Executive pay is 'out of control', warn MPs

New report by MPs puts forward measures for controlling salaries, which it says no longer bears any correlation with performance

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Executive pay has been "ratcheted up" to the point where it is no longer linked to the performance of the business, a new report by MPs has warned.

The Business, Energy and Industrial Strategy (BEIS) select committee is calling for a crackdown on excessive remuneration as part of a widespread review of corporate governance.

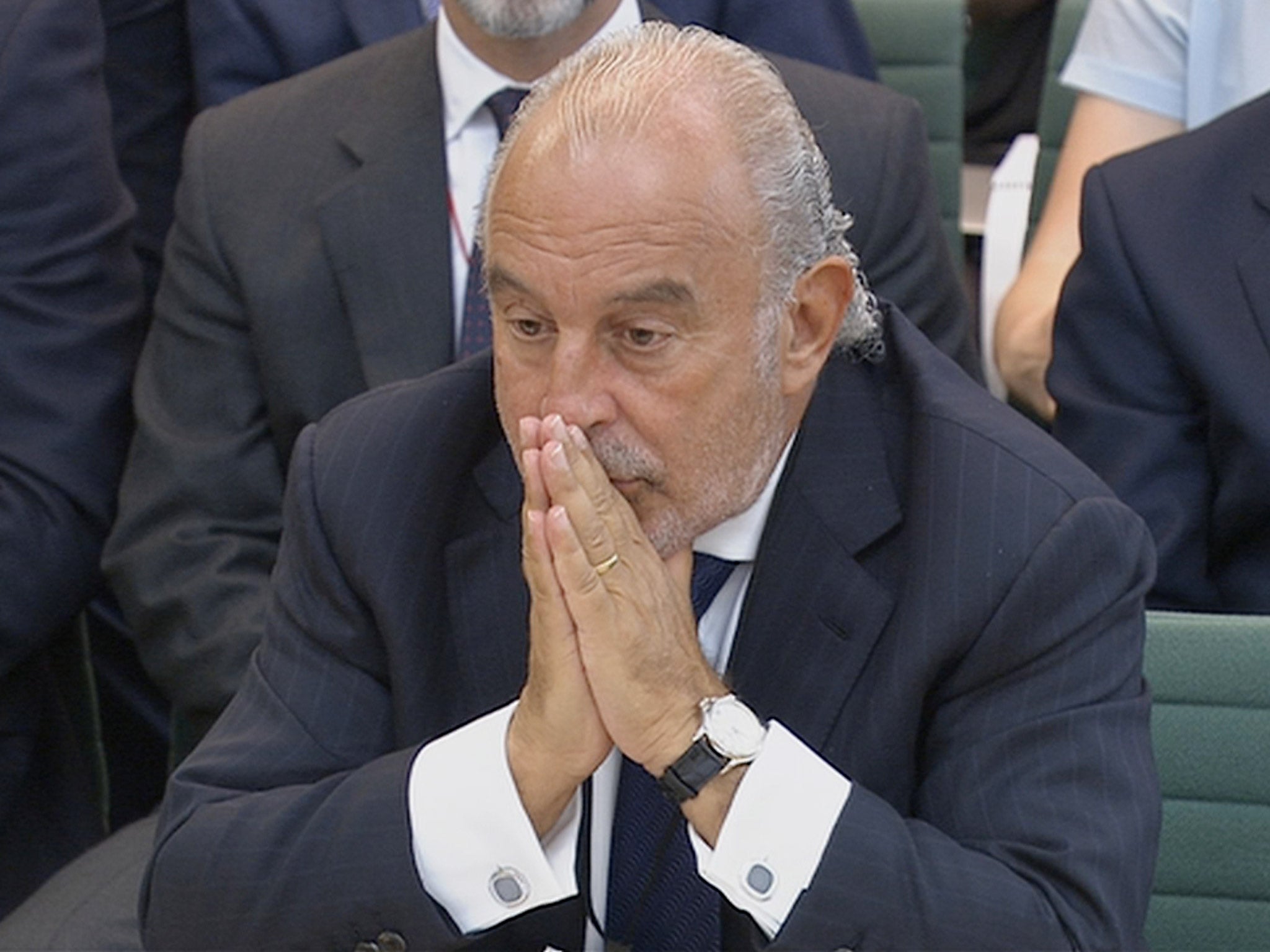

The Committee, which has played a significant role in compelling Sir Philip Green to address huge pension deficits at BHS, said the public's faith in corporate governance has been shaken in the wake of such scandals, and called for tough new measures to bring boardrooms back into line.

Committee chairman Iain Wright said: "Executive pay has been ratcheted up so high that it is impossible to see a credible link between remuneration and performance.

"Pay must be reformed and simplified to incentivise decision-making for the long term success of the business and to pursue wider company objectives than share value."

The committee has called for businesses to simplify the structure of executive pay and put an end to long-term investment plans.

Their recommendations include putting workers on remuneration committees and for the chairs of these committees to be expected to resign if shareholders reject their proposed pay policy.

The committee has also backed publishing pay ratios annually.

Other recommendations include a target that at least half of all new appointments to senior management positions in the FTSE 350 and listed companies should be women, as well as a new voluntary code of governance for private companies.

"The collapse of BHS highlighted the flaws in damage which private companies can do," said Mr Wright.

"The UK corporate governance system is recognised throughout the world as of high quality.

"However, recent scandals and the issue of executive pay have undermined public trust in corporate culture.

"That, together with rising stakeholder expectations, changing business models and technology, means that corporate governance needs to evolve to provide assurance to investors and wider society."

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments