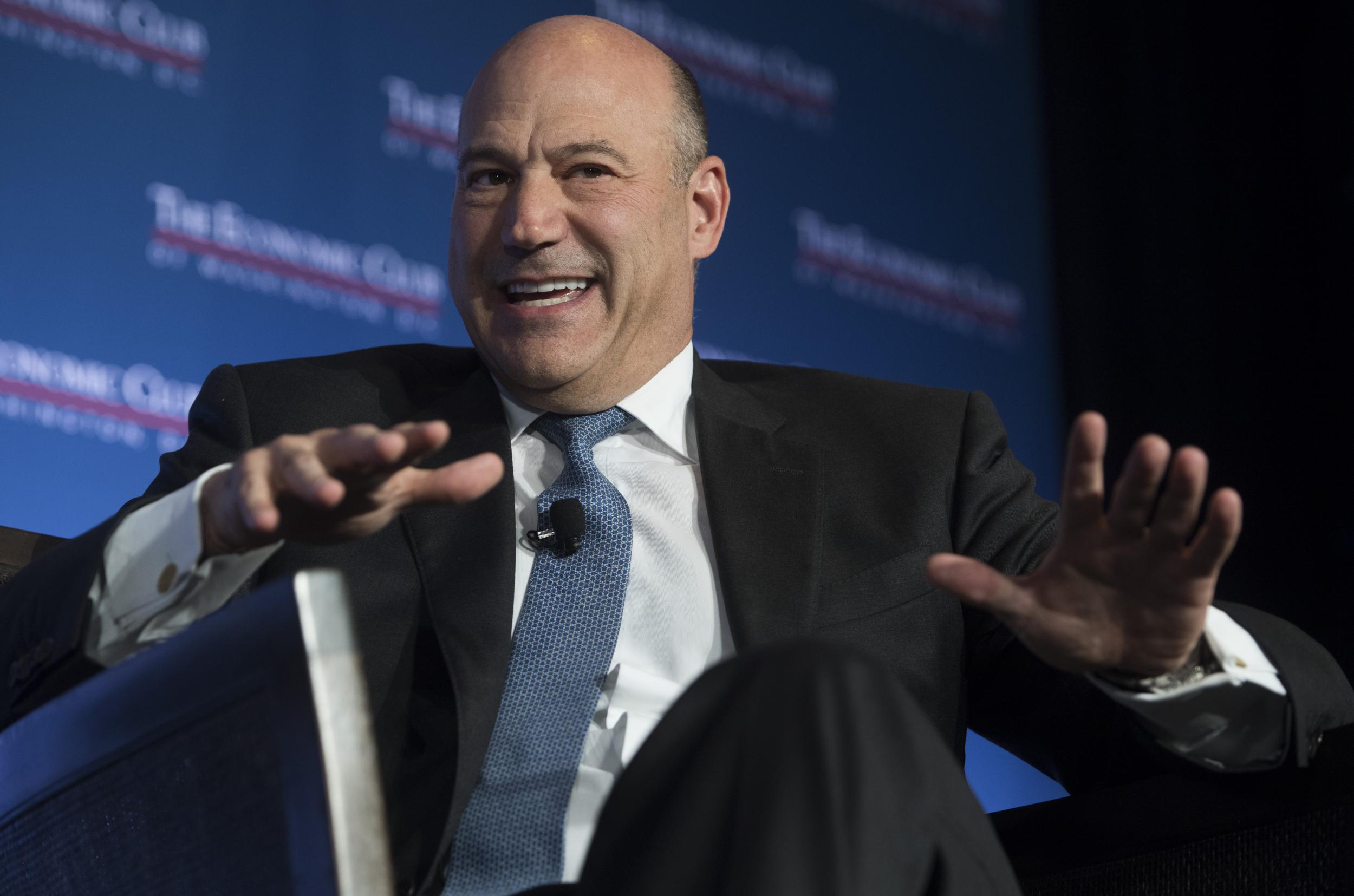

US trade war fears spark selloff of European shares after Gary Cohn resignation

Trump economic advisor’s departure rattles markets

European shares opened lower on Wednesday after the resignation of Donald Trump’s economic adviser Gary Cohn, seen as a bulwark against protectionist forces within the US government.

The pan-European Stoxx 600 index was down 0.4 per cent shortly after opening, while Wall Street futures were trading in negative territory.

“Gary Cohn’s departure rattled markets and equity markets look set to fall on the open. Stocks have declined overnight in Asia and it’s looking like it will be red today on the open,” Neil Wilson, a Senior Market Analyst at ETX Capital told his clients in a morning note.

Most European markets and sectors were down, with Germany’s DAX losing 0.5 per cent.

German carmakers, which are expected to suffer from new US tariffs, took a hit. Volkswagen lost 1.6 per cent and Daimler 1.3 per cent, the second and third worst performance of the German blue chip index.

Still in Germany, postal and logistics group DHL was down 2.1 per cent after reporting 2017 results.

Oil prices fell and London metals slipped, weighing on the energy and basic materials sectors, which were down 1.4 per cent and 0.8 per cent respectively.

The advertising sector retreated after the Financial Times said P&G would cut agency spending by $1.25bn over three years. France’s Publicis and Britain’s WPP fell 1.9 per cent and 1.6 per cent respectively.

Rolls-Royce was the best Stoxx index performer, surging 8.5 per cent after saying it remained on track to meet its financial goals for 2020.

Second came Smurfit Kappa, after US peer International Paper revealed the takeover offer it made for Europe’s largest paper packaging producer was worth €8bn (£7.2bn).

Shares in ADP came in third, up 2.3 per cent, after a media report said the government would go ahead with plans to privatise the French airport operator and sell its 50.6 per cent stake entirely.

French construction group Vinci, which has an 8 per cent stake in ADP and expressed an interest for acquiring more, rose 0.4 per cent.

Reuters

Subscribe to Independent Premium to bookmark this article

Want to bookmark your favourite articles and stories to read or reference later? Start your Independent Premium subscription today.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies