Mastercard to start using selfies as ID for online payments

Of those who tested the software, 83 per cent said it was more secure than passwords

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

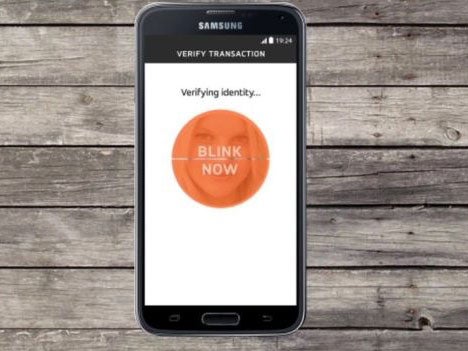

Your support makes all the difference.Mastercard has confirmed that it is to start accepting selfies and fingerprints as an alternative to passwords when verifying IDs for online payments.

The credit card firm has been testing selfie software in the US and Netherlands. Some 92 per cent of test subjects preferred the new system to passwords.

Some security researchers have said that biometric checks have the potential to cut fraud, but others have warned that they might not be as secure as traditional methods.

Of those who tested the software, 83 per cent said it was more secure than passwords.

Mastercard plans to roll out the technology to the UK, US, Canada, Netherlands, Belgium, Spain, Italy, France, Germany, Switzerland, Norway, Sweden, Finland and Denmark.

Users download the software to their PC, tablet or smartphone to use the system.

Last week, HSBC said it was introducing voice recognition software as a security measure for its UK customers.

HSBC follows Barclays, which is already using voice recognition for many clients, and RBS and Natwest, which both use fingerprint technology.

The technology works by cross-checking 100 unique identifiers. These include behavioural features such as speed, cadence and pronunciation as well as physical aspects including the shape of larynx, vocal tract and nasal passages.

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments