Cable threatens banks with tax on bonuses

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

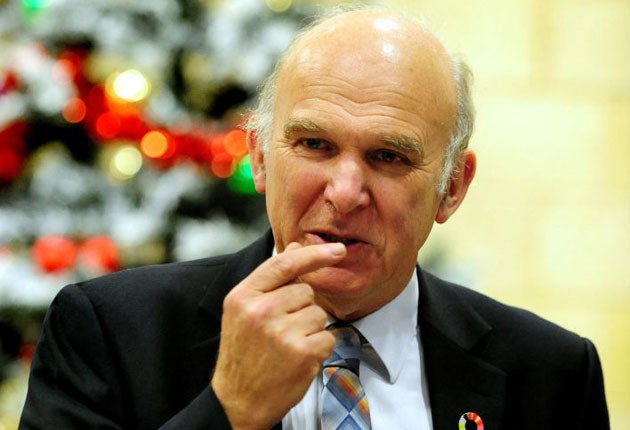

Your support makes all the difference.Business Secretary Vince Cable warns today that the Government will tax bankers' bonuses as a "last resort" if voluntary restraint and other "sanctions" failed to end what he calls "a very damaging bonus culture": "We have got to get this right".

Speaking to The Independent, and sensitive to growing claims that the Government is soft-pedalling on bankers at a time of austerity, Mr Cable said it was "very difficult to justify large bonuses". At a series of meetings at the Treasury with the Chancellor and the Business Secretary leaders of the major banks have been asked to show "self-restraint". Mr Cable acknowledged that it was "highly sensitive" for both parties in the coalition that their claims to be "progressive" were not mocked by the sight of bonuses in the millions being paid to some City traders and "fat cats".

As things stand, some £7bn will paid to traders and bankers over February and March and a failure to even agree on disclosure rules means taxpayers in the state-controlled Royal bank of Scotland and Lloyds Banking group will have little idea of where their money is going, let alone at any other banks.

If the talks between the banks and ministers fail to achieve an acceptable outcome, cautions Mr Cable, there are "potential sanctions through regulation in terms of cash versus non-cash bonuses, and there is the last resort of taxation of the bonus pool. So there are potential sanctions to be used". Similar discussions aimed at restraining bonuses this time last year failed when one leading US investment bank vetoed a deal with the then Chancellor Alistair Darling. Shortly after that, Mr Darling launched his "one-off" 50 per cent levy on bonuses in excess of £25,000. It raised £2.3bn.

Financial Services Authority rules now encourage bonus payment in shares rather than cash and a special tax on bank balance sheets is being introduced; but this is the first time the Government has suggested taxing bonuses.

Looking forward to a bonus season set against a backdrop of public sector sackings, VAT hikes, benefit cuts and student protests, Mr Cable senses political danger in "excessive bonuses": "We do realise we've got to get an overall public sense of fairness. We have got to get this right... We want a voluntary agreement but if not there are potential sanctions."

Reflecting on the recent student demos the Business Secretary adds that the strength of opposition was a "matter for concern", but that there was widespread "misunderstanding" of the policy: "We've got an explaining job [to do]".

Mr Cable's intervention raises the stakes within the Cabinet over the issue of bank bonuses. Critics have seized on the chancellor, George Osborne's apparent willingness to water down proposed new rules on public disclosure of bonus packages of more than £1m. Mr Osborne has said these should only be made public if agreement can be reached across the European Union – which will take many months.

A report by senior ex-banker Sir David Walker commissioned by Mr Darling suggested banks reveal what they pay to staff in various bands and without naming them.

On bank lending, Mr Cable said the banks "had a point" that the authorities were asking them to lend more at the same time as the banks were also being required to hold more of their funds in reserve in case of a crisis. However, he said, there was still a "credit crunch problem". It was not so much that the banks weren't prepared to lend to smaller companies, he thought, but that the "conditions, rates of interest and demands for security" had been so "onerous" that firms "don't ask any more".

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments