Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The Conservatives will not increase the rate of VAT if they win the next election, David Cameron has promised.

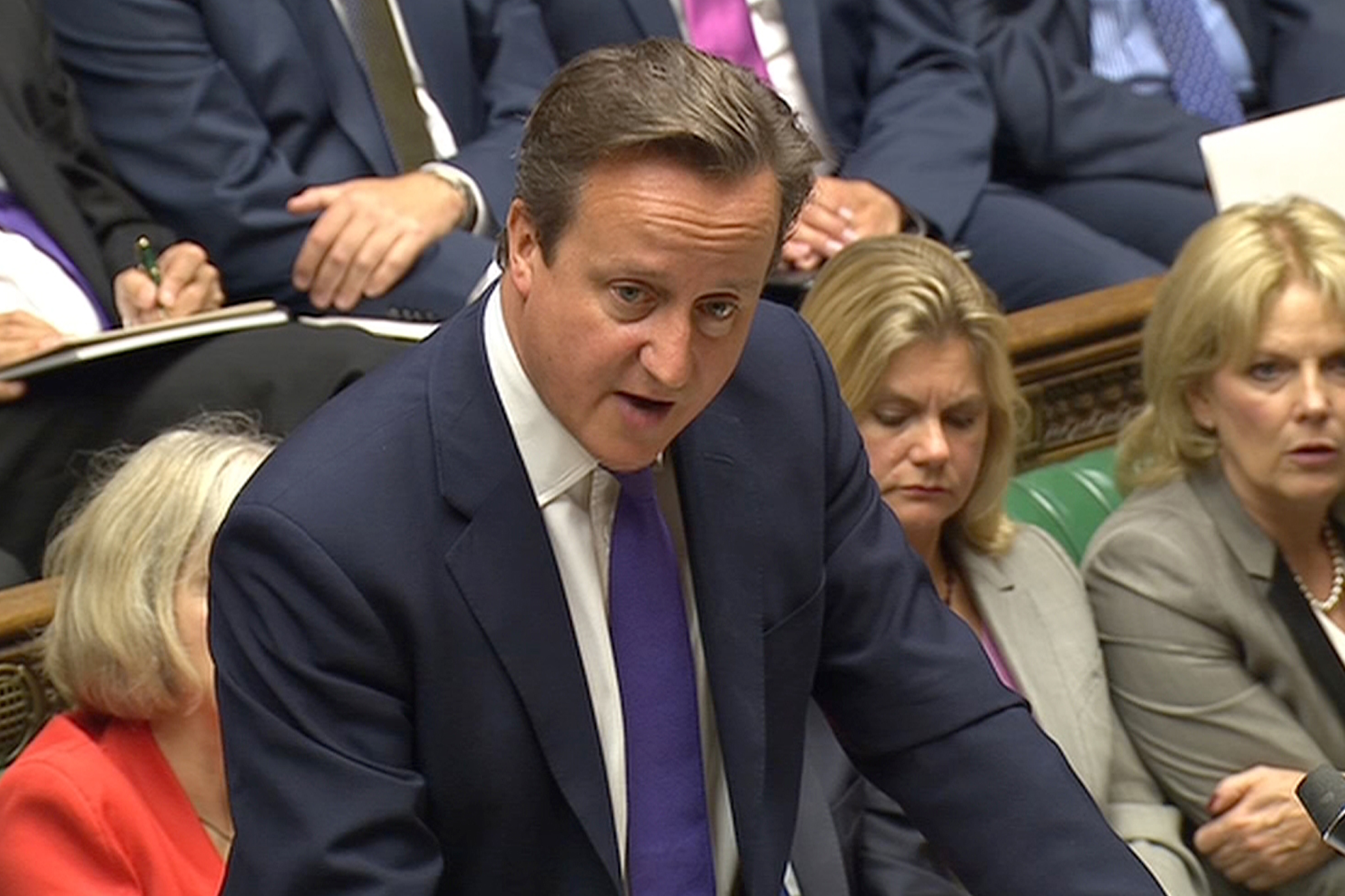

The Prime Minister made the commitment during the last session of Prime Minister’s Questions before Parliament shuts down for the general election.

Asked by Labour leader Ed Miliband whether he would rule out raising the tax, Mr Cameron simply responded “Yes” – a pledge he later described as “a clear promise on VAT from this side of the House”.

The Tories have been under pressure to rule out a rise in recent days after Labour said they would not raise the tax.

Mr Cameron then demanded that Labour rule out a rise in National Insurance to fund its public services commitments.

“A straight answer from me, straight question to him – I have ruled out VAT, will he rule out National Insurance contributions? Yes or no?” he asked.

Mr Miliband did not commit to a National Insurance freeze on the spot but told the Prime Minister that nobody would believe his pledge not to raise 20% point-of-sales tax.

“Nobody believes his promises on VAT; nobody believes his promises on the National Health Service, because he’s broken them in this Parliament,” he charged.

The Conservatives said they had no plans to raise VAT before the 2010 general election, though they did not explicitly rule the move out.

As part of the current government they quickly increased the rate of the flat tax from 17.5% to 20%.

Gordon Brown had temporarily cut the rate to 15% in an effort to stimulate the economy, but this measure was due to expire early in the parliament.

Labour has never raised the basic rate of VAT under any prime minister – the party says the tax is regressive. It is currently committed to increasing taxes on high value properties through a so-called ‘mansion tax’.

Ed Balls, the shadow Chancellor, said in a speech in Birmingham yesterday: “We will not put up VAT. And we will not extend it to food, children’s clothes, books, newspapers and public transport fares.”

“We will not raise VAT because it’s the tax that hits everyone. It’s the tax that hits you every day. And it hits pensioners and the poorest hardest.”

Unlike income tax, people pay the same rate of VAT whatever the level of their income, meaning it is more regressive than a progressive income tax system.

VAT was introduced in 1973 at 10% upon Britain’s entry to the European Economic Community. Labour cut the rate to 8% when it gained power in 1974 but introduced a higher rate for petrol and luxury items.

One of the first acts of the Thatcher government upon gaining power in 1979 was to raise the rate of the tax from 8% to 15%. In 1991 the Conservative government raised the rate further, to 17.5%, where it remained until the latest rise.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments