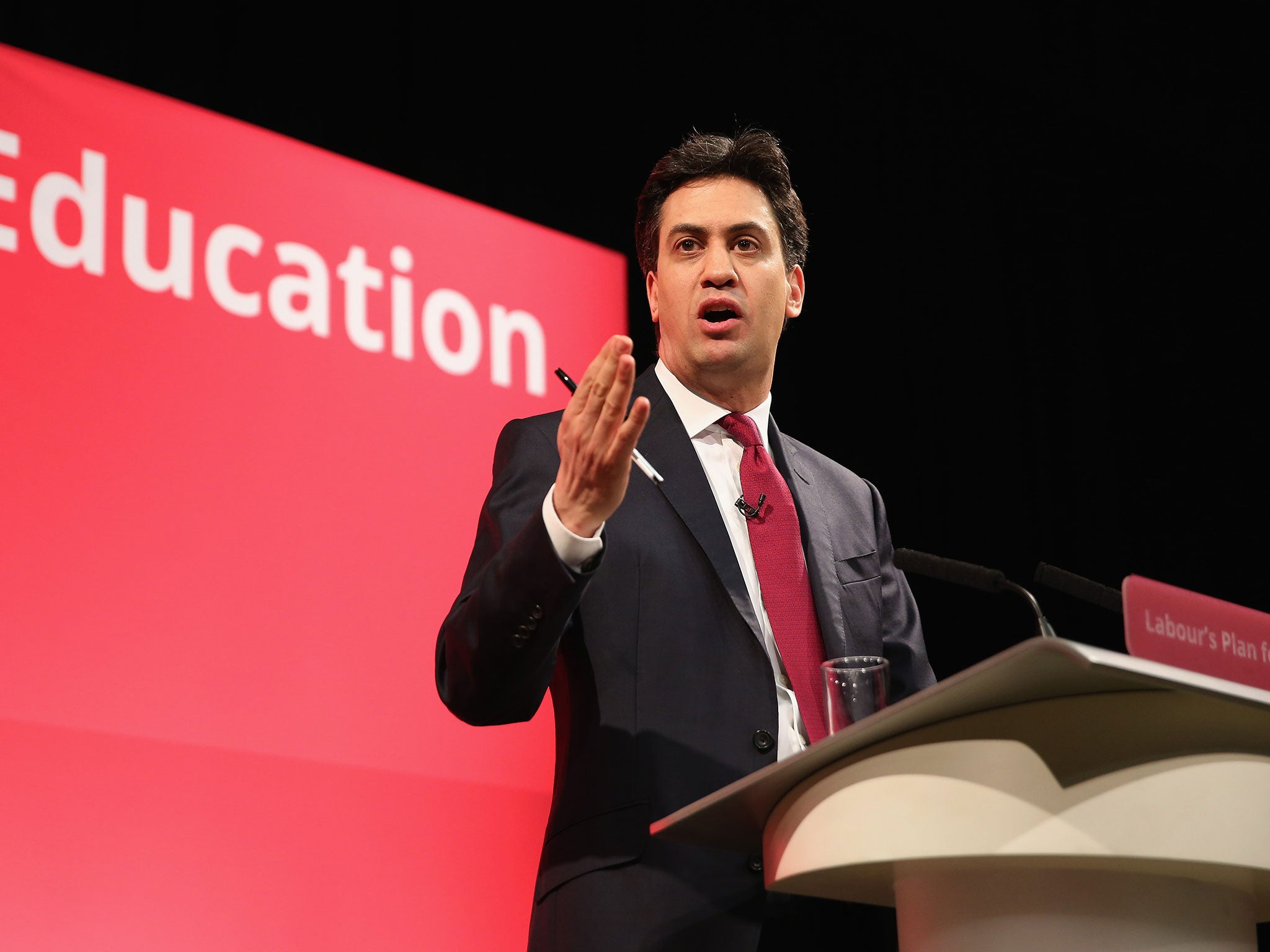

Your support makes all the difference.Labour leader Ed Miliband has challenged the Prime Minister to say whether he agrees with a former Conservative treasurer's claim that "everyone" engages in tax avoidance.

Mr Miliband made the comments after Lord Fink conceded that he had taken “vanilla, bland” steps to reduce his tax bill, adding that “everyone” is involved in tax avoidance.

The Tory peer and major party donor had threatened Mr Miliband with legal action if he repeated his claim made in the Commons that he had been involved in “tax avoidance activities” and his description of David Cameron as “a dodgy Prime Minister surrounded by dodgy donors”.

Responding today, Mr Miliband said: “Yesterday a Conservative donor challenged me to stand by what I said in the House of Commons. I do.

“And believe it or not, now today he confirmed it as well. He has just said, and I quote ‘I didn’t object to his use of the word tax avoidance, because tax avoidance – everyone does it’.

”David Cameron must explain why he appointed a treasurer of the Conservative Party who boasts about engaging in tax avoidance and thinks it is something that everyone does.”

However, the Labour leader stopped short of repeating his Commons barb, which was protected by parliamentary privilege, that Mr Cameron was “surrounded by dodgy donors”

Lord Fink said his tax planning had been at the “vanilla” or “mild” end of the spectrum and he had rejected advice to take more “aggressive” action to cut his tax bill.

“I chose the mildest end of the spectrum that I was advised on,” he told the Evening Standard. “What I did… was at the vanilla, bland, end of the spectrum.”

Lord Fink said: “I didn’t object to his use of the word ‘tax avoidance’. Because you are right: tax avoidance, everyone does it.”

He said: “I don’t even want to sue Ed Miliband... If he simply uses the words ‘Lord Fink did ordinary tax avoidance’ then, no, I couldn’t sue him.

“But if he made the statement ‘dodgy’ about my bank account, that was potentially libellous. That was the issue I took exception to.”

Lord Fink reacted: “Yesterday I challenged Ed Miliband to repeat the accusations he made in the Commons - that I used an HSBC bank account to avoid tax and that I was a ‘dodgy donor’. He did not.

“This is a major climbdown by a man who is willing to smear without getting his facts straight.”

Patrick Stevens, the tax policy director at the Chartered Institute of Taxation, told The Independent that while “tax planning” is generally understood as meaning taking steps to reduce the amount of tax paid in a way that the law allows and is intended for, “tax avoidance” - though legal - involves “getting a result that the law did not intend”.

“Not everyone does tax avoidance,” he said. “Each person decides whether they are comfortable doing transactions intended to get a result that was not intended.”

But Mr Stevens did concede that “most people would do something specifically allowed by law if it improved their tax position”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments