Blame Brown: Revenge of the whistleblower

A former HBOS executive says he has documents that prove the Prime Minister must take responsibility for the mess in the markets

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The HBOS whistleblower whose revelations led to the resignation of one of the Government's top regulators is about to release a tranche of documents which he says point a direct and accusatory finger at Gordon Brown's responsibility for the banking crisis, and has called on the Prime Minister to resign. In a further blow to Labour, an Independent on Sunday poll showed voter support for the party evaporating, leaving it only a few points ahead of the Lib Dems.

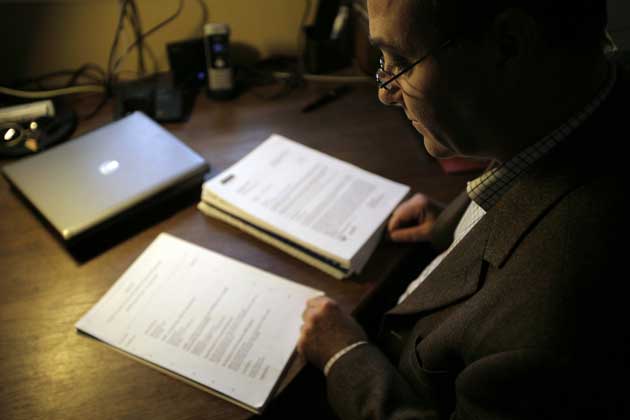

Paul Moore, the former head of risk at HBOS, told the IoS that he has more than 30 potentially incendiary documents which he will send to MPs on the Treasury Select Committee. He says they disprove Mr Brown's claim about the reasons for HBOS's catastrophic losses – now estimated to be nearly £11bn – and show that it was the reckless lending culture, easy credit and failed regulation of the Brown years that led directly to the implosion of British banks.

After Mr Moore's explosive testimony at the MPs' banking hearing, the Prime Minister had denied the former executive's central charges and said that HBOS's difficulties were due to its flawed business model. Mr Moore says his documents refute this and prove the cause of the crisis can be laid at Gordon Brown's feet. He believes Mr Brown's failure to intervene over the reckless lending undertaken by all the banks over the past decade means he should go. "The failure goes right to the heart of the system – to the internal supervisory system and right to the top of government."

Mr Moore told the IoS yesterday: "Brown must go. He cannot remain in office. He has presided over the biggest boom in the history of the country as well as one of the biggest busts. But he promised no more boom and bust. He must be held accountable for his failure to oversee the stability of the country.

"Brown presided over a policy based on excessive consumer spending based on excessive consumer credit based on massively increasing property prices, which were caused by excessively easy credit which could only ultimately lead to disaster. But no, in Gordon's mind it was all caused by global events beyond his and anyone else's control."

Mr Moore's evidence to the Treasure Select Committee last week led to the resignation from the Financial Services Authority (FSA), the City regulator, of the ex-HBOS chief executive Sir James Crosby, who dismissed Mr Moore from the bank after his warnings. In an exclusive interview with the IoS, Mr Moore revealed his documents contain all the evidence to support allegations he made to the HBOS board, which have been strongly denied by the bank and KPMG, the auditors brought in to investigate Mr Moore's claims. Yesterday, Mr Moore said his documents will "put to bed the idea that the KPMG report can be relied upon by Mr Brown, Sir James, the FSA and any other of the HBOS directors on the board at the time".

He says the papers – which he has kept from his time in his post as head of risk, from 2002 to 2005 – show that HBOS was involved in a huge sales drive to win market share which ultimately led to its collapse. Mr Moore claims that the "driven sales culture" was led by Sir James, and this, plus the "staggering failure" of the Government to manage the economy, had forced him to speak out. "Brown swaggers around holding himself out as the economic saviour of the world with a level of hubris that defies belief. But does he ever acknowledge that it was he, as Chancellor of the Exchequer, who presided functionally over the economic strategy that got us into this mess in the first place?"

As a trained barrister, Mr Moore stressed that his new evidence being sent to the committee will back up his claims. "I have compiled a meticulous record of my time at the bank. This will show that the version of events given by KPMG, which was brought in to carry out an audit of my claims, is inaccurate," he said. "Key witnesses were not included in the original audit and there are many factual errors. I will only be vindicated when all my allegations are proved by the evidence I have."

Mr Moore also attacks Mr Brown's judgement in appointing Sir James as his key adviser on the mortgage market, whom he blames for HBOS's high-octane sales culture. He says: "What I would like to ask the PM is this. If you are going to appoint the deputy chairman of the FSA, and former HBOS boss as your adviser, don't you think you should take references? Wouldn't you ask for references of the FSA? If you had got those references, they would have showed that there were serious concerns raised by the FSA over the business model."

The revelations come after a stunning week of developments in the banking sector, with HBOS – taken over by Lloyds TSB last autumn in a move prompted by Mr Brown's intervention – proving to have lost £11bn. Eric Daniels, the Lloyds chief executive, said £800m in profit had been annihilated by HBOS's losses. This is about £5bn more than City investors had been expecting and has renewed fears that the Government will have to nationalise the newly created Lloyds Banking Group. But senior sources said it could weather the storm. The Chancellor, Alistair Darling, has refused to rule out a full nationalisation.

Meanwhile, the IoS/ComRes poll finds that the controversy over bonuses has rebounded badly. Mr Brown, who has for several months enjoyed a polls boost because of the way voters view his handling of the financial crisis, is back at 25 per cent, the lowest since last September, before the banking crisis. The Lib Dems are the main beneficiaries, rising to 22 per cent, and the gap between the two parties is now at its narrowest since 1987 when support for the SDP/Liberal Alliance was at a high. The poll also reveals a backlash against bankers' bonuses, with 82 per cent of those asked calling for the bosses of bailed-out banks to repay their bonuses.

Regulatory failure: How the Prime Minister smoothed the way for 'disastrous' HBOS takeover

Surrounded by some of the City's most senior figures at a party on the day of the collapse of Lehman Brothers last September, Gordon Brown held a conversation with Sir Victor Blank, the chairman of Lloyds TSB. As champagne was nervously downed against the backdrop of a banking system on the brink, the Prime Minister, who never drinks at such events, facilitated Lloyds's takeover of the collapsing HBOS by agreeing to waive competition rules.

Details of the conversation at the Citigroup reception were widely briefed the next day, with Mr Brown apparently happy to let it be known he had helped rescue HBOS by smoothing the waters for the takeover.

The Prime Minister's role in the takeover, and his other swift responses early on in the banking crisis, marked the beginning of his resurgence. Five months on, with Britain in a deep recession, and Lloyds Banking Group shaken by the £10bn HBOS loss, Mr Brown's word in the ear of Sir Victor is viewed in a very different light. Critics say his eagerness to see the deal completed now looks reckless, and has fuelled suspicions that Lloyds bosses had their "arms twisted", in the words of the Lib Dem Treasury spokesman, Vince Cable.

HBOS whistleblower Paul Moore is not the only one to argue that Mr Brown's contribution to the crisis goes back much further. As Chancellor, he presided over a weakened banking regulation structure – of his own design, in defiance of strong expert dissent at the time – and excessive consumer credit, critics say.

Mr Moore is backed up by Lord Burns, Mr Brown's first permanent secretary to the Treasury in 1997. Giving evidence to a committee of peers last week, Lord Burns gave a damning assessment of the tripartite arrangement of the Bank of England, the Treasury and the FSA introduced by the then Chancellor, arguing that the three were not joined-up, allowing reckless banking to go unchecked.

Lord Burns told the Lords Economic Affairs Committee: "The new system had been set up on the basis of a Treasury instinct that the Bank of England was always too ready to rescue banks. Much of the arrangements were designed to make it just a little more difficult for the Bank to get involved in this."

Mr Brown's role is also under the spotlight because of the resignation of his close ally Sir James Crosby as deputy chairman of the FSA last week, following claims by Mr Moore that Sir James ignored his warnings about HBOS.

Critics said yesterday that Mr Brown had to take "huge responsibility" for the crisis at Lloyds and elsewhere. Former Tory Chancellor Lord Lamont said: "What has happened with Lloyds TSB/HBOS is truly scandalous.

"The Government encouraged the merger, the Prime Minister personally claimed the credit for it and the Government – despite many warnings – suspended the competition rules so that the merger could happen. The result has been nothing short of a disaster."

Jane Merrick

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments