Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The world’s biggest banks face being pursued through the UK civil courts this autumn for billions of pounds in compensation payments for the actions of its traders in rigging foreign exchange rates.

Five multinational banks – which include Britain’s Royal Bank of Scotland, Barclays and HSBC – agreed this week to pay off aggrieved investors in order to settle a class action brought in New York.

They joined four other global banks that settled earlier in the year. The total compensation pledged to investors, which are made up of hedge funds and pension funds, has now reached $2bn, according to Hausfeld, the law firm that brought the case on behalf of the investors.

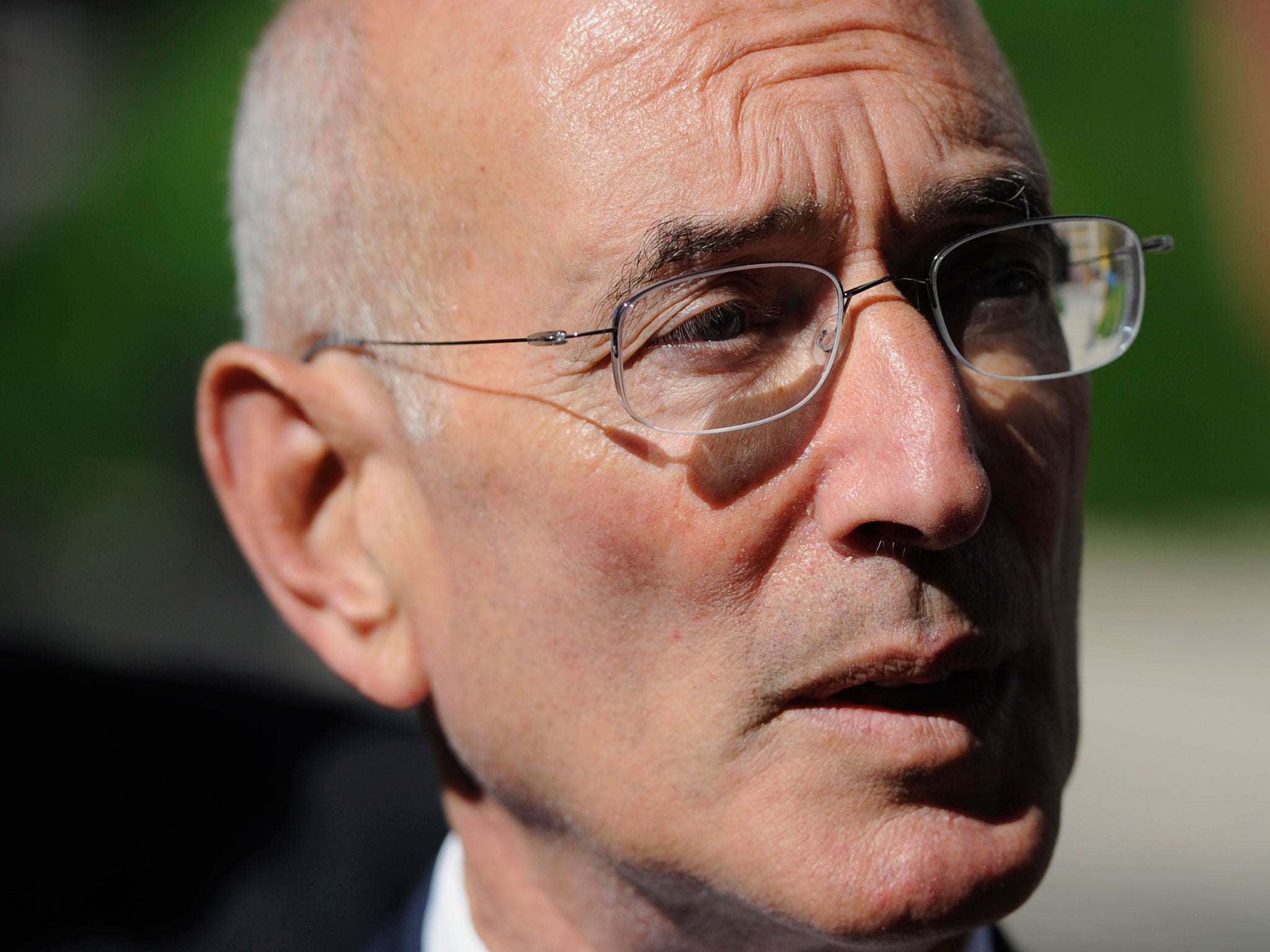

And Hausfeld said the massive US compensation payments were “just the beginning”. The law firm’s chairman, Michael Hausfeld, told The Independent it had already received inquiries about bringing a legal action in London and that an announcement could be made as soon as October.

Some have suggested that American law, which allows class action cases, is better suited to these kinds of civil lawsuits. But Mr Hausfeld said he was confident of success in London. “This is a very strong case on its merits. I think we have clear ‘intent’ in UK law,” he commented.

Mr Hausfeld also pointed out that the size of the forex trading market in London was bigger than that in the US, meaning the potential compensation was likely to be larger too. “Anyone who traded in the market at any time in this period [2007 to 2013] was at risk,” he said.

Forex rigging was the most recent in a long line of rate-rigging scandals to hit the financial sector. Traders at these banks – brazenly using names such as “The Cartel”, “The Bandits Club” and “The Mafia” – conspired over email and online chat rooms to co-ordinate foreign currency trades in the $5.4trn-a-day market and to make profits at the expense of their clients – often companies and investors. The traders then cited these profits as they lobbied managers for higher bonuses.

Four global banks – Citigroup, JP Morgan, Barclays and RBS – pleaded guilty in May in the US to conspiring to manipulate foreign exchange rates between 2007 and 2013. They, along with UBS and Bank of America, were hit by $6bn (£4bn) in fines from US and UK regulators.

The prospect of further large forex-related litigation costs for big UK banks will concern regulators. The Bank of England’s Financial Policy Committee identified misconduct costs as one of the “main risks” facing the financial sector. It noted that the £30bn in fines and redress costs paid by UK banks since the financial crisis was equivalent to all the extra capital that they had raised privately since 2009.

The banks involved in this week’s settlement in New York declined to comment on the details, but it was reported by The Wall Street Journal in June that HSBC will pay $285m and Barclays $375m to settle the US litigation.

The other banks involved in the case are RBS, BNP Paribas, UBS, Bank of America, JP Morgan, Citibank and Goldman Sachs. Seven other banks, including Standard Chartered, are still being pursued by Hausfeld in New York.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments