Darling embarrassed as Northern Rock fails to pass on rate cut

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Gordon Brown sought yesterday to convince voters he is not out of touch and that he understands their anxiety about the gathering economic gloom.

As some Labour MPs expressed fears that the Government looks to be "in denial" about the pressures facing ordinary people, Mr Brown insisted that he was listening to the "concerns and aspirations" of the British people.

Today, the Prime Minister will discuss the global credit crunch at a breakfast meeting in Downing Street with leading figures from the City. His spokesman denied it was a crisis session. The meeting takes place amid what a report by the Royal Institution of Chartered Surveyors says is the steepest decline in house prices since records began 30 years ago.

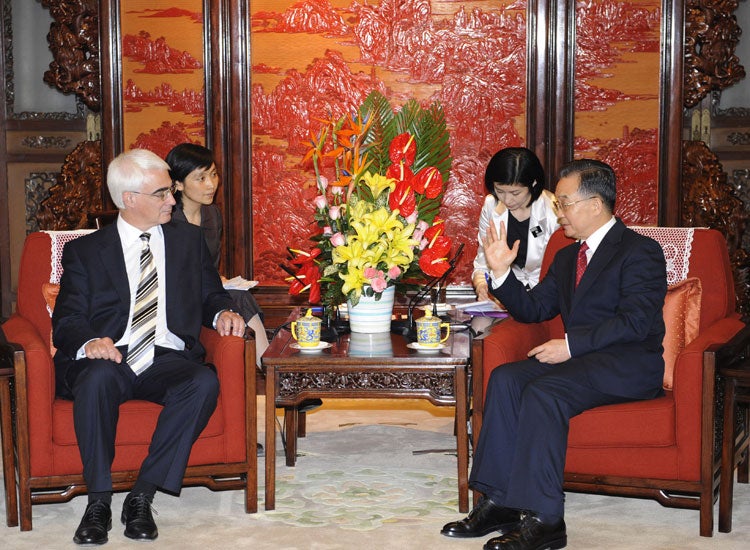

Next week, the Chancellor, Alistair Darling, will meet the Council of Mortgage Lenders and urge it to pass on interest rate cuts to homebuyers, do more to avoid repossessions by giving people better advice when they fall behind with their payments and help more people get a foot on the housing ladder.

Caroline Flint, the Housing minister, said: "We want to ensure there continues to be stability ... in the housing market, and that support is in place for consumers who might need it right now."

Northern Rock, the recently nationalised bank, threatened to further embarrass ministers by declining to pass on to its borrowers last week's cut in rates by the Bank of England. The bank said yesterday that its standard variable rate (SVR) "remained under review". So far, only a handful of lenders have said they will reduce their SVR.

Promising that ministers would bring forward measures over the next few months to address the "insecurities" people feel as a result of the global economic turbulence, Mr Brown assured voters yesterday he shared their concerns. "Every effort of mine ... is about keeping this economy moving forward, keeping stability ... and keeping growth," he said.

But the Prime Minister's new tone failed to stem the criticism from Labour MPs as more of them called on him to show the country a clearer direction. Graham Stringer, a former minister, said people were "disappointed" that Mr Brown had not done more. "There is no doubt that expectations were extremely high when Gordon became Prime Minister, and I think that it is those high expectations not being realised that has disappointed people," he said.

Ian Gibson, MP for Norwich North, said: "He's a bit like a scared rabbit in the headlines and he should not be. Give us five pledges which he can believe in. That would give the Government clear direction."

The Tories added to the pressure when George Osborne, the shadow Chancellor, said: "The pillars of the Prime Minister's economic strategy – stability, prudence and competitiveness – have collapsed in a heap of rubble. His economic reputation is in tatters." Mr Osborne also told the Policy Exchange think-tank that the housing bubble had burst.

Ministers adopted a more sympathetic tone as some admitted privately the Government had been slow to acknowledge people's concerns. Hazel Blears, the Communities Secretary, said: "[These are] difficult times for the Government... [and] for the country.

"It is entirely understandable that people are concerned about their ... homes, utility bills, cost of living. But ... the test for any government is when you are in difficult times, how do you perform – do you stand firm?"

Last night there were fresh questions over Mr Brown's grip on his government after a report claimed the Trade minister Lord Jones was "frustrated" and preparing to leave office before the next election.

Has your bank followed base rates?

Abbey

*Abbey increased the rate on eSaver and 50+ saver accounts by 0.25 per cent to 6.5 per cent. They have reduced their mortgage standard variable rate (SVR) by the full 0.25 per cent.

Nationwide

*Has increased fixed-rate mortgage products by up to 0.32 per cent.

Alliance and Leicester

*No move on savings rates. Reduced SVR by a quarter per cent, but increased some mortgage interest rates twice in a week.

HSBC

*No move on savings rates, and reduced SVR by a quarter per cent.

NatWest

*No move on savings rates. NatWest reduced SVR by a quarter per cent, but increased two-year fixed rate mortgage by 0.1 per cent, and two-year tracker mortgage by 0.35 per cent.

Lloyds TSB

*Reduced SVR by 0.25 per cent in line with MPC decision. No changes to savings rates.

Barclays

*No changes.

Bradford & Bingley

*Reduced mortgages by 0.25 per cent in line with the MPC decision. No change to savings rates.

First Direct

*Closed doors to all new mortgage business, due to oversubscription.

Bank of Ireland

*Also closed doors to all new mortgage business due to oversubscription, but reduced SVR for existing customers by the full quarter per cent.

Halifax

*Reduced SVR by 0.25 per cent in line with the interest rate decision.

Northern Rock

*Reduced SVR by 0.1 per cent.

Source: Savills Private Finance, Moneysupermarket.com

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments