Euro founding father says eurozone's lack of exit strategy was a mistake

Professor Otmar Issing said the EU's single currency was 'performing much better than expected' but the same could not be said about the EU bloc

Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.The eurozone made an error by not creating an exit strategy from the bloc, putting the future of the project at risk, the man widely regarded as the architect of the euro has warned.

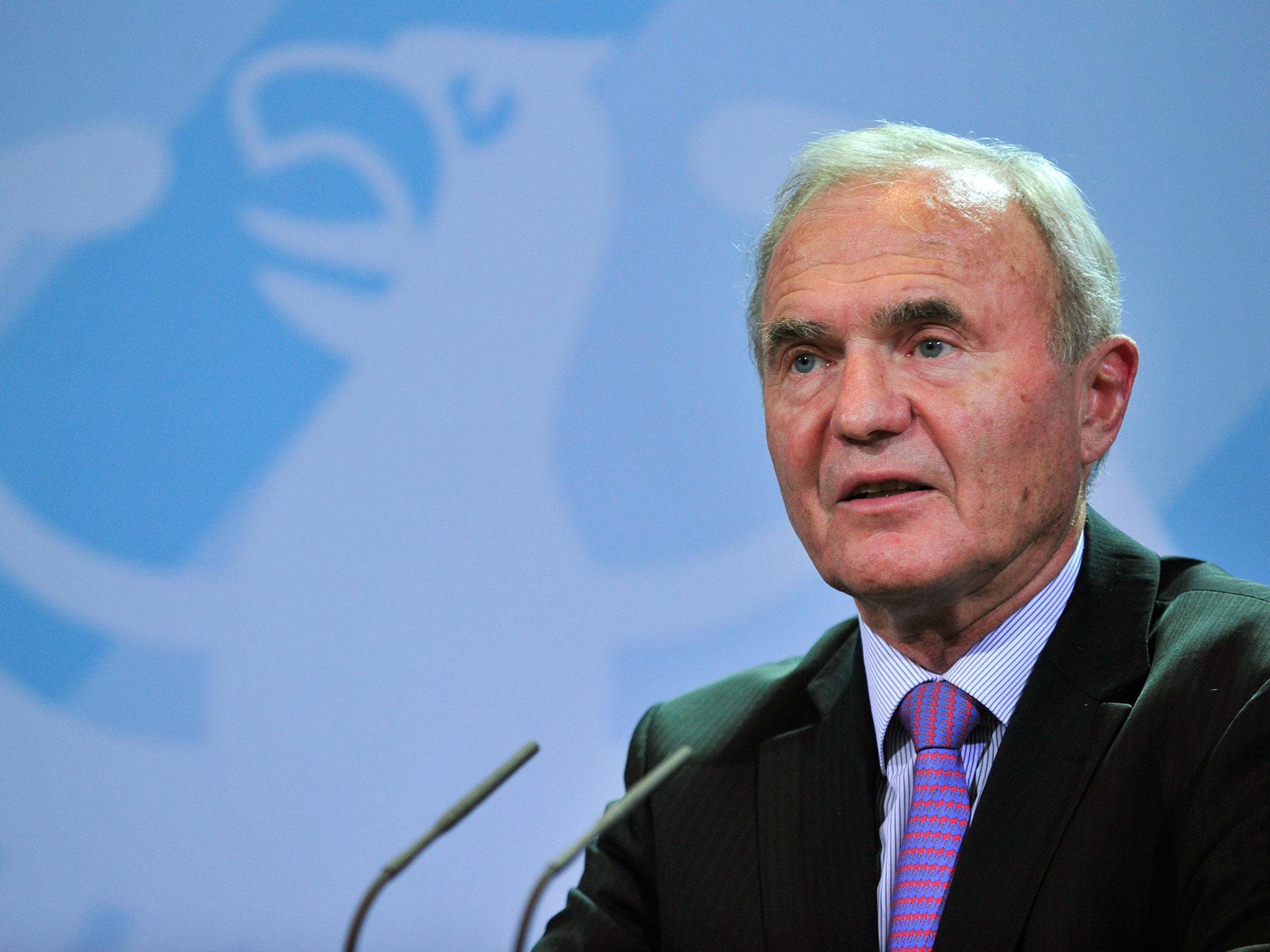

Professo Otmar Issing, the European Central Bank’s first chief economist who helped create the single currency at the turn of the century, recently became more suspicious of the euro project, warning last month that it could collapse without reform.

Speaking to the BBC on Monday, he said the EU's single currency was “performing much better than expected” but the same could not be said about the bloc itself.

Prof Issing said there were “mistakes in the construction of the whole arrangement that once a member, you remain a member for eternity”.

It meant that countries not complying with the EU’s economic and budgetary rules “can blackmail the others”.

He argued that allowing a temporary exit would have helped Greece to reform its economy, giving the country the opportunity to return in better financial health later.

Prof Issing, a former adviser to Germany's Chancellor Angela Merkel, added that countries such as Greece, Portugal and Italy were holding back the EU and were still struggling to find their feet after the financial collapse in 2007.

Asked about Brexit, the economist said it was too early to comment on the impact the UK vote to leave the EU will have on the eurozone. However, he warned that London’s position as a financial centre would be under threat once Article 50 is triggered, arguing that the capital financial centre will not be able to keep the same benefits outside of the EU.

Last month, Prof Issing said the ECB had become dangerously overextended as it tries to manage the 19 economies using the single currency. He warned that “one day, the house of cards will collapse”.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments