Britain still wants funding from the EU’s investment bank after Brexit, David Davis says

The bank pours billions into British infrastructure every year

The UK’s Brexit negotiators still want Britain to have access to funding from the EU’s investment bank after the country leaves the bloc, it has been revealed.

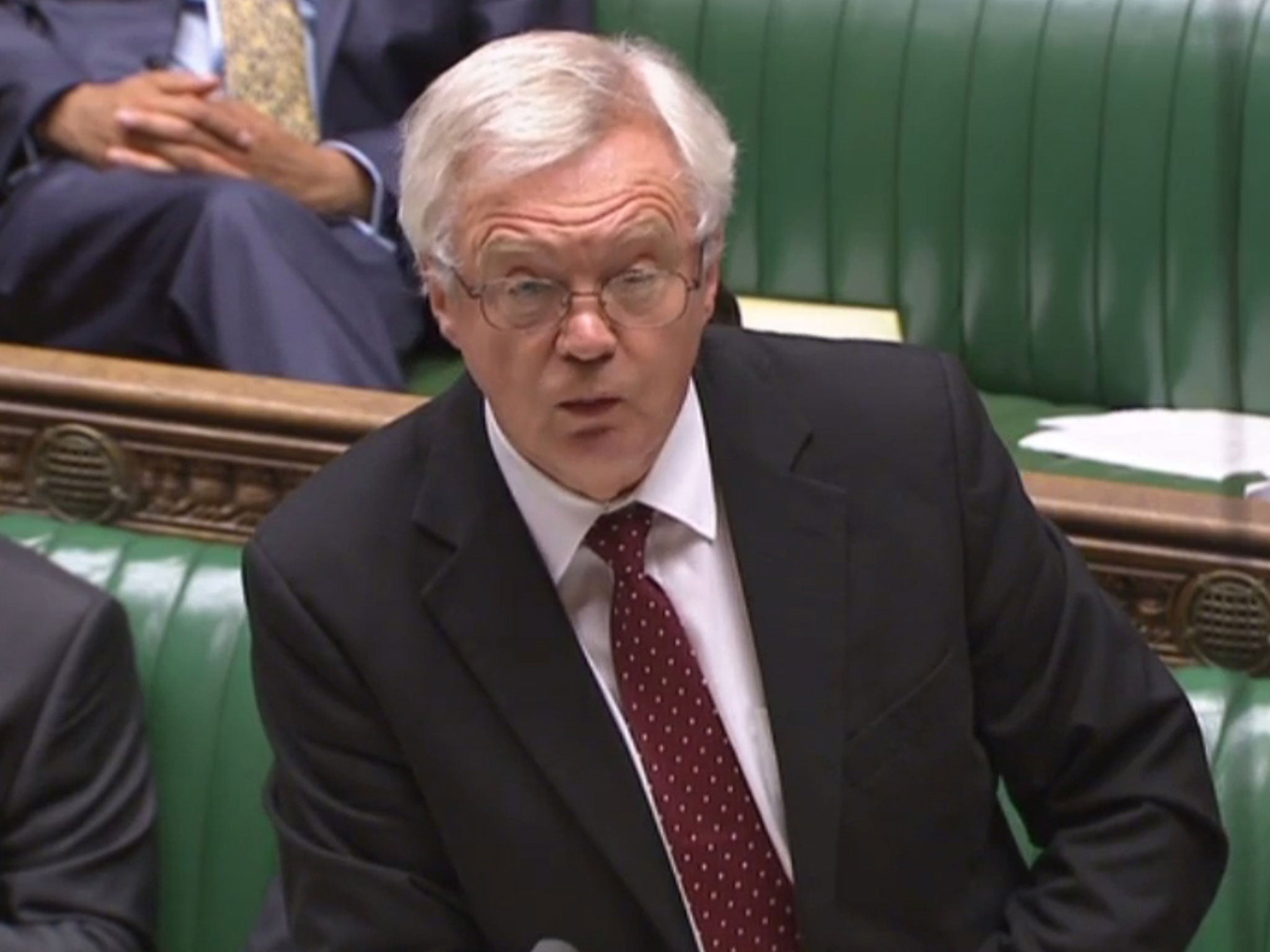

Brexit Secretary David Davis says Britain’s objective in negotiations will be to maintain an “ongoing relationship” with the European Investment Bank despite Brexit.

The Bank, which is the biggest multilateral borrower and lender in the world, has funded £31.3 billion of for infrastructure spending, entrepreneurship and development in the UK over the last five years.

The EIB describes itself as “representing the interests of the European Union member states” and makes no profit on its activites, which are aimed at enacting EU policies like European integration and cohesion.

Britain was the fifth largest recipient of EIB loans in 2016, with most funding going to upgrading infrastructure like water, transport projects, or energy.

The bank’s funding is the latest benefit of EU membership the UK is seeking to retain despite planning to leave. Last month Britain published a series of position papers that included a plan for the UK to stay involved in shaping some kinds of EU regulations despite leaving the EU.

The announcement by the Brexit Secretary comes week after EU chief negotiator Michel Barnier said the consequences of leaving the EU did not appear to have been considered in “sufficient depth” in the UK and that he saw a certain “nostalgia” in British negotiating positions for the bloc’s benefits.

Labour MP Seema Malhotra, who sits on the House of Commons Brexit Committee, had asked Mr Davis on Tuesday whether the UK would stay a member of the bank.

“What specific discussions has the Secretary of State had on the EIB, is he committed to doing all he can to seek for the UK to remain a member of the EIB after we leave, or does the government plan for us to leave and can he guarantee that withdrawing will not have a negative impact on investment in the UK and on our economy?” she asked.

Mr Davis replied that the UK was “looking to maintain that ongoing relationship” with the bank.

“What she failed to say as well is that the British economy has been more successful than more others in obtaining investment from that source,” he said.

Brexit: the deciders

Show all 8“So far the discussions have only talked about departure arrangements … When we get to the point of talking about the ongoing relationship I think that we will be looking to maintain that ongoing relationship.”

The largest chunk of the EIB's loans to the UK, around 30 per cent, go to energy projects; the second largest chunk are on sewage and waste disposal. Other areas that benefit significantly include transport and telecoms, education, and health. As an EU member state the UK is currently a shareholder in the bank.

The EIB does currently lend outside the EU, but generally does so in line with the EU's foreign policy objectives: mostly pouring cash into pre-accession countries that could one day join the EU, or providing support for the EU's poorer southern and eastern neighbours.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies