Your support helps us to tell the story

From reproductive rights to climate change to Big Tech, The Independent is on the ground when the story is developing. Whether it's investigating the financials of Elon Musk's pro-Trump PAC or producing our latest documentary, 'The A Word', which shines a light on the American women fighting for reproductive rights, we know how important it is to parse out the facts from the messaging.

At such a critical moment in US history, we need reporters on the ground. Your donation allows us to keep sending journalists to speak to both sides of the story.

The Independent is trusted by Americans across the entire political spectrum. And unlike many other quality news outlets, we choose not to lock Americans out of our reporting and analysis with paywalls. We believe quality journalism should be available to everyone, paid for by those who can afford it.

Your support makes all the difference.Real pay growth ground to a halt in February, the latest official statistics confirm.

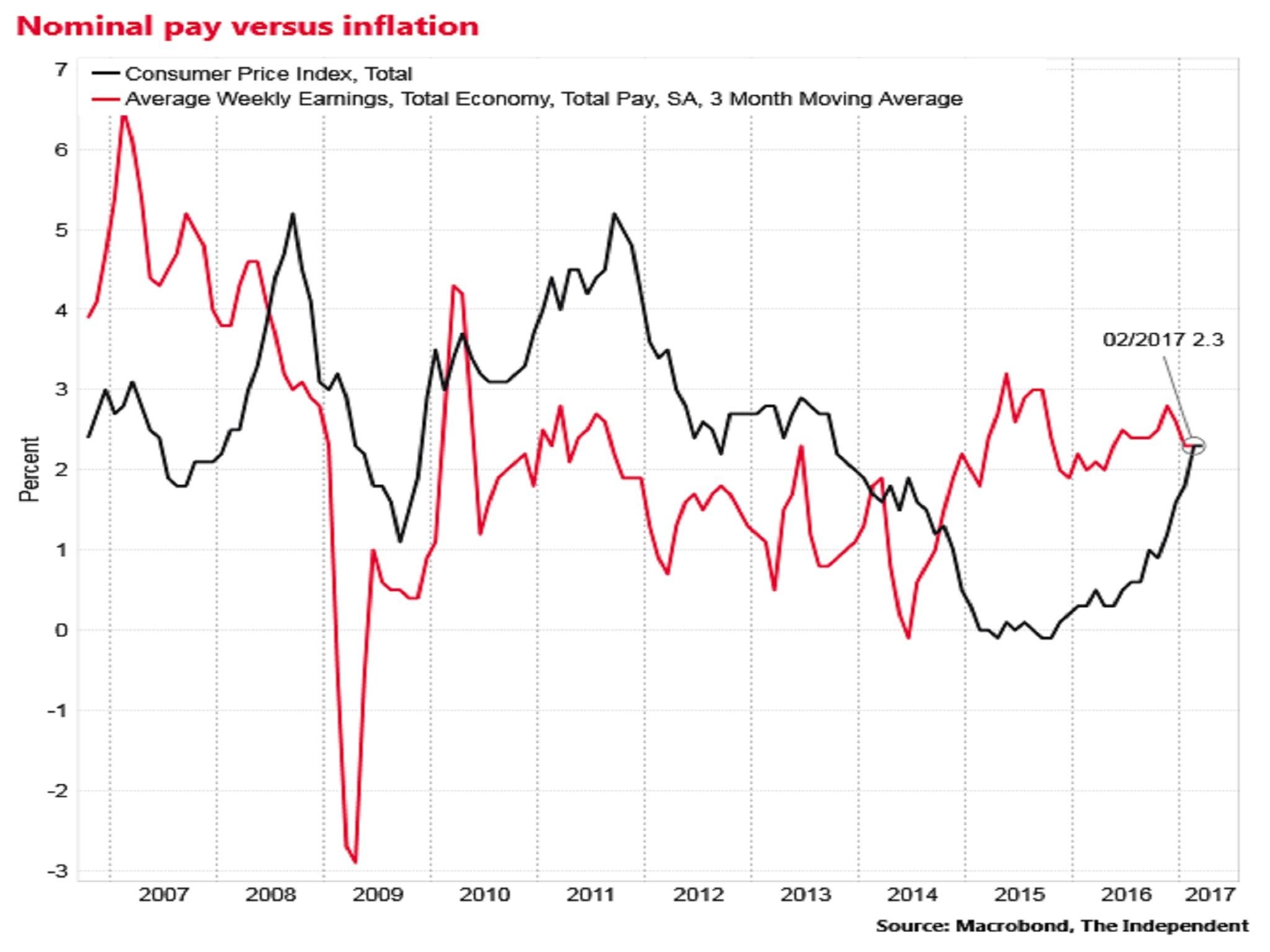

In its labour market report on Wednesday the Office for National Statistics reported that average nominal total annual pay growth in the three months to February was 2.3 per cent.

Putting this together with the February inflation data of 2.3 per cent means that real terms average pay was zero in the month.

The last time inflation outstripped pay growth was September 2014.

The inflation rate was steady in March at 2.3 per cent, but the Bank of England expects it to peak at 2.75 per cent in the first half of next year, reflecting the slump in the pound since last Summer's Brexit vote.

Many analysts expect inflation to breach 3 per cent.

Real wage growth evaporates

Excluding bonuses (which spiked in February largely reflecting weak growth in the same month last year in discretionary rewards in the financial sector) regular annual pay growth slipped to 2.2 per cent in the month, meaning real pay growth was negative.

The Resolution Foundation think tank estimated that real terms pay was now falling in around 40 per cent of the workforce, including mining, real estate, health work and education.

“Households are being caught in a perfect storm of rising inflation and slowing labour income growth,” said Samuel Tombs, an economist at Pantheon.

The ONS also reported that the overall unemployment rate remained at 4.7 per cent in the three months to February.

It has not been lower since August 1975.

Employment was also robust, with the numbers in work rising 39,000 in the three months to 31.84 million.

The employment rate was 74.6 per cent, the joint highest on record.

Vacancies rose to 767,000 in March, a 16,000 increase on the October to December period.

However, some analysts saw signs of a slowdown.

“In the six months to February, only 30,000 jobs were added to the economy versus the preceding six months, the softest pace of growth seen since mid-2013,” said Chris Hare, an economist at Investec.

“We do see a jobs slowdown in prospect because we expect higher inflation to weigh on economic growth.”

Join our commenting forum

Join thought-provoking conversations, follow other Independent readers and see their replies

Comments