Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

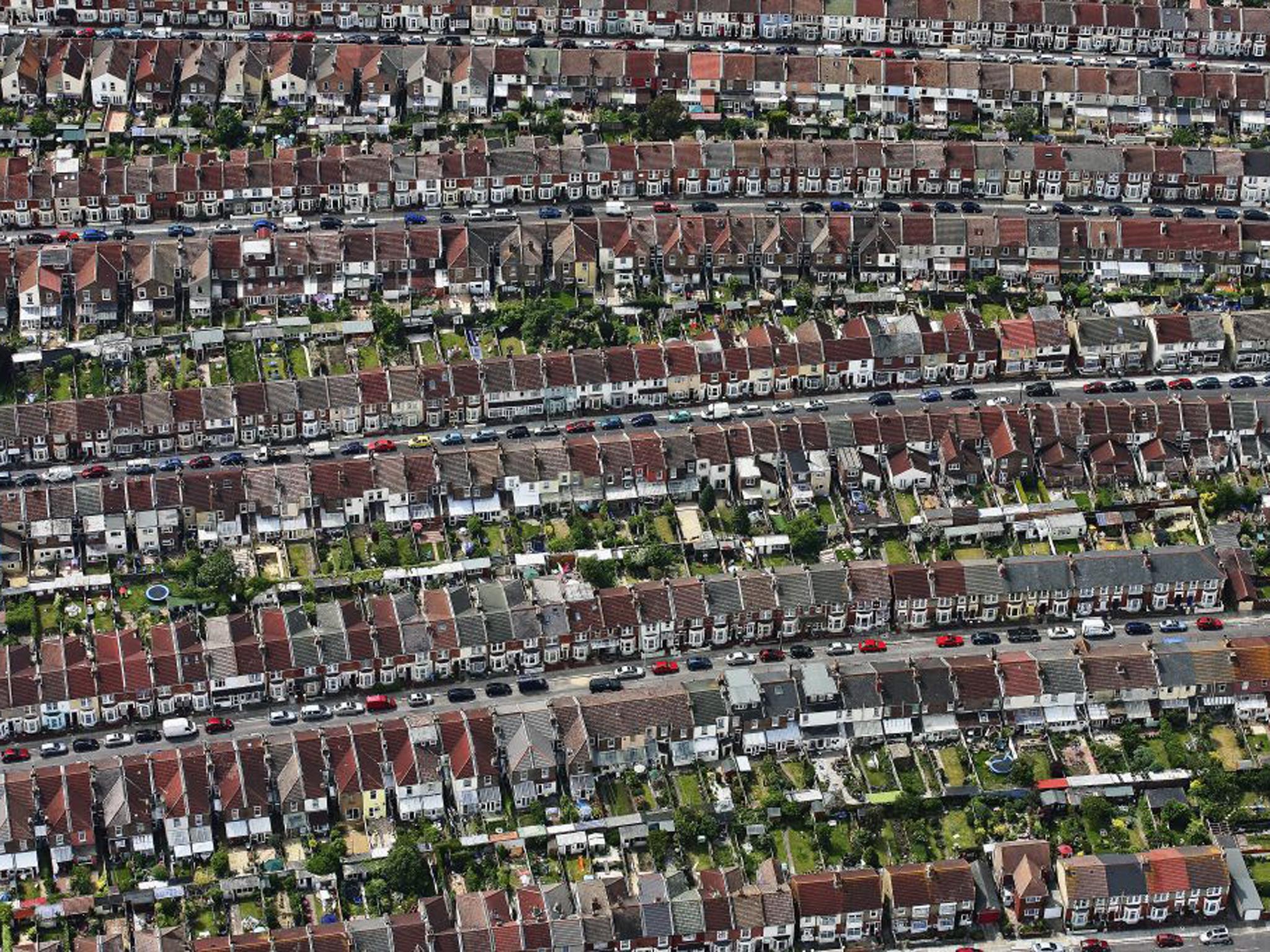

Your support makes all the difference.The Bank of England has been urged by the OECD to dampen the booming UK property market by watering down the Government’s mortgage subsidies.

In its latest report, the multilateral organisation noted yesterday that British house prices look overvalued relative to average earnings and rents and said the time has come for the regulator to take corrective action.

“Monetary policy tightening should be accompanied by timely prudential measures to address the risks of excessive house price inflation,” it said.

The OECD added that this action might include “tighter access” to the Help to Buy scheme, which offers state guarantees for mortgages worth up to £600,000, alongside higher capital requirements for lenders and maximum loan-to-value ratios for mortgages.

Many have called for the £600,000 cap on Help to Buy mortgage eligibility to be significantly reduced.

Last week, the Bank’s deputy Governor, Sir Jon Cunliffe, said house prices, which are rising at an annual rate of more than 10 per cent, are “the brightest light” on the regulator’s dashboard and said the Bank was “ready to act” if necessary to head off the danger of another damaging property bubble.

Stricter rules on mortgage lending were introduced last month and the Bank’s Financial Policy Committee could take further action to curb the availability of credit at its meeting next month. George Osborne and other ministers have sought to play down suggestions of a housing bubble and also the impact of the Help to Buy scheme on prices.

But asked yesterday in Brussels about the OECD’s recommendations the Chancellor said the matter lay in the hands of the independent regulator. “The Bank of England has the tools and independence to do what it feels it needs to do to help to contribute to building that resilient economy,” he said.

The OECD also yesterday upped its forecast for economic growth in the UK for this year and next. It now expects GDP growth of 3.2 per cent over 2014, up from 2.4 per cent in November. For 2015, the latest prediction is 2.7 per cent growth, up from 2.5 per cent last time. The latest snapshot of the UK’s services sector yesterday showed the fastest pace of growth this year. The Markit/Cips purchasing managers’ index rose to 58.7 in April, up from 57.6 the previous month. That helped to send sterling higher to around $1.69, the highest since 2008.

“All the signs are that Britain is booming,” said Michael Saunders of Citi. “The need for the current ultra-loose policy stance is receding rapidly, in our view. Indeed, the current policy stance may well – if sustained for much longer – start to create a dangerous bubble mentality in housing and other assets.”

The mortgage guarantee element of Help to Buy was introduced in October 2013 and is due to end in December 2016.

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments