Budget 2016: All the talk of investing for the next generation is just hot air

Cutting public investment during the Coalition years has delayed the recovery

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The most disappointing news in the Budget was that the Office for Budget Responsibility (OBR) has revised down its projection for the long-term UK growth rate.

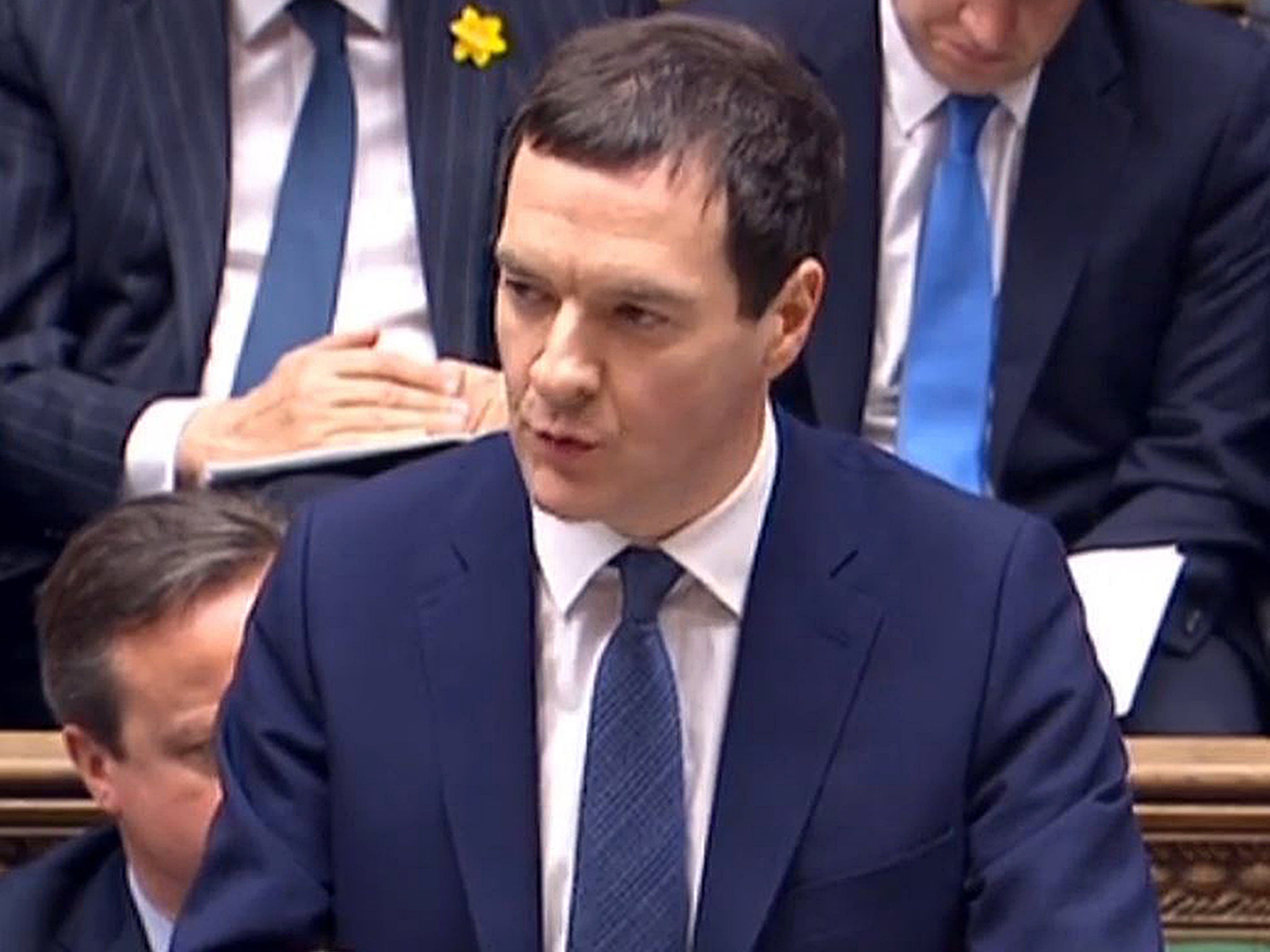

To hit Osborne’s surplus target, that means that the growth of public spending also has to fall to match the projection for lower GDP growth. This accounts for most of the additional spending cuts announced in the Budget, with the rest required to fund some tax giveaways.

A lower level of productivity growth is bad news for everyone in the economy, and not just for spending departments. Growth in output per head in the UK from the mid-1950s until the global financial crisis was remarkably steady, averaging around 2.25 per cent. Of course in the recessions of the early 1980s and early 90s growth fell, but the subsequent recoveries were rapid and GDP returned to its trend growth line.

All that changed following the global financial crisis. Not only did the UK appear to lose permanently around 15 per cent of GDP relative to this trend, but now – if the OBR is right – the trend growth rate has also fallen.

We do not know why this has happened. It may have had something to do with the fiscal consolidation undertaken in the UK and around the world (China apart), or it may not. What we can say is that any additional dynamism that is supposed to come from lower corporation tax has yet to materialise.

What we do know, from countless empirical studies, is that public investment has a positive impact on growth. It was therefore highly unfortunate that public investment was cut back sharply by the Coalition government.

This not only delayed the recovery, and had a very visible adverse effect on areas hit by the floods, but it may also be one factor behind the deterioration in UK productivity.

The Chancellor would like you to think he now recognises this, with lots of announcements of new investment projects.

The OBR’s figures tell a different story. In the last five years of the Labour government, the average share of net public investment in GDP was over 2.5 per cent.

During the Coalition years it fell to 2.2 per cent, and for the five years from 2015 it is planned to average just 1.7 per cent. This last figure is a 0.1 per cent increase compared to the Autumn Statement, which suggests that all the talk of investing for the next generation is just talk.

Simon Wren-Lewis is professor of economic policy, Blavatnik School of Government, Oxford University

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments