Exclusive: Tory benefits freeze means tax cuts won't help low-income families

'They will be running just to stand still,' says Resolution Foundation

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Tax cuts promised by the three main parties will be no more than an illusion for up to 3.3m low income families, according to research for The Independent.

The Resolution Foundation think tank studied George Osborne’s decision in his Autumn Statement to freeze until 2018 the work allowance - the amount people on benefits and tax credits can earn before their in-work state support starts to be withdrawn.

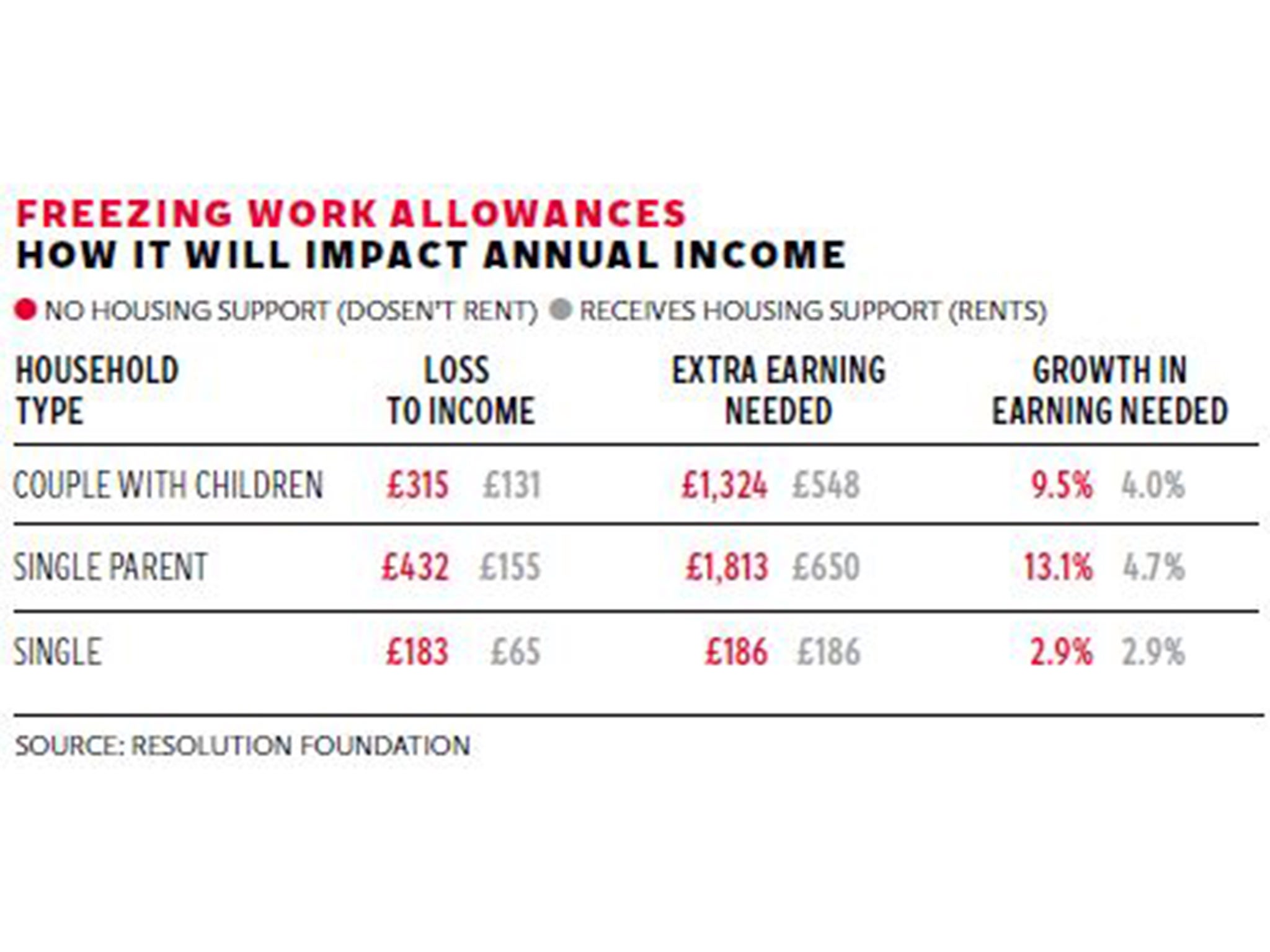

This first study of its impact found that a couple with children would need to see their combined earnings rise by more than £1,300 just to wipe out the income lost from the freeze, which began in 2013. This means their income would have to rise by 10 per cent more than the wage increases forecast by the Office for Budget Responsibility.

The Conservatives and Liberal Democrats have pledged to raise the personal tax allowance to £12,500 a year if they remain in power, while Labour has promised a lower 10p starting rate of income tax.

The think tank warned that, for millions of households, the freeze would wipe out 65p of every pound of the tax cuts trumpeted by the three parties. It proposed that Universal Credit, which is merging six benefits including housing benefit and tax credits, should be changed to ensure all working households get the full value of the tax cuts. It warned that one of Universal Credit’s key aims - improving the incentive to work for people on benefits - would be eroded by high marginal tax rates. Overall, people will lose 76p of every extra pound they earn.

David Finch, senior economic analyst at the foundation, said: “No political party has pledged to reverse these cuts to the work allowance. And as things stand the tax cuts proposed by the main parties will do little to offset these losses as the majority of any gains are immediately withdrawn through lower benefits. As yet, no leader has admitted that their tax cuts won’t deliver for millions of working families on Universal Credit.”

Mr Finch added: “The ongoing freeze to the work allowance in Universal Credit is eroding one of the most desirable features of the policy before it even comes into existence. It’s poorly understood but it matters greatly and will make a major difference to the prospects of millions of hard-pressed households. They will be running just to stand still.

“It will be hard to convince low-income families that Universal Credit really is making work pay if they see their disposable incomes fall year after year when moved onto the new system, even if they are receiving real terms earnings increases.”

The think tank, which focuses on those on low and middle incomes, found that the freeze would cost a couple with children £315 a year by 2018. As they would keep only 24p of every £1 of any pay rise, they would need to boost their combined earnings by £1,325 just to stand still.

A single parent would lose £430 by 2018 because of the freeze, so their annual earnings would have to rise by £1,815 just to stand still. Single people would lose £65 but would need a pay rise of £186 to catch up.

The study also found that the freeze will mean that many people would be able to work fewer hours before seeing their benefits cut.

Iain Duncan Smith, the Work and Pensions Secretary, insists his flagship Universal Credit will reduce the high marginal tax rates under the existing system. Asked about the freeze this month, he admitted: “If circumstances were much easier and we didn’t have an economy that crashed in 2010, we could probably have been a little more generous.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments