Small Talk: Immigrants start businesses, create jobs and pay taxes: let’s welcome them

Nigel Farage is right: we should be having a more honest debate about immigration

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Nigel Farage is right: we should be having a more honest debate about immigration. But the issue is not the one with which the Ukip leader is obsessed: in fact, we need more immigration, not less.

That’s the view of leading entrepreneurs, who worry about their ability to hire talented people, wherever these come from. A study published last week by Silicon Valley Bank found that for all the talk of small business frustration with red tape and regulation, three times as many entrepreneurs are concerned about the effect of immigration laws on their recruitment.

A better argument still for getting rather less worked up about the number of immigrants is made by new figures showing just how many of Britain’s entrepreneurs were born in other parts of the world. Research by Procorre, a professional services company, indicates that tens of thousands of foreign-born entrepreneurs have flooded into the UK (as Mr Farage might put it). How dare they bring their commercial nous, entrepreneurial creativity and job creation skills to this green and pleasant land?

Procorre’s analysis of Companies House data shows that Indian-born entrepreneurs alone are running more than 16,000 small and medium-sized enterprises. There are almost 10,000 companies with Pakistan-born directors at the helm. As for Eastern Europe, whose immigrants so often send Ukip members into states of apoplexy, Romanian-born entrepreneurs have launched almost 7,500 companies, while Bulgarians account for another 4,600.

A common trait of immigrant-led businesses is that they have strong links to the countries of their founders. These are often the firms leading the recovery of the export sector that everyone, Ukip included, thinks is so important.

Procorre’s findings shouldn’t surprise anyone, because time and again independent research shows that immigrants’ contribution to the economy is greater than their take from it.

Last year, the Centre for Entrepreneurs published a study showing that one in seven companies trading in the UK was originally set up by an immigrant. In the small and medium-size enterprise community, immigrant-founded companies created 14 per cent of all jobs, the study revealed. And in Britain’s migrant community, 17.2 per cent of people have launched businesses, compared to 10.4 per cent of people born in the UK.

A University College London report for the Royal Economic Society’s Economic Journal revealed that immigrants from the 10 countries that joined the EU in 2004 paid almost £5bn more in taxes than they took out in public services over the years to 2011.

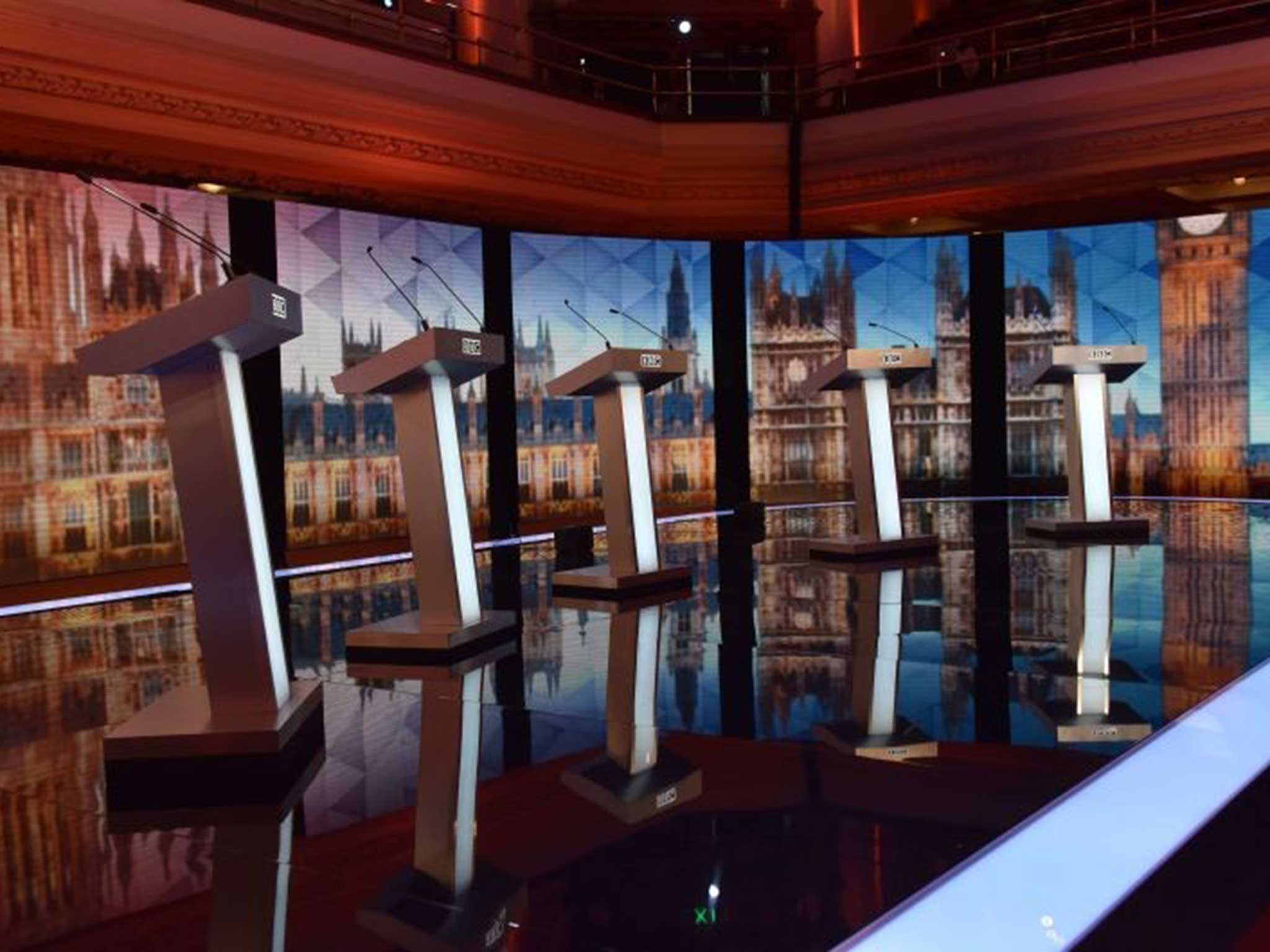

In last week’s televised leaders’ debate, one of Mr Farage’s few successful hits on his opponents came when none of them would acknowledge that the arrival of 300,000 immigrants each year in recent times has added to demand for public services. Of course it has, the rest of the leaders should have conceded, before pointing out that not only have these immigrants brought with them sufficient additional economic benefit to cover the cost of meeting this demand, but that there is money left over for the rest of us too.

Other countries get this, of course. When the US made it tougher for foreign entrepreneurs to get visas a couple of years ago, the Canadian government paid for an advertising campaign aimed at persuading these wealth creators to come to its country instead.

In Britain, however, we’re stuck with this toxic debate on immigration, and we’re worse off financially as a result. Do we really want foreign-born entrepreneurs to build businesses, create jobs and pay taxes somewhere else?

Women account for almost 9 per cent of executive directors at the largest FTSE 100 companies

Fewer women serve on boards of Aim companies

Women account for just 6 per cent of the executive directors of the largest companies on the Alternative Investment Market, research from the compliance group ionStar indicates. Of the 300 executive directors serving on these companies’ boards, just 18 are women.

The figures compare poorly to larger businesses, where government action has seen a large increase in the number of female appointments. While the most dramatic increase in female board membership of FTSE 100 companies has been at non-executive level, women account for almost 9 per cent of executive directors at the largest companies.

Aim, meanwhile, appears to be heading in the wrong direction. The 18 businesses joining Aim during the first four months of the year had just one female executive director between them. “It is disappointing to discover how poorly women are represented,” says ionStar’s managing director, Liz Hughes.

Businesses must register for VAT once sales reach a set threshold: £81,000 over the previous 12 months in the 2015-16 tax year

Many small firms are ignorant of VAT rules

Thousands of people who have started their own businesses or even set up as freelancers may have left themselves open to an uncomfortable inquiry from the VAT inspector.

Businesses must register for VAT once sales reach a set threshold: £81,000 over the previous 12 months in the 2015-16 tax year. They must usually then charge customers VAT and make regular returns and payments to HM Revenue & Customs.

However, a survey conducted by Direct Line for Business suggests that 36 per cent of small businesses are not aware of the VAT threshold. Many have sales above £81,000 a year and may therefore not be charging and paying the right amount of tax.

“We are a fantastically entrepreneurial nation with increasing numbers of businesses being started all the time, but these companies still have tax obligations even if they are run out of a bedroom or a garage,” warns Jasvinder Gakhal, a director of Direct Line for Business.

Small Business Person of the Week: Asi Sharabi, CEO, Lost My Name

“We’re a digital publishing business launched in 2012. The founders were sitting together and looking at a personalised book one of my children had been given – it gave you a warm feeling, but only for a minute or so, until you realised it was a gimmick. We decided that there was an opportunity to do something more creative and rich.

“It started as a project between friends, but The Little Boy/Girl Who Lost His/Her Name was such a great product that we saw a commercial opportunity. We’ve sold 500,000 copies – last year we sold more than some of the top-selling children’s authors.

“We’ve brought a very lean, vertical approach to the business – we do everything in-house because the control that gives you enables you to get better all the time; it sounds counter-intuitive, but it is also less costly this way.

“The internet has democratised distribution and we said we would sell to customers in any market and ship for free. The economics of that stack up better than you might think. Our margins may not have been so good on our early overseas sales, but every time a book arrived with a family, we’d get more orders from other families. We now sell in more than 135 countries, and our volumes have enabled us to set up five distribution centres around the world.

“The next challenge is to launch new products. The idea behind the company is personalisation, and that’s a hugely rich concept to exploit. We have two or three products in the pipeline, the first of which should be available in the summer.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments