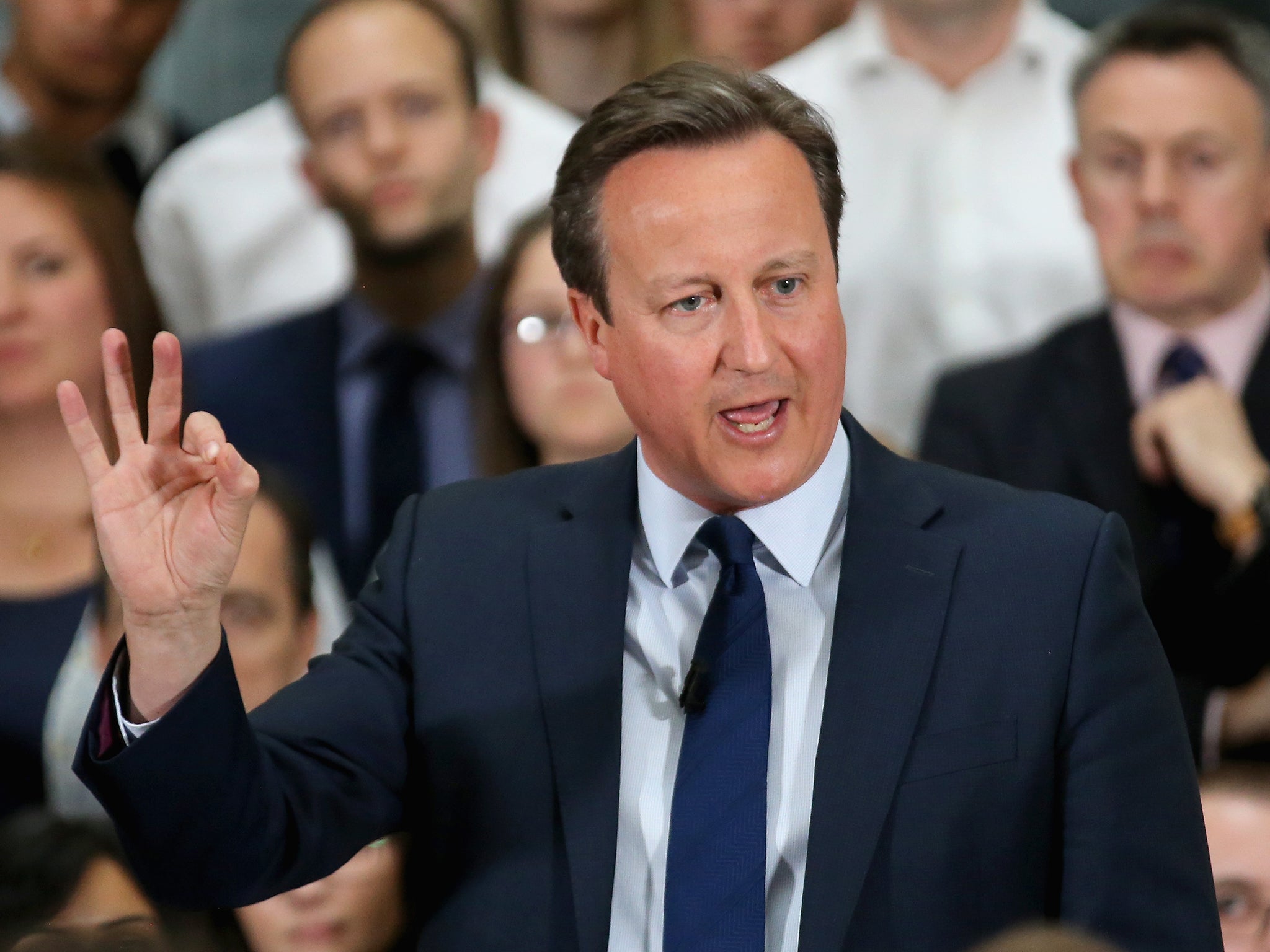

'Frankly and morally wrong': David Cameron's past attacks on tax evasion

In 2015 the Prime Minister said: 'No government has done more than this one to crackdown on tax evasion and aggressive tax avoidance'

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.After nearly a week of refusing to comment fully about his financial affairs, David Cameron has admitted he and his wife sold shares worth more than £30,000 in an offshore tax haven fund set up by his late father.

The stake, purchased for £12,497, was sold for £31,500 in January 2010 – four months before Mr Cameron became Prime Minister. The Camerons received £19,003 profit, £300 below the capital gains tax allowance.

The admission, made in an interview with ITV News, comes five days after the leak of a cache of documents – the so-called Panama Papers – detailing the tax affairs of thousands of individuals worldwide.

The data revealed the Prime Minister’s father, Ian Cameron, who passed away in 2010, ran a fund under the name Blairmore Holdings. The company was founded in the 1980s and moved to Ireland in 2012. In its 30-year history, Blairmore has never paid any tax in the UK on its profits.

In the past Mr Cameron has been critical of tax avoidance and has made tackling tax evasion a key part of his economic plan.

In June 2012 he called such schemes “frankly and morally wrong”, following revelations the comedian Jimmy Carr had channelled money through a Jersey-based company.

Speaking at the time he said: "It is not fair on hardworking people who do the right thing and pay their taxes to see these sorts of scams taking place."

In 2013, he revealed the G8 summit, hosted by the UK that year, would draw particular attention to tax dodging.

In January of that year he said: “We want to drive a more serious debate on tax evasion and tax avoidance.

"After years of abuse, people across the planet are rightly calling for more action and, most importantly, there is gathering political will to actually do something about it.”

In June 2013, the G8 leaders announced new measures to clampdown on illegal tax evaders and corporate tax avoiders. At the time Mr Cameron, wrote to British Overseas Territories and Crown Dependencies, urging there to be more transparency and publicly said: “Those who want to evade taxes have nowhere to hide.”

In April 2014, Mr Cameron called on UK tax havens to create public registers revealing the beneficiaries of companies incorporated in their territories. At the time he said: "These very aggressive tax avoidance schemes, they are wrong and we should really persuade people not to do them.”

The following February, as report about a tax scandal linked to HSBC's Swiss arm surfaced, the Prime Minister said: "No government has done more than this one to crackdown on tax evasion and aggressive tax avoidance".

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments