Analysis of Britain's £9 trillion of wealth reveals a deeply divided nation

The richest 20% of people hold 105 times more wealth than the poorest

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

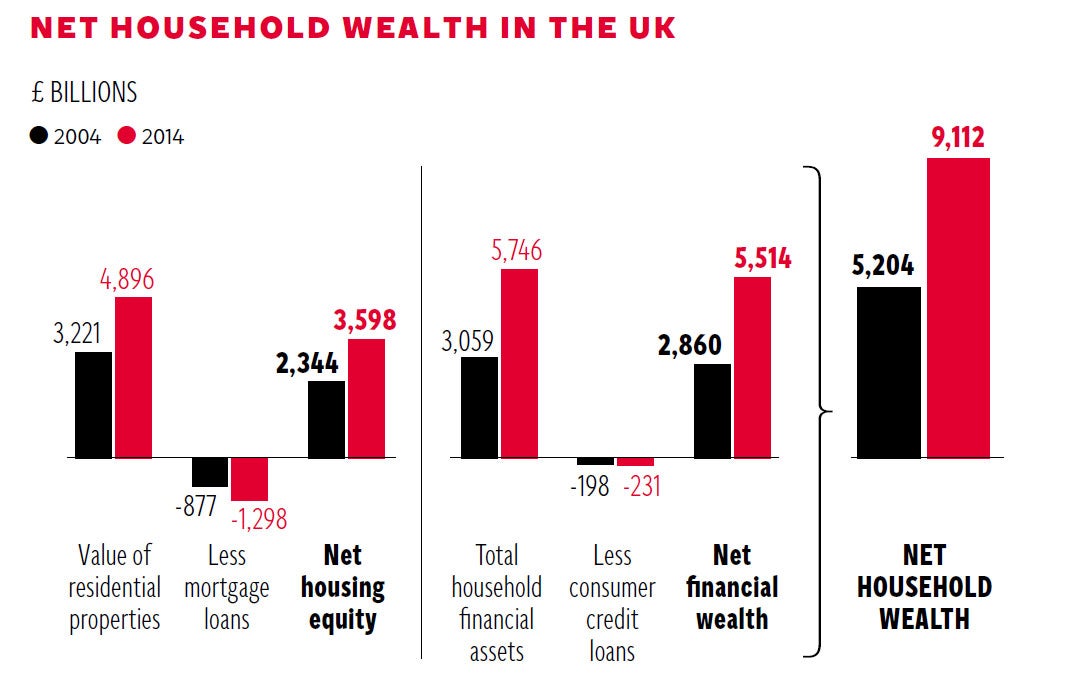

Your support makes all the difference.UK families hold a combined wealth of more than £9.1trn – the equivalent of £326,414 for every household in the land, according to a new analysis.

Despite average household wealth growing by more than £126,000 in just 10 years, however, the figures reveal a deeply divided Britain, where the richest 20 per cent hold 105 times more wealth than the poorest fifth.

People already on the property ladder or with good pensions are accumulating personal wealth fast, according to the data from Lloyds Bank Private Banking.

The value of property and other personal assets grew by £1.5trn in 2014, the largest annual increase in household wealth since records began in 2001. Average house prices rose by 9 per cent last year, adding £452bn to the total.

However, housing now accounts for just 39 per cent of total wealth, compared to 45 per cent in 2004. Other financial assets, such as the pension pots and life assurance funds, have doubled in value over the same period to £5.5trn, and now make up 61 per cent of total wealth.

Markus Stadlmann, chief investment officer of Lloyds Bank Private Banking, said the “growing number of older households” was also a factor in the accumulation of personal wealth.

But the Equality Trust, citing the Office for National Statistics, said the majority of the UK population (66 per cent) hold no positive financial assets at all – with the combined £9trn held privately in the UK spread between the remaining 34 per cent.

The new figures also point to a huge generational divide between wealthy older people and a younger generation which finds itself priced out of the property market and unable to access the lucrative pension schemes open to their parents’ generation.

According to the ONS, 40 per cent of 24-34 year olds own their own home, compared to 75 per cent of those aged between 50 and 65.

Research carried out by Professor John Hills, director of the Centre for the Analysis of Social Exclusion at the London School of Economics, found that for the younger generation to bridge the gap between them and the average wealth of their parents they would have to save £33 every day for the next 30 years.

“Some of that generation eventually inherit from the more prosperous members of the older generation. But for those who cannot look forward to that assistance, building up the kind of wealth that many older people take for granted looks hopeless,” he said.

“Given how much bigger the wealth gap now is compared to annual incomes, the growing importance of who you might get help from acts against social mobility.”

Ashley Seager, co-founder of the Intergenerational Foundation, said increases in pension funds and housing equity represented “the largest transfer of wealth from young to old in history”. “It raises the question as to how the Government can continue to justify the protection of pensioner perks when they state that £12bn of welfare savings are still needed.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments