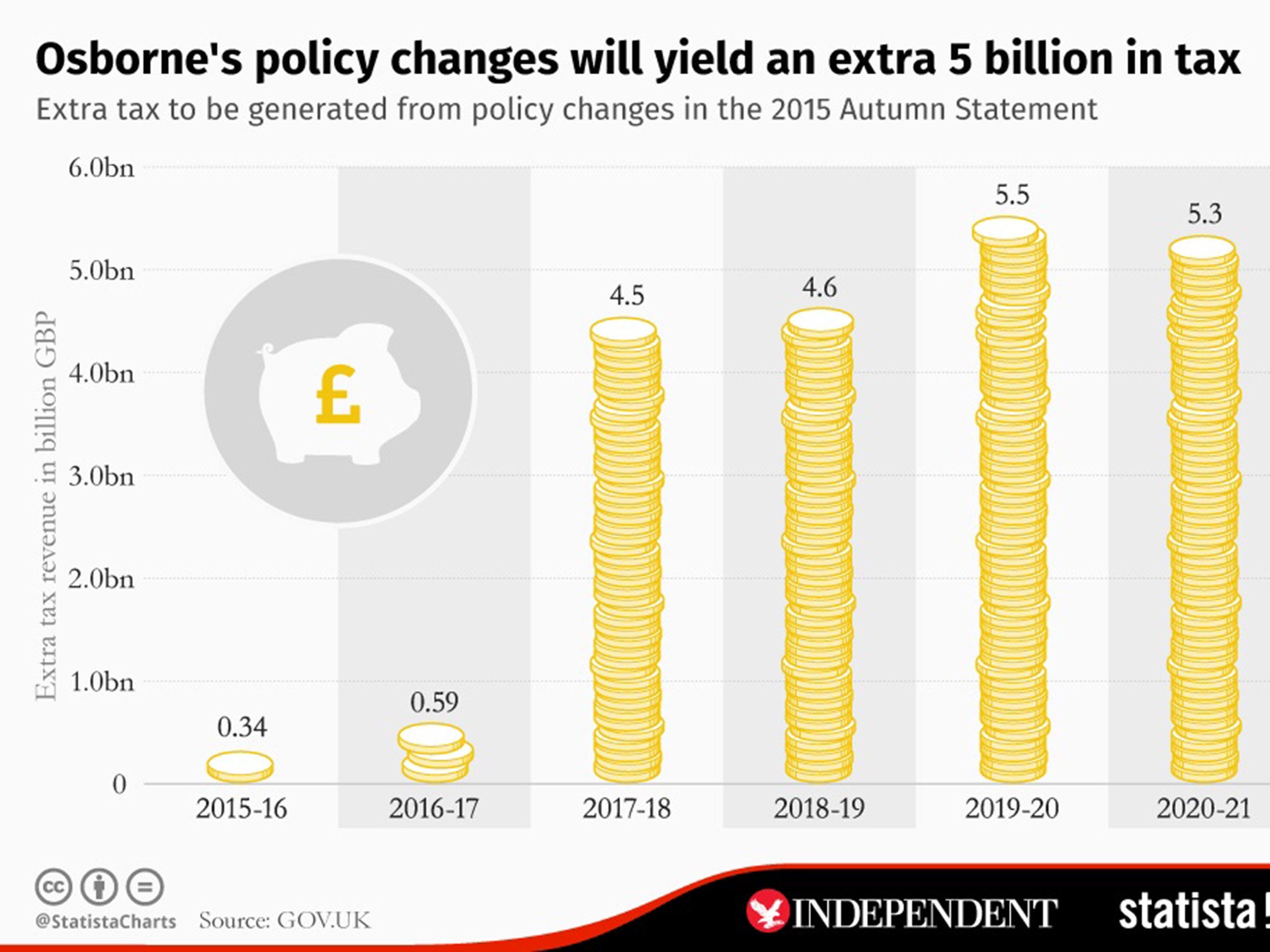

Autumn Statement: The chart that shows how much extra taxpayers will pay because of George Osborne's changes

The Chancellor made major changes to stamp duty and brought in new "Apprenticeship Levy" to raise £3bn a year

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Taxpayers could be handing the Government an extra £5 billion over the coming five years thanks to changes announced in the Chancellor’s Autumn Statement.

Analysis for The Independent by Statista showed that the new apprenticeship levy, changes to stamp duty and the “making tax digital” initiative were among policies driving millions of pounds into HM Revenue & Customs’ coffers.

Delivering his statement to the House of Commons on Wednesday, George Osborne said he was achieving his target to move public finances into surplus by 2020.

He hailed higher tax receipts and lower interest payments for helping reduce the country's debts and borrowing.

The Office for Budget Responsibility's forecast shows the UK is expected to narrowly beat its borrowing goal this year and move “out of the red and into the black” in 2019/20 with a slightly higher-than-expected £10.1 billion surplus.

“We have the economic security of knowing our country is paying its way in the world,” Mr Osborne said.

But the Tory Chancellor has been criticised over changes to the new Universal Credit (UC) system cutting the entitlement for working families.

An estimated 2.6 million employed households can be expected to be an average £1,600 a year worse off under UC than they would have been under the existing system, said the Institute for Fiscal Studies.

Transitional protections mean that no existing claimants will lose out in cash terms when the new system comes in, but new claimants and those whose circumstances change will lose out in the long run, the IFS said.

Despite Mr Osborne's decision to scrap cuts to tax credits proposed for next April, the IFS said that his plans still envisage reducing non-pension benefits to their lowest level as a share of national income for 30 years.

Additional reporting by PA

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments