Interest rate cut hopes dented by strong wage growth

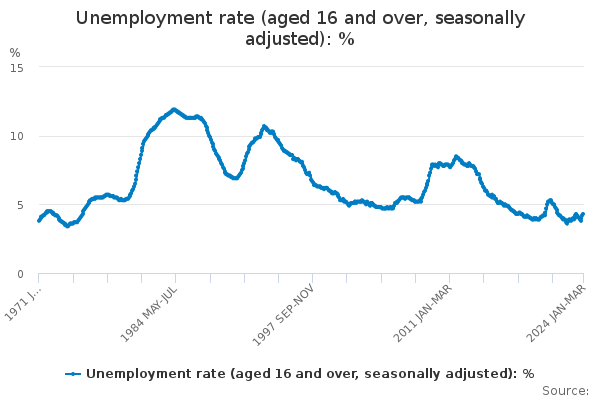

The ONS figures also revealed that Britain’s unemployment rate has risen to its highest level for nearly a year

Your support helps us to tell the story

This election is still a dead heat, according to most polls. In a fight with such wafer-thin margins, we need reporters on the ground talking to the people Trump and Harris are courting. Your support allows us to keep sending journalists to the story.

The Independent is trusted by 27 million Americans from across the entire political spectrum every month. Unlike many other quality news outlets, we choose not to lock you out of our reporting and analysis with paywalls. But quality journalism must still be paid for.

Help us keep bring these critical stories to light. Your support makes all the difference.

The prospect of an interest rate cut next month by the Bank of England has been dented by stronger than expected wage growth figures.

Annual pay growth excluding bonuses was 6 per cent in the three months to March, unchanged from last month, according to figures from the Office for National Statistics (ONS).

Most economists were expecting earnings growth to fall to 5.9 per cent, which is the second time in a row that the decline in earnings growth has failed to match forecasts.

Wages are outstripping inflation by 2.4 per cent which is not helpful for the Bank of England in its battle to rein in inflation. The BoE is keeping a watchful eye on if strong wage growth could revive high inflation, as it looks to bring it back under control to its 2 per cent target.

Last week, the BoE chose to keep interest rates unchanged at 5.25 per cent, but governor Andrew Bailey hinted that rate cuts could be on the way as he was “optimistic that things are moving in the right direction”.

Alice Haine, personal finance analyst at Bestinvest, said: “The likelihood of a summer rate cut, with many consumers pinning their hopes on a move as early next month, may be slightly dented by the better-than-expected pay growth data.”

Ashley Webb, UK economist at Capital Economics said: “While the further easing in regular private sector pay in March suggests that wage pressures faded a bit faster than the Bank of England expected, broader measures of wage growth are probably still a bit too strong for the Bank’s liking.

“At the margin, this may make the Bank a bit more uneasy about first cutting interest rates in June.”

However, Rob Wood, of Pantheon Macroeconomics, said he believed a rate cut in June was still “on track” despite the strong wages growth.

“That said, strong wage growth will likely stop the Monetary Policy Committee cutting bank rates quickly, so we look for them to reduce interest rates at alternate meetings after June - in September and December - and then four times in 2025,” he said.

The figures also revealed that Britain’s unemployment rate has risen to its highest level for nearly a year as vacancies continued to fall and yet more people dropped out of the labour market, mostly due to ill health.

The ONS said the rate of UK unemployment rose to 4.3 per cent in the three months to March - the highest since May to July last year and up from 4.2 per cent in the previous three months.

Job vacancies fell by 26,000 to 898,000 between February and April of this year - a reduction of 2.8 per cent from November 2023 to January 2024.

Liz McKeown, ONS director of economic statistics, said: “We continue to see tentative signs that the jobs market is cooling, with both employment from our household survey and the number of workers on payroll showing falls in the latest periods.

“At the same time the steady decline in the number of job vacancies has continued for a 22nd consecutive month, although numbers remain above pre-pandemic levels.”

The economic inactivity rate also jumped to 22.1 per cent in January to March, up from 21.9 per cent in the final three months of 2023.

TUC General Secretary Paul Nowak said the Tories are presiding over a “rapidly deteriorating jobs market”.

He added: “Unemployment and economic inactivity are shooting up. Over a million people are trapped on zero-hours contracts. And real wages are still worth less than in 2008.

“Forget ‘green shoots’ - everywhere you look the Conservatives are failing working people.

“Our country is crying out for a proper economic plan for jobs and growth to make sure household incomes can recover and everyone is secure at work.

“And our NHS desperately needs investment to get waiting lists back down. When people can access treatment faster, they will return to work sooner.”

Nye Cominetti, principal economist at the Resolution Foundation, said that the UK’s jobs recovery “continues to falter” and that the workforce has shrank by the equivalent of one million workers since pre-pandemic times.

He said: “This worrying employment fall shows the damage that an economic slowdown can cause.

“The news for those in work is more positive however, with real wages growing almost as much over the past 12 months as they did in the 16 years prior to this.

“The big question is whether the UK’s recent economic recovery will boost employment and raise output per worker, which will be needed to sustain its mini pay recovery.”

The data comes after official figures last week showed the UK emerged from recession, with gross domestic product (GDP) up 0.6 per cent in the first three months of the year.

Chancellor Jeremy Hunt said: “This is the 10th month in a row that wages have risen faster than inflation, which will help with the cost-of-living pressures on families.

“While we are dealing with some challenges in our labour supply, including pandemic impacts, as our reforms on childcare, pensions tax reform and welfare come online I am confident we will start to increase the number of people in work.”

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments