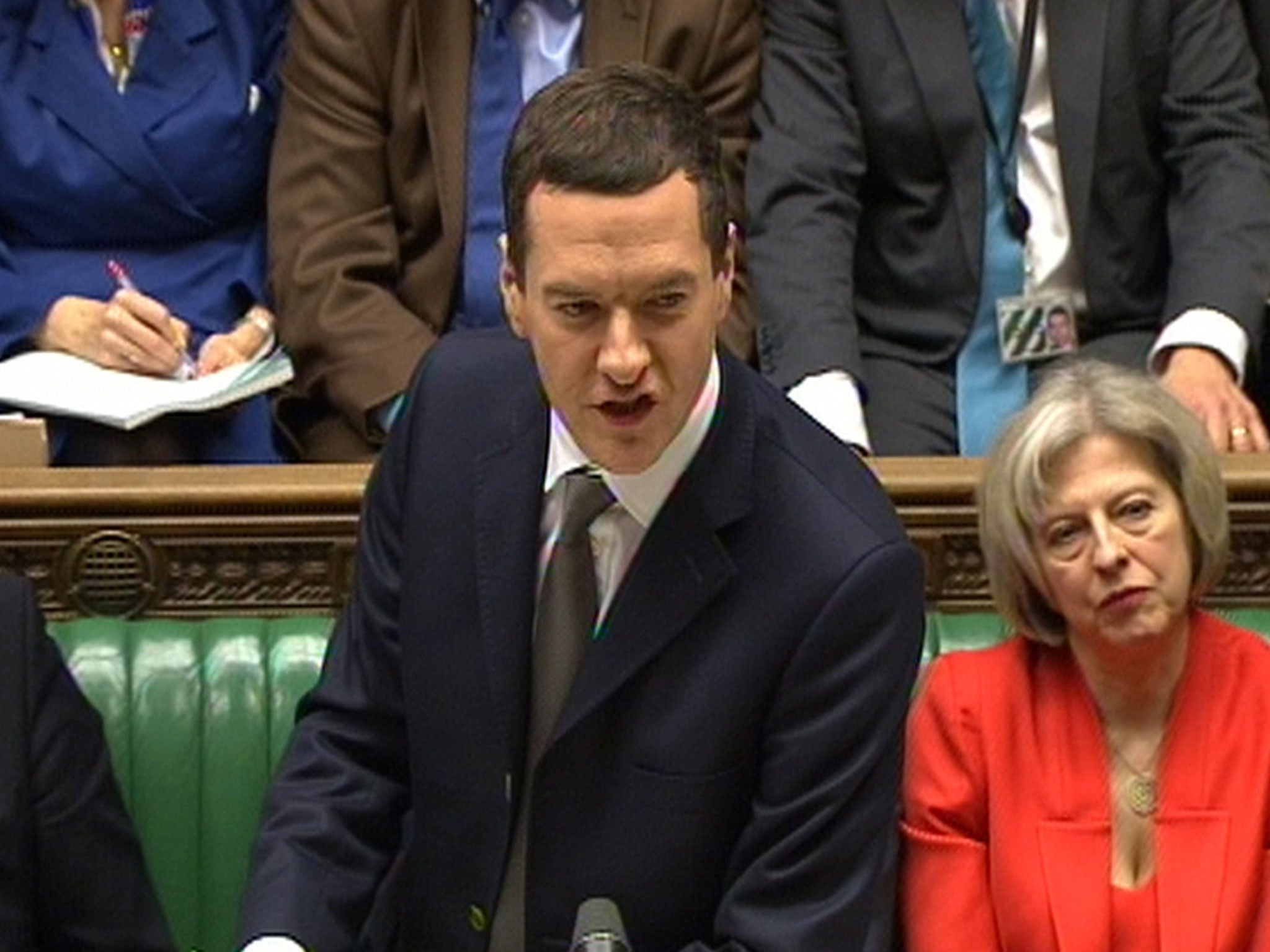

Budget 2015 – small businesses: Companies cautiously welcome cocktail of tax cuts

But there have been warnings over the uncertainty of future investments

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Britain’s small companies gave a cautious welcome to a cocktail of tax cuts in the Budget - but warned of the impact of uncertainty over future investments as the Chancellor dodged a decision on firms’ Annual Investment Allowance.

However there was consternation over the lack of clarity on the Annual Investment Allowance, which gives businesses a 100% deduction on plant machinery expenditure. Currently this is given for the first £500,000 of expenditure, but it’s due to be cut to £25,000 from January 2016.

“The decision won’t come until the Autumn Statement in early December, which means that businesses face uncertainty about the level of tax-efficient investment they will be able to make,” said Cormac Marum, tax specialist at Harwood Hutton. “If they are are going to invest £100,000, will they be getting 100% relief or only 18% on three-quarters of it? No one knows.”

Small firms could also benefit from the Government’s allocation of up to £600 million to clear new spectrum broadband bands for further auction, as well as its expansion of the allocation of super-fast broadband vouchers, which will help SMEs in urban areas. The continuation of a freeze fuel duty was also seen as a boon to small firms, especially those struggling with the cost of petrol at the pump.

Case study: The small manufacturer

There were a few points that we thought were beneficial: corporation tax being brought down to 20 per cent; the removal of National Insurance for anyone under 21 or any apprentices.

Another good point was more resources being pumped into UKTI (UK Trade & Investment) to help double the exports. I hope it’s not just going to concentrate on China and [that they] spread the net a bit further as well.

With the business rates, it’s a key thing for a small-business owner so we are a bit disappointed that there wasn’t something a bit more finite put down. It’s encouraging that it was mentioned.

It is becoming more and more difficult to [increase the wages of employees] because prices are being held or lowered constantly in order to remain competitive and other things, such as energy bills and water rates, are continuing to rise. So your profit margins are continuously being squeezed year-on-year.

So which way will you vote?

I’ll vote Conservative, because people have now seen, certainly business owners, how well [the Conservatives in government have] performed to get the country moving again.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments